TARGET CORPORATION: CEC Project Approval Assistance for NOV -2006 Case Solution

The Barn

This area is a small rural area with no composure to organization till date. The investment required is of $ 13 Million and the calculated NPV for the project is at $ 20.5 Million, high growth rate is projected for the future.

According to the quantitative data, the sales forecast for year 1 will be $ 2 million and $2.7 million in the 5 year forecast. NPV is record $ 20.5 Million on a little investment and according to the new discount factor initiated of a 13% as required by IRR, the NPV stays at $ 19.6 Million. This is great for the organization, as the organization has a higher revenue as compared to the prototype and even if it decreases by 18%, still the margins will be achieved if it decreases by 2.35 pp.

But, in comparison to the other markets, this is relatively new for Target as the nearest Target outlets are 80-90 miles away. In cases of shortages and supplies- it will take time to resolve as this rural area is far away.

Further, though due to lower investment and higher returns; the project seems viable for approach and investment for the organization.

Goldie’s’ Square

The Goldie’s square is a highly competitive area, and the project is considering the opening of a Super Target store in the area. As the area is highly contested amongst rivals, but still holds a significant position due to the heritage anchor, if growth materialized in the area, then it will lead to heavy profits for the organization. The required investment for this area is at $ 23.9 Million and would recognize an NPV of $ 317,000; which is very low as considering the investment amount.

The area suggests that the qualitative benefits are more than the quantitative data as project sales will under perform greatly as $ 10 Million deficit from the prototype in year 1, and $ 14 million deficit than the prototype in year 5.

As per the data, the net investment required is a little less than the prototype, though the sales % has to be increased by 45.1 % and the IRR needs to increase by 47.1% to match the prototype bench marks.

The quantitative data does not suggest the investment criteria, though the market mix of the store will increase the brand position and its visibility in the urbanized population.

Stadium Reloaded

This is a capital expenditure project, which will enhance the ongoing activity of a store which is in operation since 1972, and will provide an image for the organization. The stadium Super-Target store has been remodeled twice and investment is needed to re-invent the position of the Super store in the area. This is heritage important for the organization, and the quantitative data also suggests it.

The sales figure will be $ 64 Million and $ 64 Million in the 5 year annual future. The requested sum for investment holds at $ 17 million and a positive NPV of $ 15.7 Million is suggested for the store in the coming years. According to the repositioning of the discount factor of 13% IRR, the NPV still suggests positive at $ 15.09 Million. This is a heritage store for the organization and requires organization to consider as this will lead to image being reinvented for the organization.

Recommendation & Conclusion

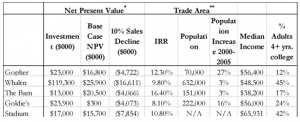

After analysis of the case and the required projects, qualitatively and quantitatively, a decision matrix has been created on the Five factors being; Investment, Base case NPV, New NPV @ New required IRR @ 13%, Project IRR, Qualitative factors, and Prototype Comparison; this is provided below in the appendix 3 of the project.

According to the first phase of Decision criteria, on investment basis; The Barn is selected to be at the least required rate of investment with the Whalen court investment categorized as last.

For all of the above 5 phases it is recorded on the projects and the Goldie’s square, of its circumstances and it being an important factor, still it ranks last in the IRR, NPV, and the Prototype comparison areas for this instant, the project is not suggested to go ahead.

According to the interest rate of 6.25% prevailing in 2006, the suggested investment of Goldie’s of $23.6 Million will lead to an annual interest of $ 1.47 million which is more than the NPV of $ 300,000, and a perpetuity amount at 13% Discount rate of $ 11.34 million. (FRED, 2018).

Thus, it is concluded that, all the projects are viable for the organization except for the GOLDIE’s Project, and the CEC should go ahead for approval. Though the Whalen project needs approval directly from the CEO and further data on the Stadium is required to provide a complete analysis for the project.

Exhibits

Exhibit 2:

| Gopher | Whalen | The Barn | Goldie | The Stadium | ||||||

| Project | B/(P) Proto | Project | B/(P) Proto | Project | B/(P) Proto | Project | B/(P) Proto | Project | B/(P) Proto | |

| TOTAL R&P SALES | ||||||||||

| 1st year 2005 Equivalent | $26,000 | $2,745 | $86,000 | $52,185 | $24,000 | $2,043 | $34,000 | ($10,304) | $64,000 | $19,677 |

| 5th year 2005 Equivalent | $35,100 | $5,688 | $111,800 | $69,031 | $30,500 | $2,729 | $42,000 | ($14,036) | $64,000 | $7,940 |

| INVESTMENT | ||||||||||

| Land | $3,205 | $264 | $87,309 | ($78,855) | $10 | $3,390 | $3,615 | $1,385 | $0 | $5,000 |

| Sitework | 3,164 | (580) | 0 | 3,796 | 2,303 | 290 | 3,695 | (425) | 1,173 | 2,097 |

| Subtotal | $6,369 | ($315) | $87,309 | ($75,059) | $2,313 | $3,680 | $7,310 | $960 | $1,173 | $7,097 |

| Building | 15,420 | (5,052) | 29,434 | (15,128) | 9,705 | (378) | 14,969 | (313) | 12,411 | 2,245 |

| Other | 1,227 | (96) | 2,520 | 93 | 998 | 121 | 1,660 | 48 | 3,271 | (1,618) |

| Total Net Investment | $23,016 | ($5,463) | $119,263 | ($90,094) | $13,017 | $3,423 | $23,939 | $694 | $16,855 | $7,724 |

| VALUE | NPV | B/(P) Proto | NPV | B/(P) Proto | NPV | B/(P) Proto | NPV | B/(P) Proto | NPV | |

| Store | $13,201 | $2,493 | $14,225 | ($3,174) | $17,406 | $7,326 | ($3,319) | ($18,222) | $14,911 | |

| Credit | $3,554 | $544 | $11,650 | $7,164 | $3,121 | $279 | $3,635 | ($1,294) | $828 | |

| $16,755 | $3,038 | $25,875 | $3,989 | $20,527 | $7,605 | $317 | ($19,516) | $15,739 | ||

| Further Discounts @ 14% (13-9=4);(13-4=9) | NPV | NPV | NPV | NPV | NPV | |||||

| Store @ 4% | $12,693 | $13,678 | $16,737 | ($3,191) | $14,338 | |||||

| Credit Card @ 9% | $3,261 | $10,688 | $2,863 | $3,335 | $760 | |||||

| NPV | $15,954 | $24,366 | $19,600 | $144 | $15,098 | |||||

Exhibit 3:

| DECISION MATRIX | ||||||

| INVESTMENT | NPV | NEW NPV | IRR | QUALITATIVE FACTORS | PROTOTYPE Comparison | |

| Gopher Place | 3 | 3 | 3 | 2 | 4 | 3 |

| Whalen Court | 5 | 1 | 1 | 4 | 2 | 1 |

| The Barn | 1 | 2 | 2 | 1 | 5 | 4 |

| Goldie’s Square | 4 | 5 | 5 | 5 | 3 | 5 |

| Stadium Remodel | 2 | 4 | 4 | 3 | 1 | 2 |

| Key of Decision Matrix: | 1 being Highest suggestive, and so on till 5 being Least suggestive | |||||