Stone Rock Golf & Country Club: Wedding Bells Case Study Analysis

Quantitative Analysis

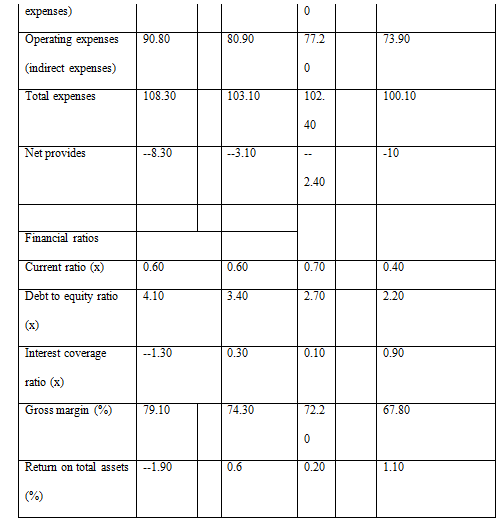

Financial Ratio Analysis (Appendix 2)

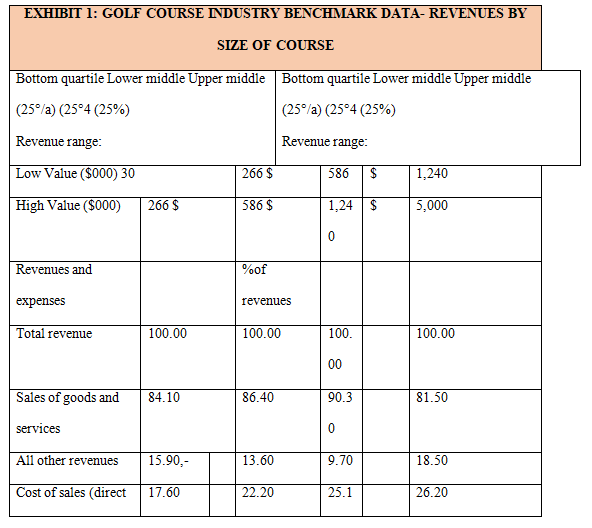

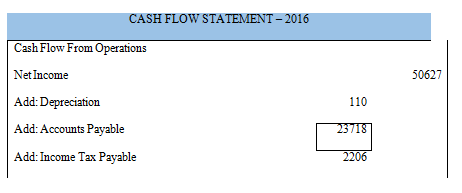

To help Robert and Kelly with decision making; we have conducted a financial analysis.To analyze the performance of SRGCC we used financial ratios analysis. The current ratio, debt to equity ratio, Interest coverage ratio, gross margin ratio and return to total assets were calculated for year 2014, 2015 and 2017. The current of SRGCC was (0.28) less than the industry ratio (0.40)throughout 2014 to 2016. Further thedebt to equity ratio of SRGCC (0.83) was also less than the industry ratio (2.20) throughout 2014 to 2016. And the interest coverage ratio of SRGCC (1.37) was more than the industry ratio (0.90). Gross margin ratio of SRGCC (75%) was more than the industry (67.80) and return to asset ratio (6%) of SRGCC was more than the industry ratio (1.10).

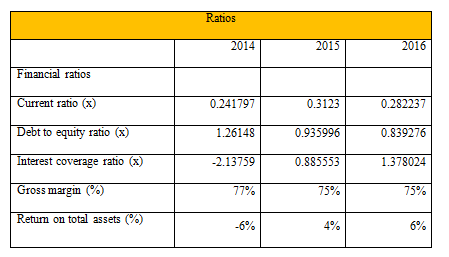

Cash Flow Statement (Appendix 3)

We have prepared the cash flow statements of SRGCC for the year 2016. SRGCC has made a positive cash flow from operations of $82415, and the negative cash flow from investing activities amounting to CA$4795 – due to investment in equipment and a negative cash flow from investmentwas $4795. SRGCCcreated a net positive cash flow of $1539597 for the fiscal year 2017. The important resource of cash is from the operations of the company and the major uses of the cash included the payment due to shareholders and investment in the equipment.

Projections – Income Statements & Balance Sheet (Appendix 3, 4, 5 & 6)

For Kelly and Robert;there were two options and each option was discussed and analyzed through the income statements. SRGCC had two alternatives of increasing the profitability and supporting the business revenues, which were to either go for maintenance or to strengthen the existing business of the company. The income statements were made on the basis of options discussed in the case, so the net income of new maintenance was 141852.78, parking expansion was 326826.5 and hideaway was 427347.62.

The net income for hideaway was more than other two options, whichmeans that for Robert and Kelly; going for maintenance shop to create new space for indoor weddings;we have made the budgeted balance sheet of hideaway option, which shows the assets of 656607.8.

Recommendation

As per our quantitative analysis; SRGCC should go for maintenance option, because it will help it inreducing the cost and this option will also provide more positive net income and assets contributions. As we know that it is a property which the company already possess, so going for this option would cost less to the company, which would increase the profit through sales. As estimations show that the SRGCC would be able to have good sales and would have advanced capabilities to increase its sales.

Implementation

SRGCC should invest in maintenance and renovation of that maintenance shop which was supporting the current wedding trends. To implement this, Robert should assign this project to the best interior designer in the town and then get the best work done. The renovation will enhance the beauty of the venue and will also promote indoor weddings. On the other hand, the sales or the weddings or events would also increase.

So in order to track the performance of SRGCC’s implementation plans; the managers should focus on the company’s profitability ratio. They should track the performance of the newly implemented options continuously, by analyzing the previous and after implementation ratio in order to find out that whether this option would add on value to the shareholders’ worth or not. Additionally, an internal analysis should also be put into action to determine if the sales of wedding or events have increased or not. If not, then they should follow continuous quality control and research to reach the goal. Increase in sales and budgeted figures should be compared after the implementation. Market share price of the company should be kept under consideration. Lastly, a profound observation should be kept on the industry’s trends in order to determine the future growth prospects and threats from other industry players.

Conclusion

Robert was thinking to expand the wedding business to compensate the revenues, which were affected negatively due to the industry’s downfall. So the two options which Robert had, were to invest either in the maintenance or to invest in purchasing a new space. So according to the analysis;Kelly and Robert should opt for the maintenance and renovation of the hideaway rather than focusing on the new product purchase, because it is the best option.

Appendix 1:The Academy’s Financial Statements

Appendix 2 Ratio Analysis

Appendix 3 Cash Flow Statement

Stone Rock Golf & Country Club Wedding Bells Case Study Analysis

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.