Iss A/S: The Buyout Case Study Solution

Potential Rate of Return for PE Buyers

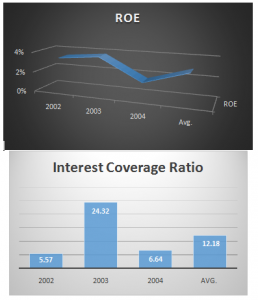

If the PE buyers would have an equity investment of DKK 4794 million in the deal, and they would exit from the deal in the year 2010, they would generate an IRR of 53% from the investment based upon the DCF calculations in the previous section.

The 53% could be compared with the buyer’s WACC to determine the feasibility. However, in the absence of a WACC, we can say on the rationality basis that the 53% IRR is quite potential and the investment would be feasible for the PE buyers. (See Exhibit B)

Evaluation of the Bid

The bid price for the ISS can be evaluated on the basis of the share price offered in the bid and the share price computed in the excel spread sheet. The bid price offered by the company equals to DKK 470 per share and the share price calculated through enterprise value equals to DKK 334. There is a huge difference in both the prices. The company is already overvalued in the market and the shares of the company are sold at higher prices than their value. Even the closing price of DKK 358 does not provide actual value as compare to the actual share value. In this scenario, where the closing price is already overvalued in the market, the bid price of DKK 470 per share at 31% premium does not make any sense.

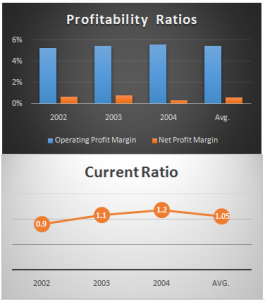

However, if the buyers would buyout the ISS at the bid price, there are still several ways to increase the return on investment, which the buyer can choose. As the company’s cash flows are calculated on the basis of an organic negative revenue growth of 2%, the buyers can take certain actions to increase the revenue growth like developing marketing strategies, introducing new facility services, expanding to new markets, market penetration etc. Along with it, the company has a high staff costs as percentage of sales i.e. 65.86%, which could be reduced by firing non-productive staffs and improving labour productivity. Moreover, the buyers could reduce the total operating costs of the company to increase the operating profit margin that is only 6% to increase their return on investment.

Conclusion

Although, the ISS could be highly beneficial for the company, as the company is one of the world’s largest facilities service company, but the offered bid price and the concerns of various stakeholders specially the bondholders and the regulations under Danish could highly impact the company and could lead to decline in its bond prices in the market. Therefore, the buyers should analyse the bid price thoroughly and then move forward in their buyout process.

Exhibits

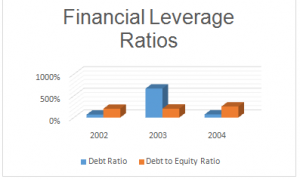

Exhibit A: ISS Financial Performance Analysis

Exhibit B: IRR Calculations

| IRR Calculations | |||||||

| Initial Outflow | Total Net Cash Flows | ||||||

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | ||

| -4794 | 801 | 767 | 734 | 702 | 670 | 44308 | |

| IRR | 53% | ||||||

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.