CAPSTONE PROJECT Case Study Help

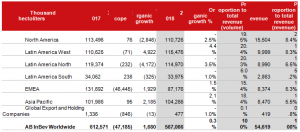

In addition to this, Table 2 shows the proportion to total revenue for each region but in dollar amounts. For this, by using the proportionate formula in excel, the proportion of total revenue in dollar amounts for North American region is 28.4 percent, for Latin American (west) region is 18.3 percent, for Latin American (north) region is 16.5 percent,for Latin American (south) region is 5.2 percent,for Europe, Middle East and African (EMEA) region is around 15.3 percent, for Asian Pacific region is around 15.5 percent and for Global Export and Holding Companies is around 0.8 percent which shows the highest contribution of North American region to maximize the company’s revenues in dollar amounts in the year 2018.Although, the North American region has negative organic growth rate of around – 2.5 percent in the year 2018 but this region is very much helpful in earning the highest sales in dollars for AB InBev in the year 2018.

Table 2

India Beer Market is anticipated to develop at a CAGR over 7.6% during 2018 to 2024. Expanding discretionary cash flows, urbanization, developing youth populace just as rising acknowledgment of social drinking have floated the development of brew showcase in India. The nation positions among one of the biggest liquor showcases over the globe.

India Manufactured Foreign Liquor (IMFL) including whisky, vodka, schnapps, and rum is profoundly favored by customers in India. In any case, with developing wellbeing cognizance, clients are moving towards lager utilization inferable from its lower liquor content. As of now, per capita brew utilization in India is beneath 5 liters, which is incredibly low when contrasted with over 25 liters in other Asian nations. A few residential and global players are putting resources into India's brew market to increase an aggressive edge in the nation.

Solid lager portion sacked most noteworthy income share in 2017. The section is foreseen to proceed with its predominance over the coming years attributable to inclination of Indian purchasers for high liquor content. Additionally, mellow brew fragment is evaluated to show most noteworthy development rate during the conjecture time frame, credited to wellbeing cognizant customers and moderate consumers who settle on lower liquor content inside enormous volume.

Off-exchange channels including wine and brew shops, hypermarkets, and stores have contributed greater part of the income share in 2017 towards the general lager showcase in India. The fragment is anticipated to additionally manage the market attributable to constantly expanding retail arranges in the nation and accessibility of lager items at sensible costs by means of off-exchange channels. In addition, on-exchange channels are foreseen to show most elevated development rate during the gauge time frame inferable from rising salary level combined with acknowledgment of specialty lager the nation over.

The report completely covers Indian brew show case by type, deals channel, bundling, socio economics, and locals. The report gives an unprejudiced and point by point examination of the on-going patterns, openings, high development zones and market drivers which would assist the partners with deciding and adjust their market procedures as indicated by the ebb and flow and future market elements.

Furthermore, Table 3 of the study shows the region volumes from the year 2015 to 2018 that represents the rapid increase and decreases in number of units for each region (volumes) in each year. This increase and decrease represents the different types of revenues that derived from the chickens, Locusts, Pigs and Black Widows. Exhibit 1 of the document shows the graphs belongs to the revenues in number of units (volume) percentages for each region in each year. These graphs are showing that the Global Export and Holding Companies are representing the revenue types as Black Widow while the all other regions such as North America, Latin America West, Latin America North, Latin America South, Europe, Middle East and African (EMEA) and Asia Pacific have the revenue types as Pigs in their graphs that are shown in Exhibit 1 of the case.

Recommendation

Since, the company has been worsening with stubborn problems related to the high debt or poor debt management and undifferentiated products within a highly competitive market, some strategic recommendations are listed below in order to allow the company to strengthen its foothold in the market.

The business strategy of AB Inbev should include planning to evolve product offerings to serve more consumer segments, in addition to deepening the relationship with existing customers. Also, it has successfully grown as the market leader and maximized market share by expanding across borders. AB InBev has been leading the group in competitive strength due to its brand recognition as well as its large market share, with the portfolio of 16 brands that are worth over $1 billion. The weakness of the company is in geographic coverage; it is heavily concentrated in the American markets, and while it consists of large profit pools and emerging market opportunities.

