Contellation Brands Valuation Case Study Solution

Company Valuation

Valuation Criteria

The valuation of the company is conducted by using DCF approach. The valuation includes the projected cash flows of the company for a 5 year time period. The valuation is conducted on the basis of certain assumptions. Sales growth is assumed on the basis of Compound Annual Growth Rate (CAGR)of sales from 2014-2018. Cost of debt is computed by using 2018 interest expense and the interest bearing debt. All the other expenses are projected on the basis of percentage of sales.

Capital Expenditures and the Working Capital are computed on the basis of percentage of capital expenditures and working capital of 2018 to the sales of that year. Along with it, a beta is also calculated by using stock market data. On the basis of above assumptions and the calculations, the WACC for Constellation Brands equals to 4.41%. All the cash flows are discounted using WACC.

The terminal value is assumed on the basis of a terminal growth rate of 3%. The terminal value computed on the basis of a 3% terminal growth and a WACC of 4.41%, for 5 years equals to $ 64434 million.

Valuation Results

The valuation shows an enterprise value of $ 54782 million for Constellation Brands as on 2018. The net worth of the company after deducting its total liabilities from the enterprise value equals to $ 42306 million. The company has weighted average outstanding shares of 224.081 million. On the basis of the net worth and the number of weighted average outstanding shares, the company has a share price equals to $189.However, the actual market price of the company as on May 2, 2019 equals to $213.9, which implies that the shares of the company are overvalued in the market by 13%.

Evaluation of Results

The overvaluation of the share price in the market implies that the investors have certain positive expectations with the company and are willing to pay a premium price for the company’s shares. However, the overvaluation of shares can result in the declining share prices in the future when investors would not gain their expected rate of returns from the company’s shares. (Brigham, 2016)

Conclusion

On the basis of the above competitive analysis, the industry analysis and especially the valuation of the company it can be said that the Constellation Brands is a quite competitive market player in the US beverage industry with strong financial position. The alcohol market segment is also one of the potential market segments with high growth potential, in which the company is operating.The valuation of Constellation Brands shows that the share of the company is over-valued in the market by 13%, showing the investors’ willingness to buy the company’s shares.

Appendices

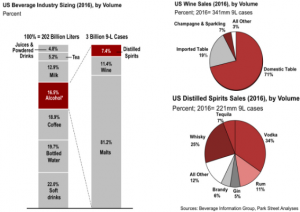

Appendix-1: US Beverage Industry

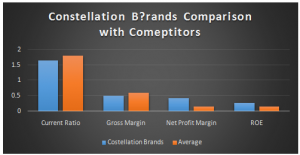

Appendix-2: Constellation Brands Competitive Analysis

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.