“Quantitative Easing in the Great Recession” Case Study Analysis

Question 1:How does buying bonds help to stimulate the economy? In your answer, consider how Quantitative Easing (QE) may impact different sectors of the economy (households, banks, and corporations), and think about macroeconomic variables (GDP, inflation, and employment) that will be most affected by QE. (5 points)

Answer 1:When the Fed gets the bonds in the market, it improves the flow of money to the economy by changing bonds in exchange for money in the general people. Furthermore, if the Fed sells bonds, it decreases the Flow of money by leaving the money from the financial system by interchanging bonds. Therefore, OMO has the same outcome of decreasing the price / increasing in the flow or raise in the price / drop down of the earnings as a direct decrease in profit rates. The real difference, however, is that OMO is a good saving tool because the size of the U.S. guarantee market. It is very large and OMO can work on the obligations of all the maturity that affects the supply of funds. Quantitative easing affects the commitment through different instruments: Credit instrument: By giving liquidity in the banking division, QE makes it simple and less costly for banks to increase loans to firms and households, thus restoring credit expansion.

The U.S. The associated fund performs open market workings - purchasing or trading bonds and other guarantees to manage the flow of funds. Through these agreements, the Fed can increase or combining the quantity of money in the banking network and operate the interest rates decreased or increased, depending on the perspectives of its financial strategy.

Significance of Open Market Showing

Open market showing is one of the 3 key measurements the Fed uses to gets its policy perspectives, and it is easily very strong and frequently used. (2 other measurements are the balance of banking condition and the terms and situations of bank giving in the Fed's discount opening.

With a dealing desk at the Fed New York branch, open market workings allows the Fed to effect the flow of security in the banking system. This procedure then affects interest rates, the desire of banks to give to consumers and trading to borrow and finance.

Question 2:Summarize the potential costs of QE. Why were critics of QE concerned about what would happen to inflation? (5 points)

Answer 2: Through QE, the main bank buys securities/certainties in an effort to decrease profit rates, giving more lending and giving increased lending to customer and firms. All of this is focused at raising economic projects during the economic crash and keeping dues moving.

When the main bank decides to use QE, it makes huge purchases of economic resources, such as executive bonds and companies bonds and shares. This simple decision has extensive difficulties: The value of money revolving in the economy is increasing, which helps to decrease future interest rates. This decreases borrowing amount, which encourages and increases financial expansion. When the linked contribute appeals a standard strategy, it changes its commercial strategy. The purpose here is to command the short-term rates that banks force search other overnight loans. The Fed has used a profit rate policy for generations to keep dues flowing and the U.S. providence floating.

But when the government budget went down to zero during the Great downturn - which made it hard to cut further to encourage supplies- the Fed sent a QE and started getting the stocks financed by resources and revenues to keep the wealth stored.

QE is still allocate in times of great unreliability or economic downturn that could turn into a market warning. It is aimed at challenge the economic downturn and stop the worst.

Limiting reductions works by making acquire of larger resources. In response to the coronavirus disease, for example, the Fed has started purchasing future valuable sand trading bonds. Here's how a basic act of acquiring goods in open markets exchanges the economy (especially) for the greater.

The Fed acquires goods. The Fed can make money- so-called money reproduce - by writing bank securities in its balance sheet. With QE, the center bank uses the new resource banks to acquire future valuable in an open market in big economic organizations.

Question 3:Describe in words and/or illustrate the effect of QE on 1) the supply and demand for money graph and 2) the aggregate demand and aggregate supply graph. (5 points)

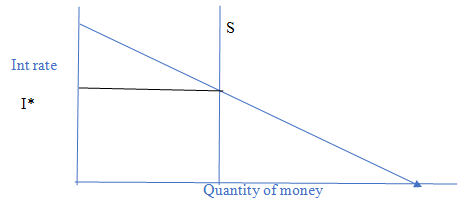

Answer 3:Increasing the flow of money decreases the value of money - the same results as increasing the flow of any other product in the market. Reduced cash flow leads to decreased profit rates. When profit rates are low, banks can take loans more easily. Limited cutback are used when profit rates close to 0. Because, at present, centre banks have little resources to affect financial expansion. However, if a merged order fails to answer to much decreased prices, another strategy should eventually be looked for. However, if a merged demand fails to answer to much decreased prices, another strategy should eventually be put forward. This is because little interest rates cannot go down below zero this is because little profit rates cannot fall below zero expansion.

Question 4: The Fed has been buying bonds ($375 billion in the week of March 23, 2020 and an additional $30 billion in the week of May 18, 2020) to help stimulate the economy during the COVID-19 pandemic (Note: WSJ news article available on Moodle). Given the context of quantitative easing during the Great Recession, is the Fed’s recent purchase of bonds the appropriate tool of monetary policy during the current crisis? Explain why or why not. (5 points)

Answer 4:Using the instrument picked up during the 2007-09 Massive down turn, the Fed has provided direction on the timing of its crucial profit rates, guessing that prices will remain decreased “until labor market situations reaches standards equivalent with high councile valuation selection and raising prices rise. At 2% and is on the point of increasing 2 % over a period of time. The Fed has also started to buy large amounts of guarantee, a key instrument used during the massive downturn, when the Fed is buying billions of $ for Future certainty. Revenue-financed certainty markets and loans are not doing well after the affect of COVID-19 and the Fed's working are focused at reinstating market performance so that dues can continue to Supply.

The Fed has also begun to have huge amounts of security, a key tool used during the massive outbreak, when the Fed buys billions of dollars on future certainty. Treasury-financed security markets and loans are not doing well after the COVID-19 pandemic, so I believe Fed most recent purchase of the bonds is a good move.

The Fed can acquire present collective bonds and exchanged financing that charge in financial bonds. These establishment "will allow firms to gain credit in order to better keep business and passion showing during the pandemic - correlated sections,”. Originally backing $ 100 b in new financing, the Fed announced that these organization would repay $ 750 b of collective dues. Also, like preceding institutions.

The Fed confirmed giving credit to families, buyer, and private firms by giving credit to container of resource supported defense deposit by new believe. These credits include substitute loans, car proceed, impose card credits, and proceed confirmed. In a stage past the crisis period plans, the Fed increased certified assurance to include living business agreements confirm safety and recently gave insurance credit dedication of the greatest standards. Like the projects financing corporate advances................

“Quantitative Easing in the Great Recession” Case Study Analysis

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.