Garmin Case Case Study Solution

Bargaining Power of customers:

Due to the loyalty of customers towards the brand products;the bargaining power of customers tends to be moderate to low. As there has been noticeable changes in the growth of the PND industry; the dynamics of the consumer demands have also known to show fluctuation.

This is primarily based on the type of innovative products introduced in the market.

Bargaining Power of Suppliers:

Due to the reliance of GPS industry on the data to provide services to its potential consumer base, different players have limited ability to negotiate on the pricing structure. As the GPS market players are dependent on suppliers for the distribution of their products and receiving the manufacturing material, the network of suppliers tends to be larger,which offers competitive pricing structure based on the relation with the organization. Thereby, the bargaining power of the suppliers is moderate.

Threat of New Entrant:

Due to the requirement of high capital investment, the threat of new entrants tends to be higher. The changes in the economies of scale and the government policies regulated by the state government affects the entrance of players in the market. Considering the opportunity of merger and acquisition;the new entrants can pose a threat to the existing players operating in the GPS market.

Threat of New Substitute:

The threat of substitute such as smartphones, digital camera and other products tends to pose a threat to the decline in sales of the existing players in the market. But because of the consistent investment in the research and development to launch innovative products in the market, the shift of consumers’ interest towards other products is somehow not possible. As customers are mainly concerned about the product quality,the threat of new substitute is low.

VRIO Analysis:

The VRIO analysis of Garmin is a broad range analysis,providing the organization with a chance to acquire a viable competitive advantage against its competitors in the food and beverage industry.(Summarized in Exhibit C).

Valuable

The resources used by the Garmin are valuable for the company or not. Such as the resources like finance, human resources, management of operations and experts in marketing. These are some of the key valuable factors for the identification of competitive advantage.

Rare

The valuable resources utilized by Garmin are even rare or expensive. If these resources are commonly found then it would be easier for the rivals and the new competitors in the industry toenter into the competition effortlessly.

Imitation

The imitation process is costly for the rivals of Garmin. However, it can be done only bytwo different techniques i.e. product duplication, which is produced and manufactured by Garmin and launching of the substitute of the products with switching cost. This increases the threat of disruption to the recent structure of the industry.

Organization

This component of VRIO analysis deals with the compatibility of the company to achieve its position in the market, making productive use of its valuable resources that are difficult to imitate. Frequently,the development of management is totally dependent on the firm’s execution strategy and team.Thus, it polishes the skills of the firm by time based on the decisions made by firm for the progression of its strategic capitals.

Competitive Analysis:

Among all the segments of Garmin’s products,it competes with a larger number of firms in the market. The key competitors of Garmin are Tom Tom, MiTAC, Navico and others. Despite these three major competitors, Garmin faces a strong competition from different players in the market of all of its products segments. Some of the competitors of Garmin are known to have greater financial, technical and marketing sources, such as Apple, Samsung, and Tom Tom etc. These players tend to have the ability of responding rapidly with the emerging technological approaches with respect to the demands and requirements of the customers. One of the key issues or a concern that needs utmost consideration includes the same network of suppliers or distributors by the competitors, which has a tendency of positing a potential threat of losing suppliers that might negatively impact the supply chain. (Garmin, 2018)

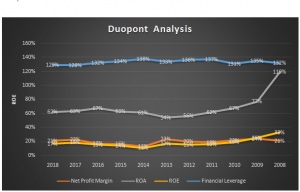

DuPont Analysis:

Considering the main components of DuPont equation, the effect profit margin, ROA and financial leverage on ROE have shown noticeable changes from 2008 to 2018. There has been a significant decline in the ROA of 2008 to 2018 i.e. 119 to 62%. Similarly, the percent of ROE has shown decline from 33% in 2008 to 17% in 2018. Therefore, the decline in ROE is due to the decline in the ROA,which primarily includes the sales and assets as shown in the Exhibit D.

Recommendation:

Based on the analysis of the company, Garmin is recommended to implement the differentiation strategy that is a combination of changes in the overall strategic approaches, such as changes in the pricing strategy, marketing, advertising, investment on research and development, which are required to not only increase the sales of the organization but also to improve the brand’s reputation in the international market.This also includes the targeting of specified audience as the key focus segment for its sales.

Implementation Plan:

Survey:

Conduct survey to gain the feedback from the customers about the services provided and evaluate how the changes in the strategic approach have been influencing the experience of customers and their level of satisfaction regarding the product, price and the services provided.

Performance measurement:

Measurement of the performance to evaluate the growth in the sales as well as the successful strategic implementation by comparison with the expected sales with the estimated sales.

Risk with mitigation tactics:

Introduction of low price products and over differentiation might negatively affect the firm in terms of revenues. So, determining the demands and needs of the customers and then investing in the fulfilments of those needs tend to reduce the chances of increased operating cost for the company.

Appendices

Appendix A – SWOT Analysis

| Strengths | Weaknesses |

| · Geographical expansion

· Wide product range · Capability of leveraging GPS technologies and in-house manufacturing · Large working force |

· Over dependency on North America

· Lack investment |

| Opportunities | Threats |

| · Joint ventures lead to increase market share

· GPS modernization |

· Economic instability in potential countries

· Risk of incremental cost by shifting of products. · Failure of supply chain |

Appendix B –Porter’s Five Forces Analysis

Appendix C – VRIO Analysis

| Resources | Valuable | Rare | Imitate | Organization | Competitive Advantage |

| Network Flexibility of Supply chain | Yes | Yes | Close – sharing some same suppliers chain | Completely consumed. | Unused competitive Advantage |

| Market position | Yes | Yes | Challenging | No | Competitive Parity |

| Leadership team | Yes | Yes | No | Yes | Strong competitive Advantage |

| Awareness of Brand | Yes | No | No | Yes | Competitive Parity |

| Financial Resources | Yes | No | Compatible with all rivals | Financial status is sustainable | Temporary Competitive Advantage |

Appendix D – DuPont Analysis

| DuPont Analysis | |||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | |

| Net Profit Margin | 21% | 23% | 17% | 16% | 13% | 23% | 20% | 19% | 22% | 24% | 21% |

| ROA | 62% | 63% | 67% | 63% | 61% | 54% | 56% | 62% | 67% | 77% | 119% |

| Financial Leverage | 129% | 128% | 132% | 134% | 138% | 133% | 136% | 137% | 131% | 135% | 132% |

| ROE | 17% | 18% | 15% | 14% | 11% | 17% | 15% | 16% | 19% | 25% | 33% |

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.

How We Work?

Just email us your case materials and instructions to order@thecasesolutions.com and confirm your order by making the payment here