Estimating The Cost Of Capital In Uncertain Times Case Study Solution

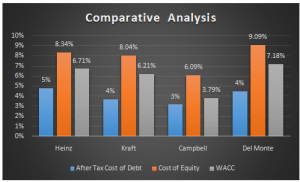

Comparative WACC:

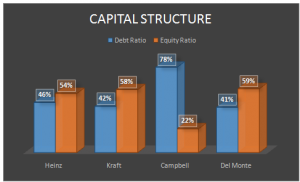

After WACC calculation of all the companies, it is observed that Heinz’s WACC is computed as 6.71%, which is below the Del Monte’s WACC and above the rest of the competitors’. As Heinz’s WACC is similar to the Kraft’s WACC, which means that both the companies have almost same capital structure. Heinz has 46% of debt and 54% of equity in its capital structure while Campbell has 42% of debt and 58% of equity in its capital structure. The tax rate is same for both the companies, while the cost of debt and cost of equity vary from each other. As the Kraft has higher debt in its portfolio, therefore the company has to pay more interest and enjoy the tax redemption. On the other hand Heinz has equity in its investment and less debt ratio. As a result,the WACC of Campbell lower than Heinz’s WACC.

When comparing Heinz with Del Monte, we found out that Del Monte’s WACC is greater than Heinz. Del Monte also hashigher debt as compared to Heinz, whereas Heinz has lower debt in their capital structure which provides a huge benefit to Heinz, because due the low interest rate it will pay low interest and enjoys tax redemption in a better way when compared to Del Monte.

Heinz in comparison with Campbell has higher WACC because of lower debt and higher equity than its competitors. The Campbell has lower WACC in comparison to all the other rival companies.

Significance of WACC

WACC is the weighted average cost of capital that is considered as a very important factor while taking the investment decision in any project. If the company plans to invest in any project it will compare the internal rate of return (IRR) and the WACC of the company. If the WACC is lower than the IRR, then the company will accept the project. The WACC is also used as discounted rate while calculating the net present value, which is used in assessing the future investment opportunities. WACC also shows the capital budgeting that how much debt and the equity ratio the company should have in its investment, and what are the stakeholders’ expectations regarding the returns. It also determines the return on invested capital that how efficiently the company builds its portfolio and if it has enough earning by which it can cover its cost, which determines the company’s performance. (EHRHARDT & BRIGHAM)

Economic Outlook:

The U.S economy has been in great confusion after the recession that had started at the end of the 2007, which increased the financial burden on the companies. It also increased thein flation rate, as a result of which, the U.S market performance had decreased. Decreases in the market performance impact on the companies, which results in volatility in the share prices and revenues of the companies.

Industry Outlook:

After the recession; the overall condition of food industry was highly volatile. The performance of the overall food industry was extremely volatile as the market conditions were uncertain. Due to the high inflation rate; the consumer were shifted to low priced substitutes. The stock prices of the companies started declining. The growth of the overall industry was decreased which contracted the margins of the company. After the recession, the industry started growing in bits and pieces, as the company’s margins were increased during 2010, but it was expected that industry could face a double dip recession in the future.

Expected Inflation Trend:

The recession that was started in 2007, increased the inflation rate in the US, which increased the cost of living. As the inflation raised, a great pressure was put on the companies regarding the industry margins. As the recession was expected in mid-2010; the expected inflation trends seemed to grow, which made the economy to struggle, causing slow growth in the industry, which increased the volatility in the revenues.

Interest Rate Trend:

As a result of recession, the inflation rate increased, and it was also expected that the increase in the inflation rate would also result in increased interest rate in the near future. Increase in the interest rate effects those companies which have high cost of debt in their capital structure. Increase in the interest rate results in high cost of capital which the company holds on its balance sheet. High cost of capital represents that the company’s WACC is increased, which ultimately puts pressure on the company’s profitability. If the increasing trend in interest rate will continue in future then it will be harmful for the firms that are highly leveraged.

Conclusion

On the basis of above analysis and calculations, it has been concluded that Heinz seems to hold a stable position at uncertain times as compared to its competitors, and has proven itself to be one of the substantial market leaders in the food industry. In case of mid 2010 recession, the company margins decreased only in the United State region, while company had an ability to increase its revenue from other regions. The company also has to focus on enhancing their quality food according to the consumers’ needs and preferences, which helps the company to increase its financial gains. The company also has a good capital structure. The company has 6.71% WACC,which is lower than Del Monte’s, and greater than the other competitors. However, the company has to put more efforts in reducing its WACC in order to gain attractivereturns.

Appendices

Appendix-1: Comparative Analysis

Appendix-2: Capital Structure

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.