MICROECONOMIC INDIVIDUAL PROJECT Case Solution

CASE ANALYSIS

The company Volkswagen has now challenged itself to compete with Tesla in growing their sales of electric cars to one million by the year 2025. They have already been on EU’s blacklist for breaching EU emission rules but now want to make their mark as the number one electric charges vehicle producer. The EU has already imposed stricter rules and are allowing only 210% carbon emission the company have to produce more efficient machines which will be expensive for the automakers. Other than this, EU is planning to reduce the carbon emission allowance to 150% means if they have to boost their car sales for the future they have to develop energy efficient machines. With the increasing demand of Lithium, its price will rise which will be costly for Volkswagen as it will increase the company’s variable cost which will result in overall increment in total cost.

Deriving the total revenue of the firm:

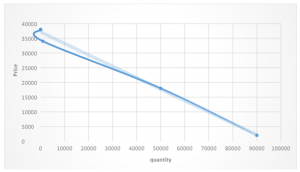

When growth is low P = -0.4Q + 38,000

The above fig 2 is a price quantity demand curve. With our condition of lower growth if we keep our quantity demanded to be 0 the price will be €35000. In other words it also means that in lower growth period at €35000 there will be no quantity demanded by the consumer. This further suggests that Volkswagen have to set their prices lower than €35000 as no one will buy the car at this price. The graphical representation also tells us that the if the car prices gets at the maximum discount rate of €0 the maximum quantity demanded will be 95000 cars.

The other scenario that will be discussed will be when the growth is at its highest and there is an economic boom.

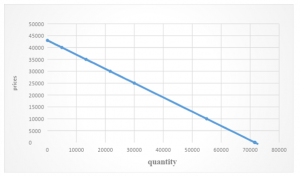

P = -0.6Q + 43,000

The above fig 3 is demand curve in growth period. Here, when there is no quantity demanded the price is €43000, but as the demand increases the company will have to reduce its price and when the price gets at its lowest point which is €0the quantity demanded is 71666 units of cars. In economic downturn the price will be $38000 and when there is economic growth the price can get as high as $43000.

Following the new classical theory the consumers will decide to buy at the price which they can come up after rationale thinking. As discussed earlier not only the cost of the production is considered but rather its perceived value is also taken into account for price setup. As people will perceive its value to be higher than the cost incurred they will buy more and with the growing demand the company will increase its prices. Here, neo-classical theory is clearly satisfied that there is no upper-limit to the prices of a good when the price is determined by consumers’ value perception. The other point that has been discussed is that if the company will work on decreasing its carbon emission it will need better technology. Neo-classical have already discussed the role of technological advancements as a betterment for the economy. The technological efficiency of Volkswagen will allow it to be one of the market leader of electric cars manufacturer. The revenues of the company will shoot up as with better technology people will prefer better electrical vehicles with well-equipped preinstalled gadgets. The increased revenues means more taxes for the government. Other than this, as the operations will expand and company planning to expand its plant it will require more employees which means an increase in employment rate as well. Investment will fluctuate as the company has decided to increases the investment amount by three times and will take it to $9billion over the next five years. The neo-classical clearly stated that a growing company will have varied investments as it won’t build a plant or buy high-end machines at one go. The process takes time and hence the $9billion investment will be invested in chunks over the five year period.

Lastly, the company’s top management have to show their smart capitalists skills to make the quality of the vehicles beyond peoples’ imagination so that it’s perceived value can increase making huge profits for the company.

Volkswagen eyes an opportunity in electric vehicles market because it sees that people demand and their behavior is changing towards more eco-friendly products or goods. The Behavioral economic theory can be applied by the heads of Volkswagen. Consumers’ behaviors can be taken of advantage here as growing global warming crises has made people realize that they should be consuming more eco-friendly goods to save the environment. Volkswagen, amongst the initial providers of the eco-friendly electric cars might be liked by the consumers and can create a goodwill. The sales of the company can take a boost just by changing consumers’ behavior towards electric cars. The psychological factor can come into play as Volkswagen has already been under fire for its 2015 diesel scandal, but now if it can emit just under 210% of the emission they will be able to retain their customers which will result in sales hike. The demand for electric vehicles have been created by the environmentalists and EU regulations have also not allowed people to buy any car with high carbon emissions. The policy implementation has become a reason for the behavioral change consumers. Behavioral economics can also be incorporated by changing the price of the vehicles. Consumers still think that electric cars are because of the latest technological advancement hence perceive its greater value than its probable intrinsic value. Consumers does think electric cars to highly efficient with greater technology hence looks to buy it. By moving the price up, initially and then reducing the price to a lower value will make consumers’ think that they are getting a higher valued thing at a cheaper rate. The good will be bought by the buyers increasing the desired sales of the company. The possibility of this rise in sales has been possible by the combination of both neo-classical theory and behavioral theory of economics.

CONCLUSION

Volkswagen in the race to become the number one electric car manufactures; needs looks at the price and cost of the electric vehicle. Other companies might get greater profit if their technological advancements are better than Volkswagen. Consumers in today’s world come up with rationale decision to buy any product. They want to have greatest satisfaction by choosing the best product after its logical reasoning that’s what neoclassical educates. Volkswagen’s lithium charged electric cars are a great value addition to the firm and can derive the vehicles demand up and hence increasing its price. Also with it, the technological advancements will fully and entirely support the company’s mission to reduce its carbon emission. With better technology the company can generate nice number of sales. Volkswagen in an effort to go for electric charged vehicles has already confirmed that it is investing a total of $9billion till the year 2025. The steps have been taken considering the behavioral change of people. The old cars might have been neglected by the consumers because of growing global warming and they want to buy newer eco-friendly cars, based on new behaviors the Volkswagen team should come up with the plan to satisfy the customers with new consumption behavior............

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.