Two Ways to Fly South: LAN Airlines and Southwest Airlines Case Study Solution

Operational analysis

Considering the statistics provided in Exhibit 2 A of the case regarding the Available Seats Miles (ASMs), Revenue Passenger Miles (RPMs) and Passengers are the operational analysis that could be used to analyze the ability to move towards international markets. It is analyzed that the Texas has been highly approached by international markets with high number of International ASMs, RPMs and the passengers, which implies that the company could easily expand its operations towards Texas, and could have an opportunity to earn more revenues as compared to its domestic markets. However, the Southwest airline doesn’t have any international experience with no international passengers and ASMs, which implies that the company requires high amount of investment to move towards South America, and has the risk of facing high chances of failure with poor liquidity position and no historic experience.

Based on the statistics of Southwest and LAN, to answer whether the land of Southwest in South America i.e. international market and further expansion of LAN in the United States would be lucrative and profitable or not, we can consider Exhibit 2 A of the case as it clearly demonstrates through the data of the year till 2005 in comparison to that of an average rate of both Southwest and LAN.

Financial analysis

The financial ratios are calculated for analyzing the financial stability and position of the companies in the market, the rations includes liquidity, solvency and profitability ratios,which are provided below:

| Comparing Lan and Southwest on the basis of Financial ratios | ||

| Lan | SW | |

| Debt Ratio | 24% | 10% |

| Current Ratio | 0.85 | 0.94 |

| ROA | 7% | 4% |

| ROE | 29% | 8% |

| Gross Profit Margin | 6% | 11% |

| Net Profit Margin | 6% | 7% |

Considering the table provided above;it can be seen that both of the organizations have low debt ratios, which implies that both can raise potential funds that are required to have an expansion into the international regions. Additionally, the Southwest has most of its ratios higher than the LAN, which implies that the Southwest is comparatively more financially strong as compared to LAN. Moreover, the ROA and ROE of both of the organizations are reasonable to justify the success of the organizations in their asset utilizations. However, both of the organizations have low current ratios, which implies that both of the organizations could face severe liquidity problems and issues in repaying the debt that would likely be acquired for the expansion purpose,if these airlines would ever decide to move towards further international markets. Therefore, on the basis of the financial ratios; it could be said that neither LANs nor the Southwest airlines could move towards Texas and South America.

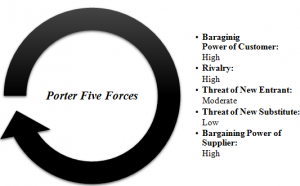

Porter five forces framework

The porter five forces analysis provides the five industry forces that are extensively used with an intent of determining the intensity of the market competition, along with the profitability level.The forces include:

- Bargaining power of passengers.

- Bargaining power of suppliers.

- Intensity of competition in the market.

- Threat of substitute product or service.

- Threat of new entrant in the market.

Bargaining Power of Passengers

For Southwest Airlines, offerings by the low cost carriers in the airline industry in the USA involves restricted service, product differentiation and similar services. For which, the company should put its major emphasis on less cancellations, fewer delays, lower price and more amenities at no added charge tending the high bargaining power of customers.

Bargaining Power of Suppliers

Bargaining power of supplier for Southwest Airline in the US Airline industry tends to be high due to the presence of planes’ suppliers,which include Boeing and airbus. On the other hand; unpredictable changes in the amount of fuel are extremely volatile in nature.

Intensity of competition

The level of competition in the airline industry is quite high. Leading airlines mainly fly in a number of similar places of the same airports with same fares. In the airline industry of the United States of America, Southwest airlines already tends to be one of the leading organization, fulfilling high quality services to its potential customers. In contradiction, there are a number of direct competitors with low-carriers in domestic means,who are offering similar services like Delta Airlines, American Airlines etc. Similarly for LAN Airlines as well, making the competition higher for the Southwest Airlines.

Threat of new substitute:

The availability of every products’ substitute is not unique in any industry.Similarly, the availability of substitute of airlines by use of ships, car and train has been quite common, but it cannot be significantly in direct competition with airlines, which primarily provides comfort, time and speed.Therefore, the threat of new substitute in any industry throughout the world is significantly expected to be lower.

Threat of New Entrant:

Because of the prevalence of new low cost carriers in the companies operating in Airline, industry creates the potential for new entrants to enter in the industry and attract the consumer base. The new entrants can easily enter into the market through offering higher quality services and strategy on the basis of low-cost, which tend to pose a moderate threat for Southwest Airlines to enter into the industry.(Jurevicius, 2013)

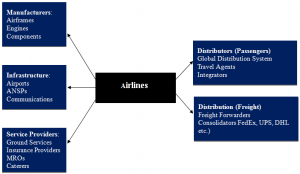

Value Chain Analysis

In the value chain analysis, the primary activities include: inbound logistics, operations, outbound logistics, marketing and sales and services. On the other hand, secondary activities include firm infrastructure, human resource management, technology and procurement.

In LAN airlines, considering inbound logistics related to operations involves a number of planning and scheduling of different services; outbound logistics transportation through aircrafts using updated fleets; marketing and sales includes indirect sales by the assistance of travel agents by participation in major Global Distribution Systems, whereas direct channels include websites, call centers and ticket offices; services includes courier, handling and logistics services. Furthermore, the infrastructure of the firm is quite well managed with an effective involvement of HR using pay structures in relation to the performances of the employees i.e. flight personnel, management and administration.

In Southwest airlines considering inbound logistics that are oriented to operations involves a number of point-to-point, low fare service; outbound logistics transportation through aircrafts, airbus and Boeing; marketing and sales includes indirect sales by assistance of travel agents.Whereas, the direct channels include websites; services includes service of RUSH Priority, the Next Flight Guaranteed. Additionally the infrastructure of the firm is like that of a loving family, working with an effective involvement of human resource HRS.

Recommendation

After taking into consideration the financial analysis of both airlines i.e. LAN and Southwest, and since both the organizations operating in different regions have been performing well,but, as the services of Southwest services have been only restricted to its domestic regions whereas LAN has been successfully involved in the international services with more statistics in comparison to average value evaluation.

In addition to this, it is to highlight that the number of services and products provided by LAN in comparison to Southwest airlines to its competitors are more prominent with effective use of strategic as well as technological approach. It is to recommend that the LAN airline has the potential to expand the business operations in Texas.

Conclusion

To sum up, it is to conclude that the evaluation of Southwest Airlines and LAN Airlines management and operations, the key reasons behind their increased profitability as well as competitive approach includes a number of factors such as fare rates, service quality, transportation etc. As the Southwest have no international experience with no international passengers and ASMs, which implies that the company would require high amount of investment to move towards South America and would face high chances of failure with no historic experience and poor liquidity position.Therefore, LAN somehow has the potential to run its airline operations in Texas.

Exhibit A – Porter five forces framework

Exhibit B – Value chain analysis

Exhibit C – Stakeholder analysis

- Stakeholders

- HR Managemnet

- Government

- Customer

- Energy Planning Department

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.

How We Work?

Just email us your case materials and instructions to order@thecasesolutions.com and confirm your order by making the payment here