GG toys Case Analysis

Introduction

G.G. Toys was a toy manufacturing company that was also a supplier of high-quality toys to retail toy stores across the United States. The company was known for the high quality and unique design of toy suppliers which had a wide marketplace across the US. Furthermore, the company manufactured unique and durable toys by using vinyl and resin material. The unique manufacturing of dolls made a strong as well as a deep-rooted market in the United States however G.G. Toys gained a strong market position as well as customer loyalty so within a short period of time G.G. Toys successfully established a qualitative market existence in the market with its high-volume Geoffrey doll product line. (Jacobsen, 2018)

G.G. Toys operated two different plants including the Chicago plant and the Springfield plant however The Springfield plant was utilized just to create doll cradles and the Chicago plant was only concerned about the production of different types of dolls. The company manufactured boy and girl versions of the doll with a slight difference in the facial appearance and the length of hair. As the company had strong popularity in the doll manufacturing industry so the company initiated the supply of a high volume of toys in the market however because steady prices of standard Geoffrey and the rising costs of production affect the gross margin of the company due to which the gross margin reduced from 25 percent to 9 percent in the same product line. Furthermore, the company started producing customized dolls under the product line of specialty-brand which enabled various retailers to place their orders based on their customized specifications again enabling the company to achieve a strong market position in the industry.

Problem Statement

The company was facing various complications in the production costs as well as in the product margin that resist the company to maintain the market position because of which G.G. Toys could achieve its targeted goals. However, G.G. Toys had a problem with the cost of production as well as in the product margin where they were facing an increase in the cost of production and a decrease in the product margin which resist the company to achieve their targeted goals objectives.

Situational Analysis of G.G Toys

The situational analysis refer to the SWOT analysis including strengths, weakness, opportunities and threats which the company is facing. See Appendix-2.

Question No 1

The existing cost system in G.G Toys resists the company to achieve its targeted goals because of the existing cost system the production cost of standard products increased so, the company needs to change its existing cost system. As the overhead costs of the company are high so G.G. Toys need to introduce the appropriate costing system. The Chicago Plant manufactured both Specialty dolls and Geoffrey dolls so, for the manufacturing of different types of dolls the company required different machines and production lines, and for the availability of products in the market the company also required different and suitable setup and shipment costs. So, the company is needed to change the traditional costing system because it is not suitable for the company. (G Foster, 1996)

The traditional or existing cost system of the company is complicated that resists the company to regulate the overheads. It is very necessary to allocate the different manufacturing costs on the basis of their respective cost drivers that would regulate the allocation of the overhead cost. However, according to the existing system, the manufacturing overheads are allocated on the basis of the production run direct labor cost. So, for the allocation of overhead costs, there should be a respective cost drive like a machine hour is the appropriate cost driver for the costs related to the machines. So, for the Chicago plant, the activity-based costing system is much more appropriate and suitable than the existing costing system which would determine different margins on the basis of toys types however, for the Springfield plant the traditional costing is suitable because it has only 5 percent of overhead costs while it produced only one cradle.

Question No 2

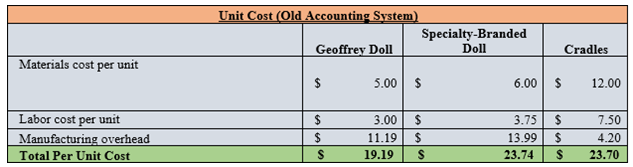

The production cost of the company has main components including overheads, labor, and substantial however the cost of operational expenses are determined on the basis of the (Traditional costing system) production run direct labor cost by G.G Toys. For the determination of operational expenses of each unit (overhead cost), the division of total overhead cost with the total labor cost is required however for the allocation of overhead cost the resultant percentage is used. While per unit cost of the Branded doll was determined as $23.74 and $23.60 was for Cradles however $19.19 was per unit cost for Geoffrey dolls.

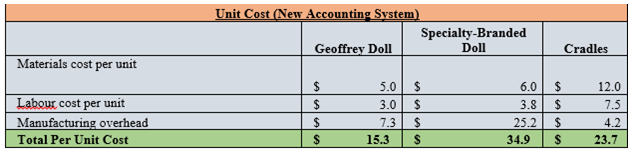

However, on the basis newly introduced accounting system i-e activity-based accounting system there was a slight difference in the cost as because in the ABC costing system during the computing the operational cost all required drivers are utilized. So that is why according to newly introduced accounting system per unit cost of Geoffrey dolls is around $15.27, $23.72 for Cradles and $34.94 for the specialty brand dolls.

The calculations shows that the price for both Specialty-Branded dolls and Geoffrey dolls are significantly different as compared to the traditional accounting system values however the calculated prices of Cradles with both system is remain same so it is determined that the traditional accounting system is suitable for only cradles it is because of the existing labor incentive policy of Springfield Plant.

order your own originally done case solution."}" data-sheets-userformat="{"2":14913,"3":{"1":0},"9":0,"12":0,"14":{"1":2,"2":3355443},"15":"Arial","16":10}">This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.