FUTURE PERFORMANCE OF CISCO SYSTEM INC. Case Solution

Alternatives

After analyzing the situation from different perspectives there are alternatives available for Stark that can possibly helped him in resolving the issue that he is facing regarding the method. These alternatives can provide him the more clear view regarding the company’s performance for the upcoming years. After the incorporation of all the facts and fluctuations that can negatively impact the company’s future growth and the cash flow, the company can expect to generate by using these alternatives.

The following are the alternatives available for Stark that he can use in order to predict the company’s performance:

Alternative 1:

Ratio analysis

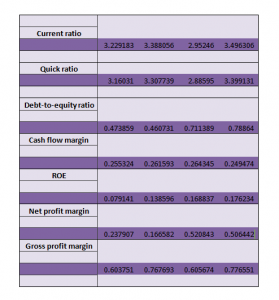

Ratios is so far the most reliable option available for Stark through which he can not only predict the company’s future performance but can also compare the results obtained, with the competitors current performance in the industry. Ratio analyzation is a major tool to analyze the performance of the company in comparison to the companies in the industry in similar market more effectively.

It helps in unfolding the company’s financial position in a much more detailed way by analyzing each and every aspect of the company. It helps in determining the areas of the company that are of high concerns. It also simplifies the complex figures and make it easy for an analyst to understand and predict the company’s performance through giving those number a meaning by connecting and relating them to each other.

It is the most effective tool used by the investor to diagnose the overall financial health of the company, helping the investor in making better decisions regarding their investment. It also benefits the investor by forecasting the company’s performance, if calculated for a number of periods.

Alternative 2:

Discounted cash flow analysis:

DCF is a common method used by various investors to evaluate the performance of the company in which they consider to invest. It is also an important tool for measuring the performance of the company.

It measures the attractiveness of any investment. It is used to forecast the cash flows that the company is expected to generate in the following years. It is obtained by discounting the future cash flows back using a discounted rate to identify the present value of the cash flows, the company is going to generate in future. The present value obtained by discounting the cash flow then determines the true potential of the investment that the investor is willing to make. If the present value of the cash flow determine is more than the cost of investment being incurred by the investor, then that investment is considered to be a valuable investment, vice versa.

It is considered as a reliable method for the identification of the intrinsic value of company. It is based on the assumption made by the analyst, the more realistic the assumption is the more it leads the investor to accurate results. It is considered to be more reliable than other methods used by the company to predict the company’s performance as it includes the free cash flow for the future projections and is not significantly affected by the fluctuation in the market in case of short run.

The drawback associated with this method is that it is entirely based on the assumption of the analysis. A wrong assumption or a slightest maladjustment can lead to a significant variations in the results obtained through the discounted cash flows than the actual result as it involves future forecasting, non-transparent operations of the company which can make it very difficult to forecast accurately sometimes.

Recommendation

Among the alternatives prescribed to Stark, the most appropriate method that can be used by Stark in order to accurately evaluate the company’s performance by using the data collected is through ratio analysis. Though it has certain limitation but so far ratio analysis is the widely accepted method used to evaluate the company’s current performance in order to predict its future growth. It determines the relationship between the values and transform it into a meaningful information for the investor to help him predict the future performance of the company. It benefits the investor by providing him with the insight of the company that whether the company is financially sound or not and whether its liabilities are sufficiently backed up by the assets or not. It reflects the overall financial health of the company and its performance in comparison to other companies operating in the same industry for more reliable comparison. It is relatively more meaningful and objective as it helps the investor to determine the strength and weaknesses in the sector it is operating.

EXHIBITS

EXHIBHIT 1