Alpine Press Case Study Solution

However all three techniques involves NPV which are calculated by using cost of capital/discount rates. The finance director of the company has proposed these discount rates without any calculation and is still uncertain about what rates should be used. She has proposed that discount rate for Heidelberg can either be 14% or 16% whereas discount rates for Akiyama can either be 12% or 14%.

Recommendations

Crandall should evaluate the project using multiple investment appraisal techniques instead of relying only on payback period method to ensure profitable projects are accepted and incorrect decisions are not made. The firm should go ahead with replacing Miller with Akiyama since all evaluation techniques IRR, profitability index, NPV and payback showed favorable results for Akiyama compared to Heidelberg.

Since almost all investment appraisal techniques involves cost of capital, finding or calculating appropriate cost of capital is essential otherwise unprofitable projects might be accepted and suboptimal decisions might be made. The finance director should calculate the appropriate cost of capital by analyzing how the company is going to finance the replacement of Miller, whether equity source will be used or debt source will be used or if the CEO will finance the replacement through combination of both sources. The finance director should analyze the risks of the printing market in which the Alpine press is based as risk will be have to incorporated in the cost of capital.

The director should study various methods and theories of calculating weighted average cost of capital like Capital asset pricing model which used to calculate cost of equity in order to gain knowledge about how WACC is calculated as currently it uses cost of capital without any calculation or consideration of risks and only uses the rate she is comfortable with.

Further factors like whether Akiyama manufacturer will provide maintenance support after its installation or not and how much wastage and pollution will be caused by the machine should be considered to make the final decision. The financial benefits should be compared with the non-financial disadvantages and if the nonfinancial disadvantages outweighs the financial benefits then, decision to purchase Akiyama shall not be made.

Conclusion

Alpine Printing press ensures quality printing and maximum customer satisfaction. The firm faced higher maintenance cost of one of its machine and decided to replace it with either Akiyama or Heidelberg. Previously the CEO used to accept projects with a shorter payback period but this time in order to ensure a right decision is made since both the machines requires huge investment, he asked the finance director of the company to evaluate the project through multiple investment appraisal techniques.

The projects were evaluated using various investment techniques like IRR, NPV, Payback and profitability index along with various non-financial factors. Each investment technique has its own pros and cons however, since payback does not consider the cash flows after payback period and results in rejection of profitable projects, IRR, NPV and profitability index methods were suggested to appraise investments.

Positive results were achieved for Akiyama using all four techniques therefore, it was suggested to undertake the project however, non-financial factors like pollution and wastage should also be evaluated to reach a conclusion. However, these results were based on cost of capital which was assumed by the finance director without understanding the risks associated with the projects and the source of finance used. Therefore, it was recommended that an appropriate cost of capital should be used to evaluate the projects.

Appendices

Appendix 1: Akiyama Payback period

| Years | NCF | Discount factors | DCF | Payback |

| 0 | 400,000 | 1 | 400,000 | |

| 1 | 269,408 | 0.893 | 240,543 | 159,457 |

| 2 | 269,408 | 0.797 | 214,771 | (55,314) |

| 3 | 269,408 | 0.712 | 191,759 | |

| 4 | 269,408 | 0.636 | 171,214 | |

| 5 | 269,408 | 0.567 | 152,869 | |

| 6 | 269,408 | 0.452 | 121,867 | |

| 7 | 341,408 | 0.404 | 137,889 | |

| Payback | 1 year 9 months | |||

Appendix 2: Heidelberg Payback Period

| Years | NCF | Discount factor | DCF | Payback |

| 0 | 880000 | 1 | 880000 | |

| 1 | 323,704 | 0.877 | 283951 | 596049 |

| 2 | 323,704 | 0.769 | 249080 | 346970 |

| 3 | 323,704 | 0.675 | 218491 | 128479 |

| 4 | 323,704 | 0.592 | 191659 | -63180 |

| 5 | 323,704 | 0.519 | 168122 | |

| 6 | 323,704 | 0.456 | 147475 | |

| 7 | 700,187 | 0.400 | 279821 | |

| Payback Period | 3 years and | 8 months |

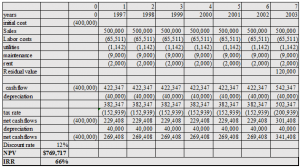

Appendix 3: Akiyama NPV

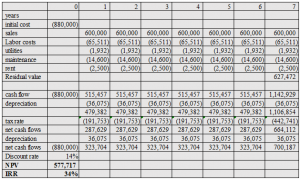

Appendix 4: Heidelberg NPV

Appendix 5: Profitability Index

| Project | NPV | Investment | Profitability Index |

| Akiyama | $1,957,857 | 400000 | 489% |

| Heidelberg | 2642410.8 | 800000 | 330% |

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.

How We Work?

Just email us your case materials and instructions to order@thecasesolutions.com and confirm your order by making the payment here