Divesture – Carlton & United Breweries to Asahi Group Holdings, Ltd

AB Inbev Company offers fresh insights of the high gravity beer products and beverages to the customers. One of the competitive edge of the company is the quality uniqueness, fresher and flavourful tasting. It has significantly diversified its business with the balanced exposure to developing and developed market arena and it has leveraged the collective strengths of nearly 175000 employees. However, it has been experiencing sluggish growth rates over the period of time and still lumbering after its purchase of SABMiller in the fiscal year 2016. Meanwhile, the net debt of the company rose to about 5.5 times EBITDA, which is more than double the pre-deal leverage of the company. Additionally, the competitors in every single market has been forging ahead resulted from high cash flows and low debt amount. The pressure from the competitors’ growth and amount of borrowing has worried the credit ratings companies. AB Inbev with too much leverage has been bearing high cost of borrowing and ran into the financial challenges in a downturn. Also, the market share of the company has been eroding constantly in US for the past 10 years (Matt Egan, 2019).

In order to reduce the debt level, and to increase the cash flows, the company is recommended to divesture its Australian subsidiary - Carlton & United Breweries (CUB) to Asahi Group Holdings, Ltd. As part of the divesture transaction, Anheuser-Busch InBev should grant Asahi Group Holdings the rights for commercializing the portfolio of the international and global brands offered by AB Inbev in Australia. After completion of the divesture of Carlton & United Breweries, would most likely help the company in accelerating its growth through expansion into other fastest growing & emerging markets globally and in APAC region. In addition to this, the divesture would help the company in creating the additional value for shareholders through optimizing its business activities at an attractive offering of price as well as strengthening its position for exploiting growth opportunities and deleveraging its financials – balance sheet. Substantially, the company should use all the proceeds from the divesture of the Carlton & United Breweries (CUB) to pay down the borrowing amount or could be applied to pay off the principle of the debt of company including bank line credit. In doing so, the company would be able to restore the cash position to the optimum or desire level and due to the availability of additional credit the company would be able take advantage of opportunities such as buying raw material and improving assets that would leverage profitability (Moschieri, 2011).

China – Merger with China based CR Snow

On surface, the condition of the Chinese beer market has appeared to be exceptional as the business proposition. For Instance: one of the wealthiest cities of china i.e. Wuxi situated in the Yangtse River Delta Area. The region had high rates for growth over the period of several years, also the consumption of beer was on the increase. Chinese brand Snow is one of the world’s largest seller of beer or alcoholic products and is leader on the Chinese market with the largest market share of all beer producer in china i.e. 26.8 percent in 2017. The mass consumed beer market in china has matured over the period of time. During the last few years, the overall volume sales of the alcoholic products or beer in china remained flat mainly because of the reason that the category of beer is saturated and mature and a significant reduction in the consumption and production of mass-consumed beer segment in China. However, during the similar period the value of the overall beer market is currently enjoying a year on year growth or rising trend, thus primarily driven by the market premiumisation and increasing cost of the packaging and raw material, hence led to higher prices for selling products. In addition to this. With the development of economy, the purchasing power of customers in china keeps rising. Gradually, the consumers are choosing beer with high quality rather than lower prices. The demand for the more premium beer offerings has been increasing in china, hence driven by the middle income & young consumer segment with the tier one cities of Tianjin, Shanghai and Beijing offering the greatest volume of this customer type. In china, the mainstream market of beer has been enjoying a robust growth rate, hence promoting breweries which includes Tsingtao Brewery, China Resources Snow Breweries as well as Yanjing Beer. In short, the rising cost of energy, huge capital investment, and high cost of maintenance are probable to inhibit the growth of the brewery equipment market.

Furthermore, in china the main consumer base has been established, even though the consumption habits of the customers have been significantly changing with the passage of time particularly amongst the young adults customers. The main consumption venues of the customers for beer or alcoholic products had shifted from KTVs to home parties, skewer bars, sports bars and even short journeys. The customers in china prefer high end craft beer for get-together with friends at bar and lager for with skewer. As compared to the stagnant volume of the growth, the current value growth for beer or alcoholic products is steady in china. This is mainly supported by the rising demand for the customized beer and high end beer and consumption upgrading, specifically the craft beer emergence in china with the tiny customer base and still at the phase of the market cultivation. With the niche presence in china in the vast beer category, the stout and dark beer have gained attention and approval from the local customers. Also, the craft beer has been experiencing growth and meeting the quickly increasing customer demand particularly from middle classes and businesspersons and is currently & gradually reaching out to more or wider customer base.

