Portfolio Project Case Study Solution

| Correlations | ||||

| Company A | Company B | Company D | Company E | |

| Company A | 1 | -0.011117051 | 0.377511306 | 0.004265384 |

| Company B | 0.377511306 | 1 | -0.093467487 | 0.419568292 |

| Company D | 0.507113969 | 0.074358644 | 1 | -0.001400528 |

| Company E | 0.367125968 | -0.010455418 | 0.421102299 | 1 |

| Covariance Matrix | ||||

| Company A | Company B | Company D | Company E | |

| Company A | 0.0064 | -0.0001 | 0.0022 | -0.1257 |

| Company B | 0.0028 | 0.0085 | -0.2569 | 0.2776 |

| Company D | 0.0029 | 0.0005 | 0.0051 | -0.1528 |

| Company E | 0.0015 | 0.0000 | 0.3003 | 0.0025 |

| Portfolio Variance | -0.000557306 | |

| Portfolio Standard Deviation | 0.023607335 | |

| Portfolio Return | 0.0083682 |

Global Minimum Variance Portfolio

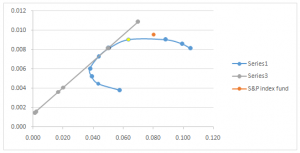

The minimum portfolio variance assists in identifying the portfolio or the mix of stocks, which will provide the highest return at the lowest risk and enable the investor to select the best portfolio mix for the investment. Furthermore, the portfolio with the highest Sharpe ratio is considered to be the most favorable portfolio among all the other portfolios. According to the efficient frontier diagram, the most efficient portfolio is determined on the point where the risk is minimum and the return is maximum, and at that point of intercept the best suitable portfolio of stocks for the investors. Hence, the diagram of the efficient frontier portfolio can be seen below.

Conclusion

The portfolio analysis is an important technique to identify the best suitable portfolio according to risk and return nature of the investor. Furthermore, different portfolios with risk and return characteristics are available from which different investor choose to invest according to the risk and return characteristics desired by them. Hence through portfolio analysis, the most desirable portfolio according to the needs of the investors is identified. So according to our analysis the best portfolio weights which provides the maximum return at the lowest risk is 30% invested in Company A, 13% invested in company B, 2% invested in company D, and 55 percent invested in company E, which provides maximum returns at lowest risk.............

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.