California Pizza Kitchen (CPK) Case Study Solution

The company is planning to repurchase its shares as the share prices are low at this moment, in order to do so, they need to have a debt financing. The company does not hold that much finance to repurchase the share. Debt financing has its own benefits and provides a tax shield, the company can save its tax amounts by a certain percentage.

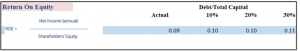

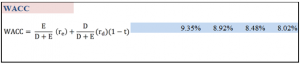

Debt financing will increase the total equity and the ROE (Exhibit 1) will increase in that matter, this shows how well the company is using its finances in generating profits. The ROE in real was 0.09, which means on each dollar that was invested by the shareholder, $ 0.09 was being generated. Increased ROE indicates better performance of the company. This will also contribute in increasing their share price. The weighted average cost of capital (WACC) will decrease as per the increase of the percentage of debt finance (Exhibit 2). Decrease in WACC is positive for the company, different companies try to keep their WACC as low as possible. Companies use different methods to keep it low and get alarmed if the WACC is more than the actual return. In all our scenarios, the WACC is going down as the debt percentage is increasing. In actual it is 9.35%, but if we have a 10% debt, it will decrease to 8.92%, on 20% it will go down to 8.48%, and on 30% it will be the lowest at 8.02%.

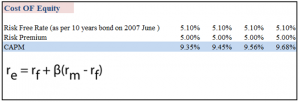

The CAPM of the company which defines the expected return on the basis of inherent risk (Exhibit 3). Higher CAPM shows the higher return the company will have on a higher inherent risk. The company can expect these returns by calculating CAPM but there is no guarantee that this will be the situation for real. In our given scenario, the CAPM will increase as the debt finance percentage will increase. This means that we can expect around 9.45% of return when we increase our debt by 10%, 9.56% on 20% debt and 9.68% on 30% debt. This is good for the company and shows how it is succeeding in the market when the whole industry is being effected by the inherited risk. s

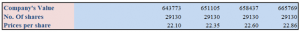

According to the calculations we have made, the share price will increase. It won’t be a drastic change, but it will still increase the value per share. The company’s value will increase, which will automatically result in the increase of share prices (Exhibit 4). If the company borrows 10% of debt, the share price will increase from $22.10 to $22.35. On 20% debt it will be $22.60, and on 30% it will become $22.86.

Under each scenario the number of shares they can repurchase will increase, if the company does not borrow money, they cannot repurchase but on burrowing 10% they will be able to repurchase 1011 shares, on 20% they will be able to buy 1999 and on 30% it will be 2965 shares.

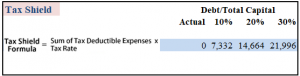

The debt finance also helps in tax shield, and the company will be able to reduceits tax expense (Exhibit 5). In actual scenario, the company has no tax shield right now, but if they take a debt of 10%, they will save $7,332, which will add to their EAT (earning after Tax). Same as if they take a debt of 20%; it will be $14,664, and on 30% it will be $21,996.

As per the calculations and evaluations, we recommend the company to borrow money in order to improve all the aspects of the company. It will improve the earning per share, ROE and also provide tax shield. The company is benefiting a lot by borrowing money than sticking to a non-debt financed company. The debt should be lower than the equity or else it will result in loss, the company should be vigilant in borrowing money, and debt financing should be implemented for the growth of the company.