JETBLUE AIRWAYS IPO VALUATION Case Solution with Excel Work

QUESTION 1

ADVANTAGES & DISADVANTAGES OF JETBLUE GOING PUBLIC

The advantages and the disadvantages for JetBlue going public are listed below:

ADVANTAGES

- The company’s cost of capital is lowered when a company goes public. The reason and the logic behind this is that the potential investors of the company are willing to pay a higher price for the company, which could be sold by the investors in future if they want to.

- Equity is injected in the capital structure of the company and this is seen as a positive signal from the current debt holders of the company. The proportion of debt to equity is also lowered.

- When the company has a large portion of equity, it can ask its lenders to raise large amounts of debt which the lenders would be willing to do until the debt to equity ratio is not significant.

- If we look at the IPO from an operational perspective, then the management of the company would have a great amount of cash which could be efficiently utilized by the management of Air Blue to invest in the asset base of the company and increase its competitiveness. The company could also focus on its hiring practices, improving its marketing efforts and funding further on product research etc.

DISADVANTAGES

- The first disadvantage related to going public is the cost. If a company wants to raise a small proportion of equity into its capital structure, it might have to pay a higher cost because the underwriter will charge the same fee as a percentage on the amount that is raised and still make a profit.

- By making stock public will also expose the company to lose the control, unless the company’s owner has retained a significant proportion of the stock of the company. If this is not the case, then the outside investors could purchase large block of shares and gain significant voting rights.

- The disclosure of information is also another problem. As the annual reports and the accounting information for the company will have to be published on the SEC website, therefore, the competitors of the company will have to just visit the website to gain access to the information of the company.

- The company will have to hire additional expert staff to handle the statutory requirements of the company.

- The management will also have to understand that they would have to serve the public now and not themselves. Therefore, the managers are encouraged to become more committed to increase the wealth of the shareholders and the compensation paid to the managers is also tied to such measures.

QUESTION 2

VALUATION OF JETBLUE’S OFFERING PRICE

WACC (Appropriate Discount Factor)

In order to find out the offering price on the basis of a discounted free cash flow method, a suitable discount rate is needed to be calculated. The discount rate will then be used to discount back the free cash flows of the company to find the enterprise value and the resulting offering price of the company.

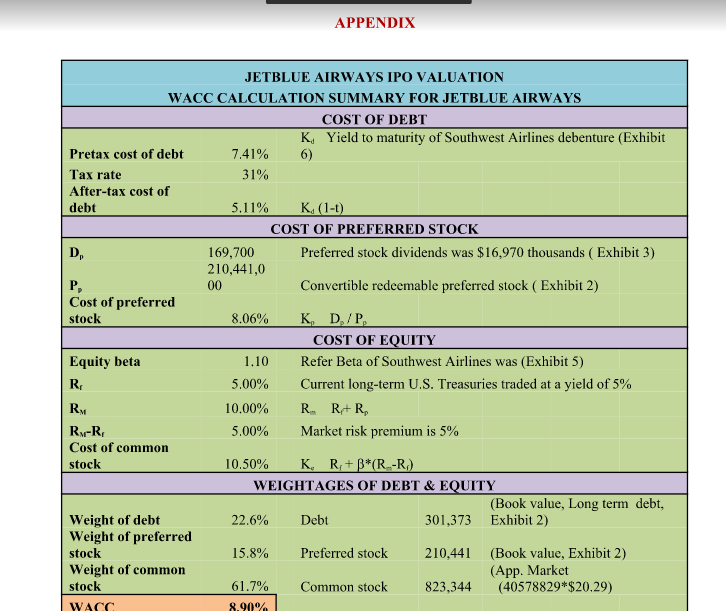

The cost of debt used in the cost of capital formula is taken as the yield to maturity of the Southwest Airlines debenture given in exhibit 6. The tax rate is 31%. Based on this, the after tax cost of debt is around 5.11%. The cost of preferred stock has also been calculated by taking the total dividends paid on preferred stock given in exhibit 2, and dividing it by the total amount of convertible preferred stock given in exhibit 2. This gives us a cost of preferred stock of around 8.06%. The cost of equity has been calculated by the capital asset pricing model. The beta is given. Based on the market risk return and the risk free rate of 10% and 5%, the cost of equity is 10.50%. This is the required rate of return required by the shareholders of the company. The Weightage for debt, equity and preferred stock has been calculated and the weighted average cost of capital for the company is found to be 8.90%. This is the discount rate which has been used in the discounted cash flow analysis to calculate the enterprise value for the company.

