Linkedin Corporation Case Study Solution

Porter Five Forces External Environment

Extent to competition

LinkedIn is allowing recruiters for posting job as well as offering similar products already being available via recruitment sites including CareerBuilder, Dice Holdings and Monster. Such companies are established and specialized in these field, the companies have expansive users that includes job seekers as compared to the predominantly employed members of LinkedIn. For instance; one of the largest job search engine is Monster in the world than Dice.com i.e. 2 million/ months and CareerBuilder’s visitors i.e. 24 million/month. Also, the competitors have strong financial standing than LinkedIn in terms of high profit margin which can be seen in Appendix C.

In addition, there are number of websites, job venture has been mobbing to online venture from offline at the average rate of 10.5% annually, thus competition within industry strong or fierce. Both users and recruiters have been benefiting from the monopoly so that they might neglect job post and redundant searches which has omitted the challenges being posed by small companies. There is no startup which can offer the unique products same as LinkedIn, because it could not amassing the database the LinkedIn has been working with. This depicts they might decreasing the job post, they could not challenge the overall recruiting revenue of LinkedIn. Furthermore, the buzz surrounding of IPO of LinkedIn has been giving enough media attention for the purpose of differentiating itself, which is one of the greater benefit to cement its market share.

Threat of entrants

The threat of entrant is high force, it is to say that advancement in technology have making sure that anyone with the coding background and personal computer has the ultimate knowledge for creating either social networking or job searching website and there are low capital requirement as server space requirement determines the cost of equipment. The reputation of LinkedIn as a professional network is well enough for staving off challenges or threats. New entrant has not enough brand equity while the popularity and ubiquity of the social media giants painting them as the unassailable targets. Also, such websites have contracts and pre-existing relationship with recruiters and advertisers making threat of entrant more challenging. LinkedIn should acquire new entrant before allowing to gather traction. The company has successfully acquire 15 patents and 5 companies.

Threat of substitutes

The users of LinkedIn could switch to social network of substitute recruiting platforms. The websites have enough product differentiation. The LinkedIn members have been looking for the professional network which makes them reluctant to switch to Facebook. Companies using LinkedIn sourcing job candidates having no direct substitute because the only company is LinkedIn with the extensive information level on the personal lives of members.

In contrast, companies that has been advertising on the LinkedIn most likely switching to another site of social media. Again and again, these are supposed to be the direct substitutes as other platforms have less information related to personal lives of users and is more informal. Due to these reasons, the share of LinkedIn’ social media advertising has bene consistently growing.

Bargaining power of suppliers

To online companies the major supplier including Monster, Facebook and LinkedIn are the bandwidth providers and server storage companies. These two groups have high bargaining power since the website’ popularity like LinkedIn and monster depicts that their business would be constituting a substantial portion of the revenue of bandwidth provider and server storage. The competition is leading to the price-cutting between these suppliers giving advantage in negotiation to LinkedIn.

Bargaining power of buyer

There is low bargaining power of Premium Subscribers of LinkedIn because Premium Subscription customer has power for influencing the volume or pricing. Even though one of the factor is the price sensitivity, the previous Premium Subscription price of LinkedIn decrease and depicting that although the shifts in price might change the number of subscribers, the overall profit of LinkedIn would remain constant. Subsequently, there is no substantial threat posed by price.

Unlikely, companies using LinkedIn to advertise having moderate bargaining power, since the companies can use other social media site to advertise and the cost of switching is relatively low. Here, one of the key factor is the price sensitivity, the amount is not public that is paid by advertisers but it can assume that the negotiation would resolve activity and user numbers. LinkedIn does not have user frequency or same cachet as Facebook, but having a professional and strong brand. Thus, it is to conclude that the advertisers would not retain high but moderate bargaining power level.

Recommendation

Based on the analysis, the strategic development should be focused ion two major areas such as honor product line to clarify brand and international expansion. The management of company has notified that the priority of company is international expansion hopping that it would boosting the growth rates of page view and stalling membership. Recruiting CareerBuilder and Monster websites have significant highlighted the existence of international markets and the success of LinkedIn has establishing that it is both qualified and prepared for taking this next step. The financial analysis depicts in case if mishandling this step, it would immensely undermining the profitability as a whole. Such preparation have influenced cost structure of LinkedIn, if substantial future returns would not be counterbalance expenses, the investors would expect dropping share prices substantially.

Once the company established itself internationally, it would allow the company to increase its worldwide infrastructure without allowing cost tend to overcome profit returns. In case of already professional network site in targeted international market, it is recommended that the company considers strategic partnership.

Even though, LinkedIn is known for its unique product, the company has to defend and thrive against new entrants due to its brand recognition in foreseeable future. In case the customer would not get satisfied with services and product offerings of LinkedIn they would turn to alternative options i.e. comparable analytic-based platforms. Thus the company has to fortify its brand, making it accumulate user data or sticky as similar to Facebook. Also, the company should add website segment which interfacing app namely business card, where the users would share contact information and profiles virtually and tapping phones. The company should also introduce internship platform, thus developing brand with the passage of time for which the debt would be used to finance the brand development strategy

Appendix A – Strategic Group Mapping

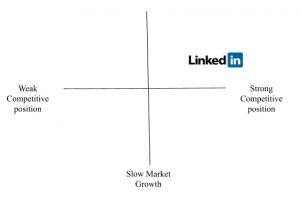

Appendix B – LinkedIn Market Position

Appendix C – Financial Ratio

| Ratio | Formula | 2009 | 2010 | 2009 | 2010 |

| Return on sales | Net income/net sales | -0.03 | 0.06 | -0.04 | 0.13 |

| Return on assets | Net income/ average total assets | -0.03 | 0.06 | -0.02 | 0.08 |

| Return on shareholders’ equity | Net income/ average shareholder equity | -0.44 | 0.42 | -0.03 | 0.12 |

| Current ratio | Current assets/current liabilities | 2.46 | 1.63 | 2.10 | 2.14 |