Analytical Report Case Study Solution

Investment Grade Corporate Bonds:

The investment-grade corporations are provided with comparatively powerful balance sheets by businesses or funding vehicles. They hold scores from Standard & Poor's, Moody's Investors Service or both of at least triple B (The scale is triple A as the maximum, followed by double A, single A, then triple B, and so on). The default risk is regarded quite remote for investment grade bonds.

However, their returns are greater than Treasury as well as the Agency bonds despite of the fact that they are fully taxable like in most of the organizations. These bonds have a habit of disappointing the treasuries and the organizations in financial downturns.

High Yield Corporate Bonds (Junk Bonds):

These bonds are issued by the businesses or comparatively weak balance sheets funding cars. They perform below triple B scores. Default is a chance that is different.

High-yield bond prices are therefore more strongly linked to corporate balance sheet health. They monitor inventory prices more carefully than the bond prices of investment grade. High yield bonds do not provide the same advantages of asset allocations, which can be accessible by the mingling of stocks and high graded bonds in the portfolio.

Foreign Bonds:

Sometimes, foreign bonds are denominated in dollars,but the average foreign bond fund has about the one third of its total assets in foreign currency and two third of its total assets are denominated in local currency debt.

In foreign currency denominated bonds, the issuer of the bonds make promises to pay the fixed interest payments on annual or semiannual basis,and at the time of maturity, the full return of principal amount is in another currency that has been promised to pay at the time of issuance to the bond. The size of these annual or semiannual payments and the final settlement of bonds will be determined by the current exchange rates in the country from where the bond has been issued.

Mortgage Backed Bonds:

The mortgage backed bonds that contain the face value of 25,000 dollars in comparison to the 1,000 dollars or 5,000 dollars for other kinds of bonds, are engaged with the prepayment risks, because their value fall when the prices of mortgage prepaid rise. If the interest rates decline in the country, these bonds will not provide any benefit to the bond holder as the other category bonds are provided in the same situation.

Municipal Bonds:

Municipal bonds are often referred to as mun is,which are issued by the United States’local and states authorities and their registered organizations. These bonds are issued in both varieties of investment graded and high yield. The interest on these bonds is tax-free, but it is not mandatory that anyone can take benefit from it.

In municipal bonds, taxable yields are higher in order to compensate the investors for paying greater taxes on different bond yields than muni returns, so, depending on its bracket, an investor may still be able to come out with taxable bonds.

Factors Affecting Bond Prices:

There are three main factors that can affect the bond prices,which are described below:

- Interest rate. (coupon rate)

- Inflation rate.

- Credit ratings.

Interest rate:

In normal situation when interest rate rises in a country, bond prices start to decline, because the coupon payment of these bonds are lower than the current interest rate in the country, while the interest rates start to decline than the bond prices upswing in a country, because the coupon payment of these bonds are higher than the current interest rate in the country.

For instance, a bond which owned 3 percent interest rate as a coupon payment of the bond and issued in a country when the interest rate is lower than the coupon payment of the bond. Now assume that the interest rate increases up to 5 percent in that country than the prices of 3 percent coupon payment bond starts to decline, because this bond is no more attractive for investors(Ontario Securities Commission, 2017).

Inflation rate:

In normal situation, when inflation rate rises in a country, bond prices start to decline because inflation has a direct connection with interest rates.An increase in the inflation rate would lead towards an increase in the interest rates of that country and vice versa.

A rise in the inflation rate has an indirect relation with the purchasing power of that country, because a rise in an inflation rate would lead towards an increase in the prices of all the products in that country, which ultimately reduces the purchasing power of an individual and even of all the citizens of the country.

In other words, due to the high inflation; the principal amount you receive at the time of bond’s maturity, the return will be worthless and the new investment in another bond will require more money to invest.(Ontario Securities Commission, 2017).

Credit Ratings:

Credit rating agencies assign bond issuers and particular bonds credit ratings. A credit rating can provide information about the ability of an issuer to pay interest and repay a bond to the principal. Generally speaking, if the loan score is greater then there are more chances that issuer would fulfill their payment commitments at least in the rating agencies view. If the credit ratings of bond issuers rise; the price of its bond will also rise, because the credit ratings have a direct relation with the bonds’ price. If the credit ratings of an issuers of bond will fall, the price of its bond will also fall, because credit ratings have a direct relation with bond price.

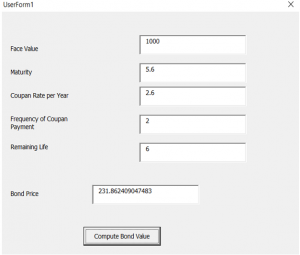

Figure 4.1: VBA Macro Code (User Form)

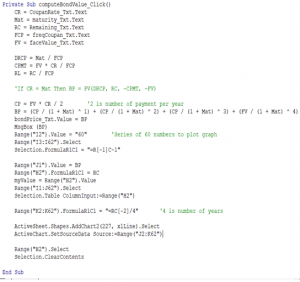

Figure 4.2: VBA Macro Code

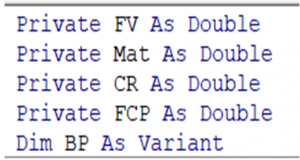

Figure 4.3: VBA Macro Code

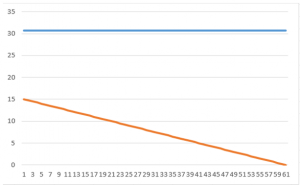

Graph 4.1: Growth and Decline of Bond’s Price

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.