TERMINAL VALUE & IPO PRICE

The free cash flows for the time period of 2002 to 2010 have been estimated on the basis of certain assumptions. The operating profit margin used to calculate the net operating profit after tax is 17.1%. The sales of the company have been increased by 4% inflation rate. It has been assumed that all the prices increase by this inflation rate. The tax rate used is 31% as given in exhibit 5. Finally, the terminal growth rate has been assumed to be the growth rate of gross equipment growth of AirTran. Based on these certain assumptions, using the estimated profits for the time period of 2002 to 2010, the free cash flows have been calculated for the company. The terminal value for the year 2011 has also been calculated on the assumed steady growth rate in perpetuity. It has been assumed that the cash flows of the company would grow at a steady rate of 7%. The terminal value for the future business value has been calculated to be around $9883 million. The enterprise value for the company has been found by taking the sum of the present value of the free cash flows from the year 2002 to 2010 and the terminal value of the foreseeable future in 2011. The total enterprise value is found to be $3567 million. Adjusting the current outstanding shares for the shares that would be issued after going public, the total outstanding shares of the company are 46.07 million. Therefore, on a per share basis the offering price for the new issue of the stock should be $66.29 per share. This price is way too high from the current estimations of the company. The calculations are shown in the appendix attached in the end.

jetblue airways ipo valuation case solution

TERMINAL VALUE METHOD FOR DETERMINING IPO

Terminal value is a very important concept in the valuation of the firms, since it constitutes about 60% to 80% of the total enterprise value of the company. The terminal value calculated in this case is also important for calculating the offer price of the company. The assumptions used in the terminal value formula, regarding the growth rate might not turn out to be true in the future, however, the best possible estimates have been used to calculate the future value of the business after the company goes public. Therefore, the terminal value method which is purely based on the free cash flows generated by the business in future is a good method to estimate the future offering price for the IPO.

QUESTION 3

COMPARABLE MULTIPLES APPROACH

INDUSTRY AVERAGE MULTIPLES & IPO PRICE

The valuation of the company based on the multiples approach is done on the basis of the values of the companies operating in the market and estimating the value of the company by comparing it to those values. The market values of the companies are converted into standardized values relative to few key statistic measures which give us the estimated value of the company. The calculations have been performed in the spreadsheet. The P/E multiple mean is around 12.4 times and its median is 14 times. On the other hand, the EBIT multiple’s mean for the airline industry is around 3.2 and its median is 9.2 times in 2001. However, for the trailing period the figures have also been calculated. The same multiples have also been calculated for JetBlue. The analysis show that the leading and the trailing EBIT and PE ratio multiples for JetBlue are poor as compared to the industry’s mean and median multiples, therefore, setting a high IPO price is not recommendable. The IPO price should be set by the company in the range of $25 per share to $30 per share.

Jetblue airways IPO valuation Case Study Solution

IPO PRICE BASED ON MULTIPLES OF JETBLUE

Furthermore, the stock price has also been calculated on the basis of the PE ratio and the EBIT multiple of the company. The new shares of around 5500000, which would be issued after the IPO have also been incorporated in the outstanding shares in order to calculate the recommended price to be set before the company goes public. The offering price under the PE multiple method is calculated to be $23.07 per share and on the basis of the EBIT multiple the offering price is $29.31 per share. Therefore, the recommended price to be set by the company before the IPO takes place should be set in the range of $25 per share and $31 per share.

QUESTION 4

RECOMMENDED PRICE FOR IPO

As depicted by the case study, there has been a huge failure faced by all the new entrants in the airline industry. This can be seen by 87 new airline failures over the past 20 years. Therefore, based on this statistic, the strategy of the company to go public is very risky. It was stated by Morgan Stanley that the deal was hyped by the investors and he also felt that the conclusion that demand exceeded supply was exaggerated. Therefore, based on the multiples comparison analysis, the mean median values of the multiples of the closest competitors of Air Blue and the value calculated by the discounted cash flows analysis, the most recommended price for the new IPO should be in the range of $25 to $30 per share. In order to recommend a single price, the company should set an IPO price of $25 per share based on the analysis performed, which have calculated the share price of around $25 to $30 per share except the discounted cash flow method which gives a more optimistic offering price for the new IPO.

QUESTION 5

ADVANTAGES & DISADVANTAGES OF OFFERING AN IPO PRICE UNDER THE EXPECTED PRICE FOR NEW STOCK

The company will have clear advantages if the company goes public on an offering price of $25 per share. This price has been estimated on the basis of a range of methods which is the best IPO price looking at the scenario of the airline industry and the performance of the company. The company would raise equity and the debt of the company could be easily repaid by the company. The lenders of the company will be happy to lend larger amounts of debt in future when the company goes public. Apart from this, the company will have all the relative advantages of going public. On the other hand, the first and the foremost disadvantage for the company to go public at this price is that the burden of the underwriting fees might be significant for the company and the cost of IPO might be high for the company. Furthermore, other risks are that a large number of potential shareholders of the company might buy large blocks for shares of the company and the management might lose control of the Air Blue operations until the owner of the company holds a large proportion of the equity of the company.

This case is the April 2002 decision of JetBlue management to price the IPO for JetBlue is one of the worst periods in the history of the airline. Case describes an innovative strategy and corresponding JetBlue strong financial results for its first two years. Students are encouraged to value the shares and take the position that the current $ 22 - $ 24 per share filing the appropriate range. Case is designed to show the corporate valuation using discounted cash flows and market several expert company. The epilogue details 67% first day increase in the stock of JetBlue $ 27 offer price. With this background, students are exposed to one of the known anomalies Finance - IPO underpricing phenomenon. - And are encouraged to critically discuss the various proposed explanations "Hide

by Michael J. Schill, Garth Monroe, Cheng Tsui Source: Darden School of Business 20 pages. Publication Date: 20 August 2003. Prod. #: UV2512-PDF-ENG