Siemens Energy How to Engineer a Green Future? Case Study Solution

Four Functional areas of Siemens business

- Management

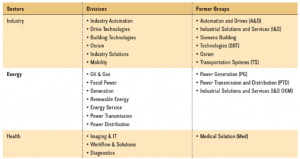

The member of the company that are the part of the managing board are entitled for the entire management of the company’s operation and are responsible for the strategic decisions made by the company. As the company’s operation is wide spread into various countries and is divided into three major sectors which is further divided into 15 subs strategic divisions. The company in order to simplify the complex structure has allocated each of the sector under a separate CEO.

Siemens management is committed to provide and work in the interest of the company and aims to achieve continuous growth. The management put its utmost efforts to deliver its potential customer the support by providing them with the innovative solutions.

Though the efficiency of the management is visible by the profits the company is able to generate each year through its strategic approach. But the bribery scandal did affect the overall position of the company in the market due to which a question was raised upon the performance of the management and the values that were being practice by the company.

Apart from this Siemens restrict itself from investing into the primary R&D majorly due to a fear of failure or loss; this will eventually affect the primary goal of the company that is to capture the energy market.

Recommendation

The company in order to improve its management should simplify the process by dividing the task among the individuals that possess the relevant expertise in the respective area, and the progress should be discussed on the weekly basis. The company should also opt for simple structure rather than having a complex infrastructure. This will benefit the company by eliminating the chances of future mismanagement by making the management much more efficient.

The company should invest more on the primary R&D as it will provide the company with a benefit and opportunity to enjoy the initial gains on the technology that was previously being realized by the initial producers.

- Marketing

Evidently Siemens have been engaged in effective marketing activities such as it has been collaboratively working with its customers and suppliers for delivering and manufacturing Made to Order (MTO) products through integrate its processes and supply chain helping the organization in delivering its products or services to its end customers.

The company has been contemplating to invest in research and development of small and medium sized companies, after evaluating the success probability and likelihood of the targeted project, the company has been taking decisions on the basis of viability of project, making g huge and massive investment in the proposed project in order to gain the market share and to strengthen its presence and position in the highly competitive market arena.

Furthermore the company as a part of its marketing strategy preferred being as a second mover in the industry. The company critically analyzes the growing market trends and look for the companies that are comparatively smaller or at their initial stage with innovative technologies in promising market segments. If the technology developed by these companies has a sustainable opportunity in the market. Siemens acquire those companies by making it a part of their growing portfolio. This strategy has benefited the company by saving its intimal investment in the R&D.

Recommendation

Though the strategy adopted by the company is working in the favor of the company and is successfully saving the cost being incurred by the company but it contains certain disadvantages. The company is known for creating a trend to be followed by other in the market. The company has created its image by being a first mover in the industry but know as per the existing strategy the company is working on the existing technologies. That has limited the gains earned by the company. As the initial gains generated on the technology is not realized under the company’s name, causing it to be a disadvantage to the company.

- International business

Siemens has been following horizontal integrated strategy, in which it has been engaged with the cross-border transaction and international commerce, which has allowed the company become more efficient and innovative in their use of financial and non-financial resources. Siemens has explored and captured number of international opportunities and strengthen its presence in domestic and international market arena.

One of the undeniable facts concentrated to Siemens is its diversification strategies, the unrelated diversification has been existing all across larger operating units such as energy, health and IT etc. while within the discussed unrelated units, there has been a related diversification. It has been actively pursuing its role in diversification by being active in several different international markets.

The business opportunities have been expanded by Siemens through an additional market potential of an existing product, therefore Siemens has been following a product market diversification strategy. Over the period of time, Siemens has been recognized as the dominant and the market leader in terms of its technical support, innovative achievements, reliability, quality and globalization.

Recommendation

After taking into account the adapted marketing strategies, it is to recommend that the company should heavily invest in R&D activities in order to find the most profitable diversification area, thus it should follow related diversification, it would allow the company to gain high profit return, whereas the unrelated diversification would negatively affect the brand value and brand image of Siemens products in the mind of customers.

- Account and finance

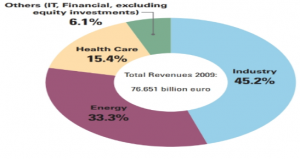

The company revenue over the year has grown by a significant margin. In the year 2009, company’s energy sector generated revenue of 26 billion euros. The company is financially sound and is among the few key players in the industry. The company operates in a highly capital intensive regulated environment.

Company’s total profit comprises of three main sectors. The major source of the company’s revenue amongst the three sectors is the Siemens industry which annually contributes 45.2% to the total revenue. The contribution made by the health care sector is comparatively the minimum. (Exhibit 2)

The company currently follows IFRS (international financial reporting standard) to compile their financial statement. The company previously used to follow GAAP to prepare their financial reports. But have now shifted to IFRS. As the company has expanded its operation across different countries outside Germany the company has incorporated more widely accepted accounting standard to maintain equality in the financials statement being prepared by the company in different countries. As the accounts prepared through the IFRS standards are widely understood and are comparatively easy to compare with the companies operating globally.

Siemens after realizing the change in the global trend from fossil fuel to alternative forms of energy has opened new opportunities for the company. Due to the number of emerging technologies to substitute the use of fossil fuel, the company has to decide between the various alternatives energies. The company is considering to have an investment in the wind and solar energies but is facing a risk, as one wrong decision can badly affect the financial health of the company. Looking at the current financial position the company had to decide whether it should acquire the small companies with an innovative products or it should form a strategic partnership with its competitors.

Recommendation

The company’s health sector is comparatively generating less amount of revenue. Therefore in order to stay amongst the key players, it is important that company should utilize each of its sectors effectively. The company needs to take some strategic decision regarding the health sector to boost its revenue and by making it equally competitive. Furthermore the company is considering investing in the new alternative energy. In order to limit the risk the company should continue to acquire the smaller firms that are producing some innovative products as this will save the some of the cost and will benefit the company by eliminating the risk of losing huge sum of money.

Conclusion

The company has maintained its culture throughout and is working quite efficiently in all the sectors. The company infrastructure is based on excellence, innovation and is highly customer focused. The company has narrowed down its sector in order to make the structure simpler. As this will improve the overall efficiency of the company and will help it to maintain a strong hold of the values and culture being practiced by the company intact.

Exhibits

Exhibit 1: Siemens organizational corporate structure

Exhibit 2: Siemens sector revenue