Suburban Office Property Acquisition Case Solution

Introduction:

This case is situational based on two friends are involved in this case. One is the middle-level manager whose responsibility is to handle the asset management and acquisition of investments in the city of New York. Other friend belongs to the family having the portfolio in suburban investments in Boston. She has the experience of many characteristics of production, leasing and investment. Both the friends have so much interest from the institute time for working together. They both perform an academic project of investing in suburban office in New Jersey. After graduation, both of them go back to their family office jobs. After some months, both of them were called by a broker for an excellent opportunity to gain the property. The property was on the main area of suburban with the train entrance to New York. Both of them go to the site and visit the property and draw a draft plan that should its property gain or not.

The market situation was not too good during the Downturn four years before. Now the market is moves towards stability and this can prove an excellent opportunity for both of them to invest in this main located property because it ultimately generate the more revenue in the future.

Question 1

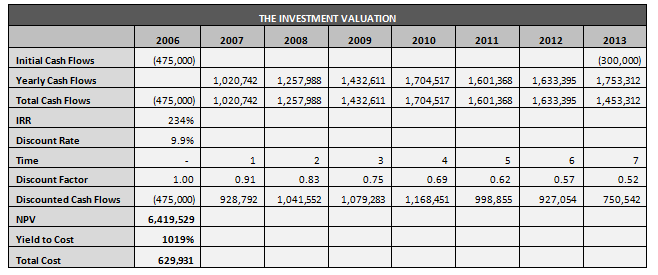

Based on the assumptions given in the case and calculations done in Exhibit 1, it could be said that since the IRR of the investment opportunity is determined to be 234% which is a lot more than the 9.9% of the required rate of return. Hence, the investment is way much workableand the investor must look for various resources to invest in the opportunity. Also, the Yield to cost of the investment is determined as 1019%. This is a good rate for a considered long-term investment.

For calculations, refer to Exhibit 1.

Question 2

- Market Risk

The difficulties in the market are not consistent. Market became challenged and the rents of property also increase. Increase in interest rates, changing in inflation, economy these all factors shows negative affect in investment market.

- Unsystematic Risk

Unsystematic risk is associated with the property investment this risk referred as the higher return generate when an investor take more risk. Here, the property is on very good and open area, so the return is definitely good from this investment.

- Asset Risk

Here, the rate of asset risk is low because the property is in a suitable location, but this can be a risk for those buyers who avoid the train tunnel.

- Replacement Cost Risk

Replacement cost risk has more chances in this case because the future profit is to be assumed in this case that the property generates more revenue. But in future may be the cost of property decrease according to market trend, so the contract may have less positive terms.

- The risk of conflict can be arise in this investment because in this property two partners are involved

How to mitigate these risks?

- The market risk is mitigated by investors to use diversified strategies to edge the instability. Use of options tool is also an excellent tactic for investor to defend it from high market loss

- The unsystematic risk is mitigated through portfolio. Investors should invest in different investments through which the risk rate can be reduced

- The asset risk is mitigated through evaluating the issue based on records that in this location, if asset risk was available, then how to manage it. The best option for mitigate the asset risk is risk avoidance strategy. This strategy eliminates the whole risk, and the investor defends from loss

- Replacement cost Risk can be mitigated through diversified investments means portfolio because if this jointly handled project make loss, then the investor can cover the profit from other investment

Question 3

If the operator is involved in the joint venture, then it has many risks and benefits allocated to it. The benefits of the joint venture includes gaining of investment insights with additional expertise of the partner. There would be access to more resources because the partner would hold access to more resources as compared to the resources in case of a singleinvestor. The overall risks and costs included in the investment would be shared. There would be more scope of efficiency in the project as the efforts to make the investment would be doubled. Besides these benefits, there also lies various risks and disadvantages with such join ventures. These include sharing of profits according to the ratio of equity. There also lies higher possibilities of conflicts of interests and the challenging coordination. Also, with the partnership terms, the single partner would not have complete autonomy over the decision making included in the investment.

If one of the friend would to put 80% of the required equity than it would be a better option under the investment opportunity to keep the capital structure debt free, i.e. 100% equity based. Because of this, there would be no risk of interest rate fluctuations. The 80% to 20% equity ratio could be made fair with the 80% stake of the investment given to the friend and the remaining stake of 20% allocated to oneself.

Question 4

If the tenant vacates the property, you can cover the cost of realizing the property. Some options are as under:

- You cover the cost of re-leasing the property by hiring a new tenant.

- If you hire a new tenant, you add the renewal leasing commission rate that is 3.25% to the tenant’s monthly rent, so you can easily cover the cost of re-leasing.

- You cover the cost of re-leasing by adjusting of leasing cost of the tenant.

Recommendations and Conclusion

With multiple major withdrawals and sluggish job growth, suburban office properties in New Jersey suffered a significant softening. Although the market has recently recovered, with fewer vacancies and moderate rent increases, it is still in a precarious position. The best-performing hotels are near public transportation and within walking distance of town centers with a variety of dining options.

Rents in this submarket range from the high teens to lower-quality properties with limited access and amenities to the low $30s for the best. Although the market vacancy rate has declined from 11% in 2012 to roughly 10% in late 2013, many of the properties are completely leased. However, job growth remains sluggish because of high state tax rates and onerous regulatory burdens on the private sector. If all goes well, the investment will yield excellent profits.

From the case, it could be analyzed that the considered investment opportunity seems to be a good option for the friends to invest. Although there are some risks in the investment opportunity but the return to risk tradeoff implies excellent investment opportunity. With the returns being at 1019% the investors are suggested invest with high hopes.

Exhibits

Exhibit 1

Suburban Office Property Acquisition Case Solution

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.