SAS Enterprise Miner homework Case Solution

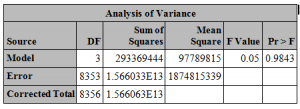

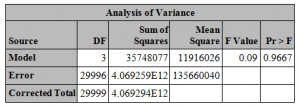

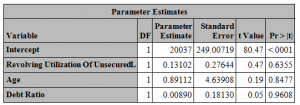

The second model is drawn between NO and Revolving Utilization of Unsecured L, age and Debt ratio. Again by looking at the R^2 of 0.00 between the dependent and independent variable; it is clear that there is no relationship between answer NO and Revolving Utilization of Unsecured L, age and Debt ratio. Our Ho is that answer NO and Revolving Utilization of Unsecured L, age and Debt ratio doesn’t have any relationship. The F-test value is 0.09 which is close to 1, this means that our null hypothesis is true.

RESULTS:

The predictive model of target variable of SeriousDlqin2yrs and Revolving Utilization of Unsecured L, age and Debt ratio shows that there is no relationship between the dependent variable and independent variables.

CONCLUSIONS AND RECOMMENDATIONS:

The predictive model was made by taking into account a target variable of SeriousDlqin2yrs and few independent variables; Revolving Utilization of Unsecured L, age and Debt ratio. It was to be seen that if there is any relationship between the independent and dependent variable. After the predictive model; it’s clear that there is no relationship between “experiences of delinquency within 90 days” with variables Revolving Utilization of Unsecured L, age and Debt ratio. The age doesn’t affect the person’s ability to repay the loans and so does the debt ratio. To predict the delinquency of a person, we need to have other variables as these variables don’t show any relationship between each other.

EXHIBITS

EXIHIBIT 1

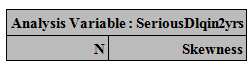

| Analysis Variable : SeriousDlqin2yrs | |

| N | Skewness |

| 150000 | 3.4688571 |

EXHBIT 2

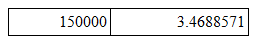

| Root MSE | 43299 | R-Square | 0.0000 |

| Dependent Mean | 75783 | Adj R-Sq | -0.0003 |

| Coeff Var | 57.13547 |

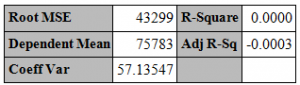

| Analysis of Variance | |||||

| Source | DF | Sum of Squares |

Mean Square |

F Value | Pr > F |

| Model | 3 | 293369444 | 97789815 | 0.05 | 0.9843 |

| Error | 8353 | 1.566033E13 | 1874815339 | ||

| Corrected Total | 8356 | 1.566063E13 | |||

EXHIBIT 3

| Analysis of Variance | |||||

| Source | DF | Sum of Squares |

Mean Square |

F Value | Pr > F |

| Model | 3 | 35748077 | 11916026 | 0.09 | 0.9667 |

| Error | 29996 | 4.069259E12 | 135660040 | ||

| Corrected Total | 29999 | 4.069294E12 | |||

| Parameter Estimates | |||||

| Variable | DF | Parameter Estimate |

Standard Error |

t Value | Pr > |t| |

| Intercept | 1 | 20037 | 249.00719 | 80.47 | <.0001 |

| Revolving Utilization Of UnsecuredL | 1 | 0.13102 | 0.27644 | 0.47 | 0.6355 |

| Age | 1 | 0.89112 | 4.63908 | 0.19 | 0.8477 |

| Debt Ratio | 1 | 0.00890 | 0.18130 | 0.05 | 0.9608 |

EXHIBITS

EXIHIBIT 1

EXHBIT 2

EXHIBIT 3