Digital Disruption in parking meter industry Case Solution

Introduction:

VW is the company that finances mobile-parking-based platforms. Mobile parking is highly useful for drivers since it prevents them from the hassle of searching places within the parking area, by providing information regarding the location of available parking spaces, hencesaving their time and helping them in avoiding unnecessary traffic load caused by the drivers searching for parking lots. Mobile parking is not something that just adds value to a customer’s life, but it is also highly beneficial business for the investors too. It saves the provider from the cost that is wasted on wires and devices. It provides a simple and easy parking monitoring option of how much space is required for the particular location. It makes cash collection easier and handier by preventing the cost of conveyance. It also prevents cost by reducing the number of labor involved.

Problem statement:

A company called ATB was providing services for phone-based parking and public transport was being operated by the CEO: Peter Bauer. The company was working fine with Bauer’s 90% stock investment in ATB, but sooner new competitors entered the market which generated greater revenue than ATB. Now the Bauer can either sell its stock to invest in another competitor company because that cost of ATB is perceived as high by its customers or the company can invest more in ATB R&D since most of its stock is invested in it.

Current Business model:

ATB is the company that was first introduced as the provider of parking management solutions in 2001, and it is a leading company to provide parking machines that can be paid through either phone or cash. Later its services extended to ticket validation, and solar lighting, and special solutions, which are designed to be individualized according to the customers' needs, and include products like charging stations and PO Box racks.(Baumann, 2017) It can also expand its services to Europe and the UAE.

The most important strength of this company is the focus on quality and providing products in the harsh climate of the UAE. The company’s strength is that the devices which it isproviding are highly durable and long-lasting, which can represent it as a worthy one-time investment. This strategy builds the company’s perception among its clients asa strong competitor in the digital parking meter industry. The company also uses a renewable and affordable energy source to recharge its parking meter devices.

The company also aims to work globally since it has chosen UAE as its customer, which is a tourist country visited by people of all cultures and backgrounds, for trips and businesses. It aims at providing the most updated technology of parking meters and has updated its products several times to provide the device of high efficiency and better functionality. Another reason that proves its preference for innovation and quality is the inclusion of free training for municipality staff on all aspects of device handling, creating a simple, user-friendly and highly useful option for its customer.

Industry analysis:

Due to the pandemic situation of the world; the demand for digital platforms has increased no matter if its healthcare, shopping mall, pharmacy, or even residential apartments; the need for digital parking-based platforms is constantly evolving on an annual basis. Itsuse is becoming more widespread. The current industrial trends include an increased demand in those areas where traffic is high, for example: America, which ranks 2nd when the traffic index is considered(Traffic Index by Country 2021 Mid-Year, 2021). Hence, its use is more widespread in The United States of America.

The parking industry focuses on on-street parking and off-street parking. The digital market although today earns more benefit from off-street parking, but was mainly established to fulfill the needs for the on-street market. It is also observed that the parking industry generates more income fromoff-street parking than it does from on-street parking. It happens only due to space restrictions of on-street parking, but also because off-street can charge customers due to the presence of entire different floors reserved for off-street parking, hence, the companies can earn better profit from it, alongside the requirement of alower degree of maintenance of devices attached in these areas.

According to GlobeNewswire; the main players for Digital parking-based platforms, include:Robert Bosch GmbH, Valeo and Cisco, BayerischeMotorenWerke (BMW) AG, Siemens AG, 3M Co., and Smart Parking Ltd(ResearchAndMarket, 2021). Main goal of these companies are providing high quality digital-parking applications and devices globally.

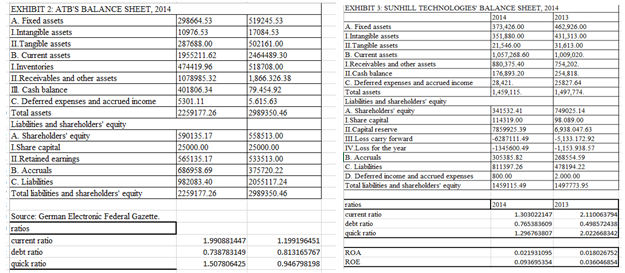

Financial analysis

The financial analysis showed that company’s revenue increased within 6 years, indicating that the company is making progress. An increase in the company’s material expense and change in its inventory reflects the same result that company is not experiencing major losses. Whereas, the increase in its net income shows variable trend, indicating that the company’s financial status is not stable.

The current ratio of ATB remained fairly constant even after a year; whereas, the current ratio of Sunhill decreased to some extent, showing that Sunhill technologies is having difficult time paying back its debts. It indicatesthat the company has taken major investment steps, but it is having a hard time in establishing it back, so it is likely that in the near future; the company mightface difficult financial times. Whereas, the steady state of current ratio for ATB reflects that the company is well-managing its resources. In short, ATB has experienced a temporary laidback position and Sunhill technologies is showing mostly a leading position in the digital parking market.

The Sunhill technology has also experienced an increased debt ratio and a decreased quick ratio which infers that the company is taking some debt but since its value is greater than 1, whichreflects the company to be capable of returning its debt, andthe company has already begun to repay its debt. Although, the debt ratio for ATB remained fairly constant with a slight decrease,but abrupt decrease in Sunhill technology’s debt ratio can cause a threat to ATB’s status in job market, because Sunhill technologies is recovering its debt and it has the potential to achieve better position in the digital job market.

Recommendations:

Alternative solution:

Bauer can invest in ATB’s marketing strategies to increase its customer market. ATB is one of the oldest manufacturer of parking devices and it should not change its aim of quality devices. This is since a short-lived transition state of the company, it should look forward to increasing its influence through marketing. Marketing will remind the company’s customer of its reliability and quality.

Also due to an increased competition in the digital parking industry; the best thing Bauer should do is to invest in ATB’s R&D department. Since, the core strategy of the business is to make such a unique product that the product attains out-competition status. R&D will ensure that their devices have been either modified to the product most desired by the customer, Hence, majority of customer matrix findings should be implemented during the company’s product update.

In such scenario, Bauer should mainly consider some further investment to support the company, which is responsible for most of its investment. The investment should preferably be in the R&D department and Marketing department of ATB. Bauer should do it because it can sell the stocks at a low cost just because of the temporary challenging situation. In case Bauer doesn’t invest; the company might continue to face decline and will be exposed to the threat of incurring more loss to Bauer. In a nutshell, the company should seek for expansion in order to make it more accessible to the customers in different markets.

Alternative solution:

Another solution to this crisis of the company is to invest some of its finance in competitor’s companies too. This is the strategy that ElonMusk used when he was indecisive about which company should he invest in,out of Space-X and Tesla, so he divided his cash into 3 divisions and didn’t spend his entire cash on a single company. Instead, he invested in both of the companies.

The pros of this strategy are that it reduces the risk of loss incurrences that might occur if new business declines. The investor is going to earn something in some way, because it is unlikely that both the companies will incur loss at the same time.

The cons of this kind of strategy is that one must be highly cautious while deciding the company in which investment is going to be made. One must make sure to invest in a company that is a strong competitor or at least has different values, goals, and objectives than the previous first company. These cautions must be considered because making an investment in a similar type of business will cause loss incurrences.

Conclusion:

The financial analysis of both the companies indicated that Sun hill technology is a rising star in digital parking, and it also has the potential of becoming a strong competitor in digital parking for ATB, so they need to invest in marketing and R&D to reestablish its position in digital marketing and there is also a necessity to develop an innovative product that must have an ability to attract the customer, for which they need investors, and Bauer can give catalyzing effect for ATB......................

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.