WELLS FARGO: ONLINE FINANCIAL SERVICES Case Solution

Initiative Identification process:

First Screen:

The process included a number of benchmarks and barriers for the qualification of best initiatives. For the selection of strategic initiatives the company developed another three benchmarks. “Strategic” projects should meet following criteria, firstly, they should help OFS to achieve three strategic platforms defined above, secondly, make a competitive advantage and thirdly, must have long-term point of difference. To get qualified as strategic, each criterion defined above should rate “high” to initiatives. The initiatives that rated “medium to low” would be minor projects whereas, “medium to high” would be major projects, moreover “low” rated would be considered simple activities. For example, if the bank start offering “discount brokerage services” that will differentiate Wells Fargo from other commercial banks and would create a competitive advantage over other banks. Moreover, it would retain more customers because of its convenience for the transactions in the same bank, in addition, the bank will generate revenue from the transaction charges on discount brokerage services. This previous defined initiative would be considered as strategic because of having all characteristics that first screen test wanted, whereas upgrade the graphics of website (another initiative) is not meeting all the criteria, hence, it wouldn’t proceed further.

Second Screen:

The initiatives that were filtered through first criteria then had to go through from another criteria for further filtration. For this measure the previously selected measures were divided in two groups. The first group was for “Cross-functional and long-term” and other group was “function-specific and short-term”. The team decided a set of three questions, those initiatives that answered “yes” in any of three questions would qualify the screen. The questions that were to be asked are as follows:

- Does the implementation of initiatives takes more than three months?

- Does the cost of initiative exceeds $500000?

- Does the resources are relocated within other functional units by initiatives?

From the previous example of “discount brokerage services”, it could easily pass through screen because it would require four month for implementation, the cost would be more than $500000 and the initiative would require support from several groups.

Third Screen:

The qualified initiatives then were asked to passed through more detailed measures i.e. the NPV and detailed analysis of revenues, expenses and income through a template designed by the company in which the weights were allocated to different six facts according to the importance of the factors. For example, one very important factor “strategic importance” was assigned with the highest weight of 40%, cost and NPV 15%, and the rest of three components were given 10%.

The total score of each initiative based on factors was used to rank the initiatives accordingly. The next step was to actually implement the selected initiatives practically and gather feedback for the performance.

Conclusion:

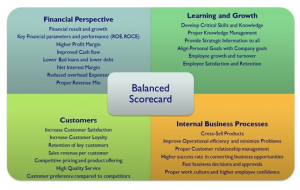

Wells Fargo, a leading online and commercial bank in the U.S. was facing difficulties for performance measure due to the selection of wrong strategy. The bank previously introduced a new online service “OFS” but it didn’t have any relevant approach to measure performance. After performing a deep research the company introduced “Balance scorecard” as a new approach to measure performance and reflect the strategic objectives of the organization. During the implementation of BSC, the team discovered three strategic platform to work on the more accurate performance. More than 100 initiatives were included in the list from 5 different divisions. For the selection of the best initiatives, three screening test were performed. In the first screening test the all initiatives were divided in two groups “strategic” and “business as usual”. Three requirements of this criteria filtered initiatives to the second screen. In the second screen, the same process repeated that the initiatives were divided in two groups, and those initiatives who meet the requirements of questions were filtered through the process. The final step included a detailed financial analysis of remaining initiatives and a factor based analysis to rank the initiatives accordingly. After selecting final initiatives the next step of the bank was implementation and feedback.

Exhibits:

Exhibit 1:

Exhibit 2:

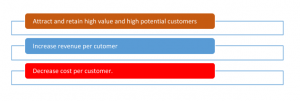

Strategic Theme: