“Radio One Incorporation” Case Solution

Introduction

Radio one was established by the Catherine Hughes in 1980 when she was currently teaching in the Howard University. (Fischer, 2000)Radio one is one of the largest radio group of the world which target the people of America and Africa. In the 1980 the Catherine and her husband raise the money to purchase the WOL-AM in Washington. For money saving, both wife and husband became the radio personalities themselves. Radio one is the successful corporation because it purchases the brilliant underperforming radio stations. In the 1995, the Radio one has 05 stations, which increase to 28 stations in 1999. With growing business, the revenue also increases and the Radio one increase the rate of acquisition and purchase many stations. The largest acquisition of the history of the company Catherine done with WKYS-FM in 34.0 million in the year 1995.

Question: 01 should Radio one acquire the 12 clear channel stations?

Acquisition of Radio one with 12 Stations

Yes, the Radio one should gain the 12 clear channel stations because with this acquisition the radio one can attract more American and African people towards their radio stations. Radio one can attract many listeners compare to other competitors. Black entertainment television is the major medium for the Radio one to attract more listeners after acquisition with clear channel stations.

Possible Assumptions

In the excel file of the solution, we use the three assumptions which are required for acquisition of Radio one with 12 clear channel stations.

Tax Rate

The tax rate for the company is assumed as 34% which is used to calculate the discounted rate on which basis we analyse whether the Radio one should acquire the 12 channel station or not. The 34% Tax is used for all the future forecasting years.

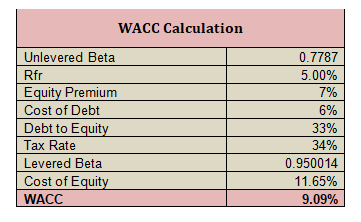

WACC

The rate of discounted is used as 9.09% for future forecasting. At this rate, the acquisition creates more value for the Radio one.

Growth rate

The Company is growing fast from its foundation.For here we are to assuming the 10% growth rate for analysing the worth of acquisition. The growth rate is taken as constant for the coming years.

Question: 02 Target purchase price

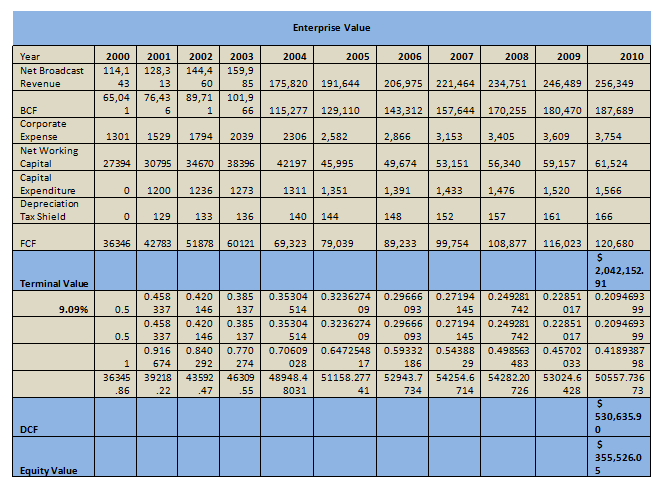

The target purchase price for the 12 Clear channel stations is $355,526.05 as shown in the Exhibit 02 given below in exhibits. It means that the 12 clear channel stations have the above value of stocks in the period’s last.

Question: 03 Variables affect the purchase price of 12 clear channel stations

The variables which affect the purchase price of 12 clear stations are organizational culture, Employees performance, Investors interest and Customers base.

Organizational Culture

After the Acquisition with radioone, the organizational culture of the 12 stations change with the change in employees’ relations with other firms’ employees. The two combined organizations change the culture of the organization and that changing affects the purchase price of 12 channel stations.

Employees Performance

The performance of the employees affects the purchasing prices because unsatisfied employees have low performance which reduce the purchase power of the 12 channel stations. That’s why the employees are the important part of the organization to make it strong.

Customer’s base

The customer base also affects the purchase price of the channel station because if listeners of the 12 channel stations are satisfied with their services, the purchase price can be remain stable or increase. The increase in prices also increases the revenue of the 12 channel stations.

Conclusion

After studying the case of Radio one, we can conclude that the corporation is very profitable from the start and increases the growth with multiple merger and acquisitions. The company is increasing the number of listeners by providing them quality services which satisfy their needs of radio stations. The Radio one is mainly target the audience of America and Africa because the people of these two countries are more like the radio stations. In the above analysis the Acquisition of 12 clear channel stations are to be discussed and the below excel Exhibits are to be given.

Exhibits

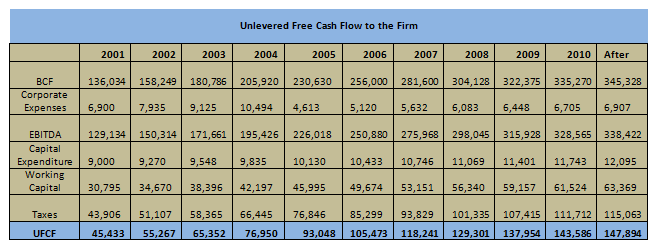

Exhibit 01 Unlevered Cash flow

Exhibit 02 Enterprise Value

Exhibit 03 WACC

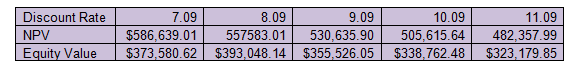

Exhibit 04 Sensitivity Analysis

“Radio One Incorporation” Case Solution

solution. Please place the order on the website to order your own originally done case solution."}" data-sheets-userformat="{"2":14913,"3":{"1":0},"9":0,"12":0,"14":{"1":2,"2":3355443},"15":"Arial","16":10}">This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.