JOHN M. CASE Co.: MANAGEMENT BUY OUT? Case Solution

The organization Value after calculation is computed at $17.675 Million, which suggests that the asking price of $ 20 Million is 13.12% more than the total benefits that will be assumed to achieve by the organization in the future. This can be further seen as Exhibit 1 below.

Considering the Enterprise Value, I don’t think the Management should go ahead with the Price mentioned above as this is high and should consult with Mr. Case on the exact value of the organization and a value of $17 Million; with $12 Million in Cash and $5 Million in Loan notes being the best price that needs to be offered to the entity.

51% Ownership Retention by Management

As the management of the organization is considering to buy off the organization, it also does know that the required capital is much more than their combined resources and the Use of Bank debt and Venture Capital Organizations will be used. With considering this, the Venture Capital Organization does provide the capital they need, but according to the needs and the policy of their organization, they will emphasize on taking a higher equity stake in the organization. According to the current equity and debt financing stake available to the organization, $ 9.5 Million out of the $ 20 Million investment will be provided by the Venture Capitalist. This amount is 47.5% of the total share in the investment. If we consider the bank term loan, then a $ 6 Million funding of the total $ 20 Million is 30% investment in the organization.

Both of these fund providers will have a controlling interest, totaling 77.5% in the organization. This needs to be authored by Mr. Johnson, and the way in which this can happen is provided below:

- The voting rights provided on the equity, such as more rights for the board members so that, they can decide the future of the organization, and not the providers.

- As the organization has Capable Plant, Property, and Equipment, then this should be used as securitizing against the bank loan so that the covenants would be low.

- The issue of Convertible Loan Notes to the Venture Capitalist, as their investment. Which would earn them interest, as well as a right to convert into shares of the organization.

The last method is the best method available to Mr. Johnson, as Convertible Loan notes of Deep Discount can be offered to the Venture Capital Firms. This would ensure that the interest provided would be low, and the Venture Capital Firms stay in the Long Term Liability rather than being an Equity Holder.

As further information being provided in the case, Mr. Johnson has worked previously in an Angel organization, and Venture Capitalist rather prefer to take Loan notes rather than equity holding, which would provide the organization to initiate the strategy. The organization will hold all the equity rights, making them take over the controlling equity of the organization.

Would the Venture Capital Firm or The BANK would Invest or provide the loan?

Venture Capital Firm

If I would be in a deciding position in the Venture Capital Organization, the investment of $ 9.5 Million will earn me according to the current terms an interest of 10% annually and a convertible loan note in the value of the organization.

This would suggest a deficit of 14% annually on the invested amount, as according to my organization; the board will be considering investments worth 20-25% of returns. The only way in which the organization will be beneficial for investment is the number of rights and shares available which will be more than the investment being provided by our firm. A handle on the controls of the organization so that the decisions are checked, and a bail clause if the investment is not realized. The organization: John M. Case, is a market holder and the board wants to improve the performance.

I would invest in the organization by putting a more than high lending rate, and a convertible share option which will be high, so that I can emphasize control.

Lending Institution

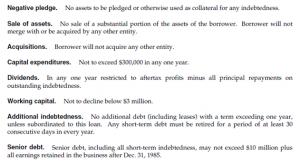

As, the lending institution is concerned, if I would have been the decision maker in providing the loan. I would set high covenants such as provided in the question. Further, I would look at the profitability and the position of the company to provide a return on the loan taken. Currently, the organization is on a growth with increased profits in excess of $ 3.9 Million and more than 10% of the Revenues each year.

I would consider investment if the loan is secured against an asset which is worth at least half of the value of the Loan amount, and a higher than Market interest rate to comply with higher risks.

Exhibits

Exhibit: 1

| Discounted Cash flow Approach | |||||||

| 1985 | 1986 | 1987 | 1988 | 1989 | 1990 | ||

| Net Sales | 16,024 | 16,844 | 17,686 | 18,570 | 19,498 | 20,472 | |

| EBIT | 3,433 | 3,460 | 3,757 | 3,608 | 3,788 | 3,976 | |

| Interest Expense | 1,675 | 1,538 | 1,369 | 908 | 800 | 800 | |

| Cash flow From Operations | 1,724 | 1,998 | 2,232 | 2,444 | 2,638 | 2,802 | |

| Less: Increase In Working Capital | 156 | 162 | 170 | 180 | 190 | 200 | |

| Less: Capital Expenditures | 120 | 134 | 142 | 150 | 466 | 600 | |

| Net Cash Flow | 1,448 | 1,702 | 1,920 | 2,114 | 1,982 | 2,002 | |

| D.F @ 11.16% | 0.8996042 | 0.8092877 | 0.7280386 | 0.6549465 | 0.5891926 | 0.5300402 | |

| Discounted Cash flows | 1,302.63 | 1,377.41 | 1,397.83 | 1,384.56 | 1,167.78 | 1,061.14 | |

| Terminal Value | 9983.8477 | ||||||

| Organization Value | 17,675.19 | ||||||

Exhibit 2:

Exhibit 3:

| Dividends | ||

| 1975 | 600 | |

| 1976 | 200 | |

| 1977 | 280 | |

| 1978 | 280 | |

| 1979 | 440 | |

| 1980 | 440 | |

| 1981 | 480 | |

| 1982 | 1220 | |

| 1983 | 1374 | |

| 1984 | 1480 | |

| CAGR | 10.55% | |