Country Risk Report Case Study Solution

INTEREST RATE RISKS:

As the inflation rate goes up the government goes for tightening the monetary policy. According to the data, current rate of 6.5% will rise up to 6.75% in year 2020 with the highest interest rate reaching up to 7.25% in the third quarter of year 2019. With the growing interest rates people will invest more and consume more which will drag down the inflation rate but it will pull back the aggregate demand and results in overall sales of the company to decline. Other than this, if the interest rates will rise; the cost of borrowing for the company will rise. The interest expense will get higher making the company less profitable.

The two macroeconomic variables, inflation rate and interest rate have given a slight indication to the foreign companies that the economic risk is moderate. Therefore, the companies develop their companies’ policies to increase their overall sales, but there are no such signs for the foreign firm to back off from investing in India.

UNEMPLOYMENT RATE:

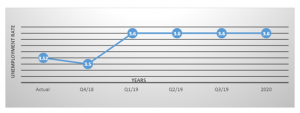

By focusing on India’s unemployment rate we can see the current unemployment rate stands at 3.52% and it will likely to stay stable for the next two years at 3.6% in the year 2020. The healthy unemployment rate is said to be between 4-6% but this unemployment rate shows a very healthy labor situation for the company.

Figure 2 shows the unemployment rate of India forecasted for 2020

The low level of unemployment will put an upward pressure on salaries. This means that the firms will have to pay more salaries because the demand for jobs is less as compared to the supply. Company’s salary expenses will increase and it will have a negative impact on their profitability.

ANNUAL GDP GROWTH:

Coming towards the GDP rate, the Indian economy is currently on 8.2% mark which is excellent and hence it makes India one of the best performing economies of the world second to China.

Figure 3 annual GDP growth of India

The annual GDP graph shows that how well the Indian economy is lifting towards higher annual GDP growth. The annual GDP growth tells us that the country’s output performance has been really good. Looking towards the GDP growth the signs are really positive for the other foreign companies to come and invest in India.

EXCHANGE RATE PATTERN

Figure 4 Indian exchange rate vs. US (Duhan, 2018)

The central bank of India has allowed the foreign exchange prices to be adjusted by simply the demand and supply forces. This type of regime is called Managed float where central bank doesn’t influence the exchange rate prices. Exchange rate is set on daily basis but if the volatility is high central bank intervenes to avoid the excessive volatility.

The rise in exchange rate gives an indication that the Indian economy is struggling to maintain its balance of payments. The companies that are import oriented will get a negative hit with the Indian rupee depreciation as their cost of imports will rise. Therefore any foreign company that will have to import the raw material has to be careful regarding the exchange rate risk. On the other hand, any company that is export-centric will have a great opportunity to enter the Indian market. The dollar-Indian rupee parity will allow them to get a high value because of high exchange rates. Also, the foreign inflows will be really helpful for the Indian economy as there value will be higher and with this foreign remittances level will also rise.

As per the multinational company, if the parent company decides to invest further capital to the company in India its cost of capital will rise because of higher exchange rate. The investment value will decline. Therefore, exchange rate risk is moderate to high for the foreign investors as per the exchange rate is getting higher.

CONCERNS FOR FOREIGN INVESTORS

STABLE PROPERTY RIGHTS:

In a democratic society property rights are essential for the free market. Foreigners can own the property by going through the legal process. Though India has to further improve its property right rules. As Indian economy is improving so its value for the property will increase because more companies are setting up their business and they need land to install their plants. Other than this, the growing population of India requires land to live hence they seek for residential property to live in which results in increased demand for properties further increasing their prices. The higher land prices means that the cost of capital will rise for the business firm either foreign or local.

PEACEFUL INDUSTRY-LABOR RELATIONS:

In year 2017, millions of worker came to the streets of India and went on strike and protested against the BJP government against privatization and reduction in minimum wage. The strike was led by major trade unions across India. According to the estimates, India lost up to Rs 550 crore rupees. The labor strike caused 57% production loss. The situation in India can be bleak if the labors are not satisfied and can cause foreign and local companies loss in production. Therefore, the foreign companies have to formulate the policies as such that they don’t motivate the labors to go on strike. Hence, the risk factor is high for any company as far as the industry-labor peace is concerned.

RECOMMENDATIONS

India has developed its economy and is on a continuous growth path. It is considered as one of the best performing economies of the world. The President’s initiative for make in India has derived some of the foreign investment to come to India. It was initiated to give foreign and local manufacturers a confidence and invitation to come and invest in India. The inflation rate has been steady for quite some time but it is going to be increased for a couple of years decreasing the demand for the goods. With the increased inflation rate the government will increase the interest rate which will increase the cost of debt and will affect the income of the company negatively. Therefore, the risk is moderate for the foreign companies. Other than this the exchange rate of India will be high which will again increase the cost of doing business for foreign investor as the parent company will have to send the investment to the company located in India. This will create a foreign exchange risk for the companies. Although growing population of India leaves a charm for the foreign companies to come and invest in India because if they play smartly they can increase the demand and therefore their profitability will be increased as well.........

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.