Atlantic Corporation- Abridged Case Study Solution

Evaluation of Acquisition of Royal Paper

Acquisition of Royal paper can be evaluate on the basis of the enterprise value and the difference between the purchase price and the enterprise value with normal projections as well using sensitivity analysis.

It can be seen from Exhibit D, that the acquisition of Royal Paper has an enterprise value of $242.09 million without sensitivity that is low than the actual purchase price of $319 million. It shows if the acquisition would be finalised at the projected price it would lead Atlantic to bear a loss of 24%. Therefore, in order to avoid the loss, the company should consider the enterprise value as the purchase prize rather than $319 million.

The percentage of losses is even higher under various scenarios of sensitivity analysis, questioning the viability of the current purchase price.

However, the acquisition is highly required to increase the capacity as building of new capacity would require more time and costs, and in the current situation of increasing prices of Linerboard, acquisition of Royal Paper would be a better option for the company.

However, the company should try to negotiate the acquisition price to avoid the discounts.

Evaluation of financing Alternatives

The company is considering three different financing alternatives including;

- Financing Option 1: Line of Credit.

- Financing Option 2: Issuance of Debentures.

- Financing Option 3: Issuance of Common Stock.

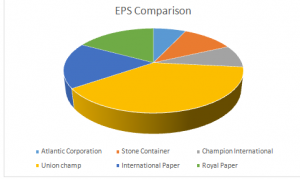

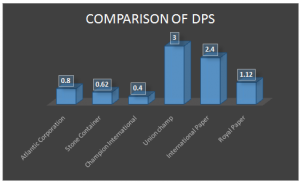

All these financing alternatives can be evaluated on the basis of various metrics including; EPS, DPS, WACC, Leverage Ratio and Interest Coverage Ratio. A brief summary of these financing alternatives is given in the Exhibit E.

It can be seen that the company would have highest EPS, DPS and Interest coverage ratio if it chose to fund the acquisition by Line of Credit. Along with it, the company would have the lowest WACC under the LOC option.

However, the company would have lowest leverage ratio in the third option, with a highest WACC and EPS values near to the option 1 and 2.

The second option of issuance of Debentures has EPS near to the option WACC where the WACC is lower than option 3 and greater than the option 1.

On the basis of above metrics LOC financing option is better for the company due to its lowest WACC and highest EPS, DPS and TIE Ratio. However, the option could more worsen the company’s credit rating and the investors may demand more returns over their investments.

Although, high EPS results in high value for shareholders and could lead to increase in current share price, but the difference in the EPS of LOC and Common stock option is not substantial. Therefore, in order to save its credit rating; the company should go for common stock rather than option despite of highest EPS, DPS and interest coverage ratio.

Recommendations

The company is recommended to acquire Royal Paper by using Common stock financing option. As the prices of Linerboard is expected to grow rapidly in near future, the company would face several problems if it would not extend its Linerboard capacity. The company has no better option than to acquire Royal Paper as building new Linerboard capacity would require substantial amount of costs and time. However, the purchase price for Royal Paper exceeds the enterprise value,and the company would face huge discounts if it fails to negotiate the price.

The company could finance its acquisition by using Common stock. Although the financing option has low EPS, DPS and TIE ratio but the difference between the EPS and other metrics is not potential that could be considered while selecting the option. Along with it, issuance of common stock would avoid the credit rating of Atlantic to further decline. However, the option has a low leverage ratio and would not bring an interest shield to the company.

Conclusion

Although, the company has low Linerboard capacity, but it can increase its capacity by acquiring various assets of Royal Paper and reduce the risk of increasing operational costs in future.The company should consider the purchase price on the basis of enterprise value and should consider common stock as a financing option to avoid the risk of declining its credit rating.

Exhibits

Exhibit A: Competitive Analysis

Exhibit B: Comparison of EPS

Exhibit C: Comparison of DPS

Exhibit D: Sensitivity Analysis Summary

| Senstivity Analysis Summary | |||||

| % Change | Enterprise Value | Discount % | |||

| Before Sensitivity | $242.09 | 24% | |||

| Scenario 1 | Utilization Rate | -5% | $40.86 | 87% | |

| Price Per Ton | -5% | ||||

| Cash Costs | 2% | ||||

| Box Plant EBTD | -3% | ||||

| Scenario 2 | NWC | 5% | $218.19 | 32% | |

| Capex | 5% | ||||

| Terminal Growth Rate | -0.5% | ||||

| Scenario 3 | Utilization Rate | -5% | $21.99 | 93% | |

| Price Per Ton | -5% | ||||

| Cash Costs | 2% | ||||

| Box Plant EBTD | -3% | ||||

| NWC | 5% | ||||

| Capex | 5% | ||||

| Terminal Growth Rate | -0.50% | ||||

Exhibit E: Financing Options Evaluation

| Financing Options Evaluation | ||||||

| Options | Metrics | 1984 | 1985 | 1986 | 1987 | |

| LOC | EPS | 2.61 | 3.99 | 4.38 | 5.53 | |

| DPS | 2.14 | 3.27 | 3.59 | 4.54 | ||

| Leverage Ratio | 1.00 | 1.05 | 1.11 | 1.17 | ||

| Interest Coverage Ratio | 2.86 | 4.00 | 4.49 | 5.68 | ||

| WACC | 9.58% | |||||

| Debentures | EPS | 2.43 | 3.81 | 4.20 | 5.35 | |

| DPS | 1.99 | 3.12 | 3.45 | 4.39 | ||

| Leverage Ratio | 1.04 | 1.08 | 1.14 | 1.21 | ||

| Interest Coverage Ratio | 2.54 | 3.53 | 3.93 | 4.93 | ||

| WACC | 10.04% | |||||

| Common Stock | EPS | 2.49 | 3.72 | 4.07 | 5.09 | |

| DPS | 2.04 | 3.05 | 3.34 | 4.18 | ||

| Leverage Ratio | 0.90 | 11.88 | 3.35 | 2.32 | ||

| Interest Coverage Ratio | 3.33 | 4.69 | 5.32 | 6.81 | ||

| WACC | 10.22% | |||||

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.