The merger with China Resource Snow would allow the company to increase the profit returns and millions of operating profit after integration and transaction costs. In addition to this, the company would be able to exceptionally increase its presence in world’s fastest growing market arena, through strong organic growth and integration. The company would also improve its leading position of brand internationally, through industry leading innovation and effective marketing, hence strengthening the routes to different arenas. The merger with CR Snow should be completed successfully with best of interest. The new operating model should delivers the improved operating margin and further efficiencies. The merger with CR Snow would broadened its portfolio further, also plays important role in expanding the access for its international brands as well as utilize its current scale for the purpose of improving the distribution. The company should be positioned in the market as a provider of wide ranges of quality products. Additionally, the products of the company should be positioned in the mind of customer as high quality and fresh bear. It should be brewed with all natural flavours to provide better taste to the customers making the customers to choose brewing malt beverage offered by AB Inbev over any other drink as the better taste of malt beverages would compel the customers to buy them in excessive quantity which would satisfy the taste buds of them.

The advertising objectives of the company should include; increasing the availability of beer for the customers, leading them towards intent to buy, to increase the sales of company and create economies of scale, to extend the presence on social media, to promote its brand to mass market, and to reach new customers and retain the existing customers. The objectives of communication strategy should encourage the brand switching, motivate the buying behaviour of customers, build customer loyalty and develop favourable association with the company’s brand. The company should intends to provide and produce products of uncompromised quality to its customers; to meet the standards of its customers.

New product offerings worldwide

The popularity of the non- or low alcoholic drinks and flavored drinks has been rising with the passage of time and the awareness among people regarding the health aspect of alcoholic drinks problems increasingly emerging. A number of market competitors are now offering low-alcohol (light alternative) to their most popular selection. It is one of the healthy alternative that has been pushing towards the health consciousness crowd as compared to the regular alcoholic drinks or beers loaded with calories.The shifting trend towards changing consumer preferences and innovative beers would propel the growth of the industry in the market. The trend is attributed to the willingness or readiness of customers to try new products and increasing awareness of the alcohol unit consumption.

Affected by the changing taste and attitudes of customers and declining consumption patterns, the beer and alcoholic drinks brands have been introducing product innovation which includes; beer with low or non-alcohol and new initiatives in distribution and marketing which includes subscription based ordering and e-commerce. Also, the brands have been focusing on sustainability in promotion and packaging. The company should offer wider choice of the new and improved product ranges to its customers with low alcoholic content and improved taste. The company should use natural ingredients such as hops, yeast, barley and water involved in the process of production. In the outlets around the globe, the company is recommended to introduce malt, higher barley content and Ales style craft beer. In doing so, the company would be able to uphold its position in the craft beer market arena. Along with this, the company is recommended to establish strong quality management system within an organization, source appropriate and suitable quality raw material, establish standard operating procedures (SOPs) detect as well as investigate deviations in the quality of product, maintain reliable laboratory tests, meet processing and sanitary requirements & label and package products according to the approved standards.

With number of customer are seeking to drink less quantity of beer and reducing their alcohol intake are increasingly happy in trading up the quantity for the higher product’s quality. The company should offer wide variety of styles to its customers so that they would choose what best suited their meal type, palate or the particular event. Another avenue of growth for company could be sweeter tasting near-beer which includes ciders, soft drinks and beer with the added flavours and malt beverages. Such flavoured wine or beers would most likely appeal to sweet tooth of Millennial and their desire for more flavour intensity. As the consumer all around the world have become environmentally conscious, the company should extend the eco-friendly commitments beyond and above recyclable packaging of products and introduce beer or products made with upcycled ingredients. For example; the company could introduce coffee flavoured beer which could be harmonized with chocolate based desserts, tiramisu, semi hard cheese and smoked pork. Also, the company could offer beer made with blueberries and other exotic ingredients including white wine must, yeast, sake, rice and wasabi. Offering new flavours and keeping pace with the changing consumer preferences towards organic beer is critical to the success of the company and to differentiate itself from the competitors. All in all, the company would be able to reap the long term benefits, gain a competitive edge and strong financial performance.

