Project return Report Case Study

Introduction:

The world of investment is strikingly full of uncertainty as investors face the possibility of either making gain or losing a fraction or even sometimes their entire investment funds. Every investor is faced with the decision of either holding back his investible funds (particularly, if the magnitude of returns on his proposed investment in not known) or invest all the same assuming he is a risk taker. Most investors hold their baskets of investment in more than just one or two portfolio for the obvious reason of diversification which is intended to minimize risk on the investment. Accordingly was quick to posit that, the main goal of such investors constructing such portfolio was to basically in an attempt to “strike a balance” between mainly two conflicting objectives, namely, making a maximum return/profit at the most minimum risk possible given that a wise choice of constituent assets was made and the proper fraction of investment funds was allocated correspondingly, two opposing objectives, namely, maximizing return/profit while minimizing risk, provided that a prudent selection of constituent assets is made and the appropriate fraction of investment funds is distributed.

The mean-variance portfolio model, which is the core of modern portfolio theory, posits that present asset prices contain all available knowledge and expectations about future values, and hence treats future payoffs and returns as random variables. In simple terms, the expected mean value of the returns and their variance 2 encapsulate all of the information about the expected outcome, likelihoods, and range of deviations from it. The reality of most investments, however, is that the actual returns on investment might differ dramatically from the predicted profits. The magnitude of such differences is frequently determined by the market's level of information asymmetry. This is a risk that is present in almost all financial assets, necessitating investors' careful selection of investment portfolios.

Potential investors, institutions, and corporate organizations have challenges when allocating investment resources in a three-asset portfolio mix. Several investors in Nigeria sometimes confront the challenge of deciding how to deploy their capital to publicly traded companies in order to maximize returns while limiting risk. Aside from the difficulty of deciding what type of asset to invest in, investors also lack technical understanding on how to allocate their cash to the chosen portfolio. Most accessible literature has outlined portfolio selection given two assets, neglecting the case of a portfolio with a multi-asset mix.

This research aims to demonstrate how to select the best portfolio in a three-asset portfolio mix by first figuring out how to determine the fraction of capital that should be allocated to each asset. 2) How to get the best predicted return with the least amount of risk 3) how to choose the best asset in a three-asset portfolio mix and 4) how to choose the best portfolio from all potential efficient portfolios. The study uses daily stock prices from the Nigerian Stock Exchange for three institutional investors.

Determination of Optional Portfolio:

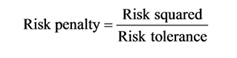

The utility function test of the portfolio is the rule for selecting the best asset, according to the predicted return of the portfolio minus the risk penalty is referred to as utility. The risk penalty is calculated as follows:

Risk squared is the portfolio's variance, while risk tolerance is a quantity between 0 and 100. Risk tolerance is difficult to quantify exactly because it is determined by an investor's financial condition, financial disposition, and preferences. The concept of risk tolerance is based on an investor's behavioral pattern. For example, if an investor's wealth rises, he or she may decide to increase (or maintain, or decrease) the percentage of the portfolio invested in a hazardous asset (constant, or increasing). As a result, the ability to withstand the danger of losses without becoming upset is determined by one's financial ability and temperament. As a result, the ideal asset for investment would be from the most cost-effective frontier that optimizes utility....

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.