Ratio Analysis

The current ratio of Dell is reduced from 1.25 in 2010 to 1.46 in 2011, which indicates that the company is growing into its capacity whereas the current ratio of Apple is reduced from 2.01 to 1.61 reflecting the high risk of default or distress. Since the acid test ration of Dell Company increased from 1.04 in 2010 to 1.26 in 2011 depicting that the company is more financially secure in the short term. Whereas the acid test ratio of Lenovo is stable, but of apple, Acer is decreasing. In addition, the return on assets of Dell and Apple is increased from last consecutive 3 years indicates that the company has generated massive profit returns in relation to its overall resources, whereas the ROA of HP & Acer is decreasing and Lenovo is stable. Furthermore, ROE of Dell, Apple and Lenovo is increasing which shows that these companies are increasing their abilities to generate profit return without the need of capital.

In addition, the price earnings ratio of Dell, Apple, Acer and HP is decreasing with significant margin, though the P/E ratio of Lenovo is also decreasing but with low margin indicating that the investors are not anticipating higher growth in future.

Question 05

As such, Chan has two options available which are; whether to maintain its relationship with Dell and continue to hold its position in dell or it should make investment in one of the competitor of Dell such as Apple, Lenovo etc.

The advantages of maintaining the relationship with Dell includes; the company would benefit from the maximized market share of dell, positive brand image, market presence, product customization and competency in acquisition & mergers. By maintaining the relationship with Dell, the company can enjoy the first mover advantage. In contrast, if the company fails to grab the market share and fail to meet the customer demands, the company would lose its feasibility or viability of investing in such company.

On the other hand, if Trinity Fund Inc. would invest in any of Dell’s competitors such as Lenovo, it would result in various market opportunities to explore or capture in an effort to maximize the market share and strengthen the market position. In contrast, the downsides of investing in Lenovo is the uncertainty and risk associated with investing in new company. Also, the financial position of the company indicates that the level of uncertainty is high of achieving the returns.

To sum up, it is to recommend that Chan should maintain his relationship with Dell and continue to hold his company’s position in Dell, the reason behind such decision is the future prospects, right structure for continued success and continued track record of Dell success. The company is now being contemplated to expand service and enterprise solution businesses, obtaining more patent via acquisition, strengthening its presence on the emerging market arena and tablet market growth.As an addition, the financial health of Dell shows that the company is growing into its capacity, financially secure in short term, and by being effective in converting the money it has invested into the net income. Whereas, the market competitor such as Lenovo has not been generating massive profit return, the investment would not be viable or feasible for the investors in both short term and long term.

Appendix – SWOT

| Strengths | Weaknesses |

| Positive Brand image

Strong market presence Product customization Environmental record Direct selling business model |

Commodity products

Low investment in R&D Few retail locations Low differentiation

|

| Opportunities | Threats |

| Expand enterprise solution and services

Strengthen presence in emerging market Online store opportunity |

Intensity of competition

Smaller price difference among brands Slow growth rate of PC industry New entrant threat

|

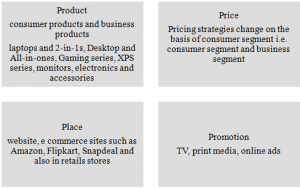

Appendix – 4 Pc’s

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.