The second available option for AB InBev has belonged to the execution of the corporate strategy that might be achieved through performing the mergers and acquisition with the competitors as well as other strong competitive companies with the help of strategic alliances. In order to conclude, it would be provided a solution to their existing problems because it contains the controlled arrangements between the acquirer and targeted companies that would be entailed to share their capabilities, resources, and knowledge to develop combined services, products, and operational processes. The options would also be beneficial mainly in horizontal integration because it leads to increased differentiation of products and services by lowering the production costs and a decrease in competitive strength. Lastly, it is a means to enable the firm to enter a new market that possesses a lot of growing opportunities.

As knows that the second available option for AB InBev has belonged to the execution of the corporate strategy that might be achieved through performing the mergers and acquisition with the competitors as well as other strong competitive companies with the help of strategic alliances. There are some advantages and disadvantages of competing in international markets which includes the (Kumar, 2018)

Advantages:

- An increase in power and control over the market due to an increase in market share over the competitors.

- Another advantage of merger and acquisition is a synergy that allows an increase in the value of efficiencies, returns and cost savings.

- By using the concept of economies of scale, another advantage of merger and acquisition is to cut off its overhead cost which ultimately lowered the company’s overall operating cost.

- An increase in buying power

- Longer production runs

- A decrease in financial risk

- Competitive advantage over technological developments

- Tax benefits, cost savings, more profits, a rapid increase in retained earnings and higher returns to shareholders equity

Disadvantages:

- Loss of experienced workers

- In the case of merger and acquisition, the small firm may require the exhausted reskilling of employees

- Conjointly risk of getting surplus employees in both of the company’s departments such as human resources, procurement, etc.

- Merger with similar functioning firms and companies might lead to the duplication and over capabilities within the company

- Increase in cost in the form of management modifications

- Uncertainty in getting the approval of the merger and proper function

- A less return of one company might lead to a less return for the whole sector that might cause to the buyouts of other company

Financial analysis for all regions for the year 2019 of AB InBev have been made which are presented in Table 5 of the document. The Table 5 of the document illustrates the organic growth for each regions which is in negative for North American region around – 2.6 percent, positive growth for Latin American region (west) around 4.3 percent, negative growth for Latin American region (north) around - 3.6 percent, negative growth for Latin American region (south) around - 1 percent, positive growth for Europe, Middle East and African (EMEA) region around 2.2 percent, positive growth for Asian Pacific region around 4.6 percent and negative growth for Global Export and Holding Companies around – 2.7 percent. These negative and positive growth leads to the overall growth for the company around 0.8 percent as compared to the year 2018. The growth rate of around 0.8 percent is not too much effective for the company and cannot lead towards the highest cash flows for the company in order to remove the heavy debt barriers to compete in competitive advantage environment because AB InBev’s competitors has lessor debt as compared to the AB InBev which leads towards the lessor Earnings Per Share as compared to the close competitors of the company.

In addition to this, Table 5 shows the proportion to total revenue for each region but in number of units (volumes). For this, by using the proportionate formula in excel, the proportion of total revenue in number of units (volumes) for North American region is 21 percent, for Latin American (west) region is 23 percent, for Latin American (north) region is 21 percent,for Latin American (south) region is 6 percent,for Europe, Middle East and African (EMEA) region is around 8 percent, for Asian Pacific region is around 21 percent and for Global Export and Holding Companies is around 0 percent which shows the highest contribution of Asia Pacific region to maximize the company’s revenues in volumes (number of units). As well as, the Asia Pacific region is also get the highest organic growth rate of around 4.6 percent in the year 2019 (expected by using the divestiture option).

In addition to this, Table 5 shows the proportion to total revenue for each region but in dollar amounts. For this, by using the proportionate formula in excel, the proportion of total revenue in dollar amounts for North American region is 26.6 percent, for Latin American (west) region is 19.7 percent, for Latin American (north) region is 14.9 percent,for Latin American (south) region is 4.8 percent,for Europe, Middle East and African (EMEA) region is around 16.1 percent, for Asian Pacific region is around 17.5 percent and for Global Export and Holding Companies is around 0.4 percent which shows the highest contribution of North American region to maximize the company’s revenues in dollar amounts in the year 2019.Although, the North American region has negative organic growth rate of around – 2.6 percent in the year 2019 but this region is very much helpful in earning the highest sales in dollars for AB InBev in the year 2019......................

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.