DEVELOPMENT OF NEW YORK TIMES BUILDING COMMON GROUND BEFORE BREAKING GROUND Case Study Solution

Problem Diagnosis

The Forest City Ratner had began to search for an equity partner in 2001 for a pioneering project, which was a 52 story tower which had been designed by Renzo Piano and this was going to serve as the new headquarters of the New York Times Company. There were many investment communities and the real estate communities, which were skeptical of the project, however, the head of ING Clarion decided to have a closer look at the deal and evaluate this real estate opportunity. This case involves the evaluation of the feasibility of a real estate investment project. The maximum area for the site based on the zoning regulations, the costs of acquiring the sites and the NOI at stabilization on the floors needs to be analyzed for ING Clarion, which is one of the equity partners in this investment.

Case Analysis

The analysis would be performed from the perspective of ING Clarion. According to the Joint Venture agreement in Table 2 in the case, the interest of Forest City in this property is around 42.05%. However, in order to evaluate the feasibility of this deal from the perspective of ING Clarion, we will be taking 60% of all the income and expenses in our analysis. This is because FC Lion partnership includes 60% share of ING Clarion and 40% share of Forest City.

Maximum Developable Area for Site

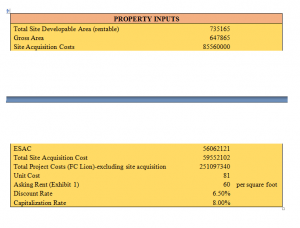

Looking at the zoning map in exhibit 5 and according to the zoning regulations the total or the maximum developable area for the site would be the total rentable area, which would be rented by Forest City. Therefore, the maximum developable area for the site would be 735,165 square foot.

Site Acquisition Costs

The site acquisition costs as seen in exhibit 3 are $ 85560000 plus ESAC of $ 56062121 for the entire developable area. However, this cost would be shared between The Times and the Forest City in the ratios of their interest, which is 57.95% for The Times and 42.05% for Forest City. Therefore, the total site acquisition costs would be $ 59552102. Apart from this, the net project costs for Forest City are $ 392,719,461, which are the total project costs. However, we would be taking the 42.05% share of the total project costs excluding the site acquisition costs. This shows that the total net project costs excluding the site acquisition costs for FC Lion would be $ 251,097,340. Finally, the unit developable costs are $ 81 per square foot.

Asking Rent, Discount Rate & Cap Rate

Looking at exhibit 1 of the case, the asking rent has been assumed to be around $ 60 per square foot for the remaining Midtown. This rental figure has been taken because in the year 2000 and in the first quarter of 2000 the average asking rent for the midtown buildings has been $ 60 per square foot. The discount rate in the Midtown Manhattan has historically ranged from 5% to 8% therefore, we assume that the discount rate would be on average between these two rates.

We have taken an average discount rate of these two rates, which is 6.5%. The exit cap rate is usually higher than the initial cap rate therefore; we have assumed the exit cap rate as 8%. The value of this building would increase in the future because of its great design and it would be soon transformed into the Avenue of Architecture. Furthermore, this project would yield significant fiscal benefits for the city and job creation.

All the property inputs are calculated in the excel spreadsheet, which are also shown in the table below;

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution