ACER INCORPORATED AN ANALYSIS AND STRATEGY Case Study Solution

Value Chain

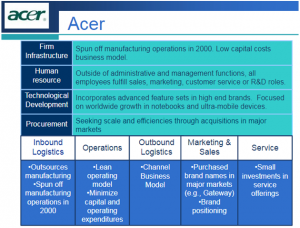

The main parts of the organizational value chain starts from the inbound logistics of the ACER Company which derives the raw materials, which are then transferred to the core engineering phase which build the products and assemble them, which are then transported to the different Business Units of the organization. The organization’s structure is constrained according to the case which has created problems for the organization as the head R & D department is located in the TAIWAN where the business is originated. The organization assembly units are in different parts of the world for which the organization has outsourced all the components of electronics and other areas such as casing and monitors to the different units. While the main components which are hot and have a smaller life of 6-9 months are directly transported via airline routes. The Outbound logistics is the supply chain of the organization which consist of air routes, and sea routes; air routes being for the first class hot items such as computer chips.

The support activities which consider the infrastructure, human resources, and other activities are of high consideration to the organization as high influences on the quality and the customer satisfaction in the organization. Further, the workforce of the organization is under a traditional rule with recent move towards the more objective and performance base; this has created problems as the two sets of perceptions have collided which needs to be carefully reorganized by Mr. Shih.

Financial Analysis

For the other areas of Internal Analysis for our report, we will be considering the given financial data for the organization and would provide ratio analysis to gather some financial aspects of the organization. The data and calculations are provided below:

| ($ M) | 1991 | 1992 | 1993 | 1994 | |

| Revenue | 985.2 | 1,260.0 | 1,883.0 | 3,220.0 | |

| Cost of Sales | (737.7) | (1,000.0) | (1,498.0) | (2,615.0) | |

| Gross Profit | 247.5 | 260.0 | 385.0 | 605.0 | |

| S,G,& A Expenses | (217.2) | (217.0) | (237.0) | (316.0) | |

| R & D Expenses | (42.3) | (38.0) | (48.0) | (59.0) | |

|

Operating Profit / (Loss) |

(12.0) | 5.0 | 100.0 | 230.0 | |

| Some FPI's: | |||||

| Revenue Increase | 0.0% | 27.9% | 49.4% | 71.0% | |

| Cost Of Sales Increase | 0.0% | 35.6% | - | 74.6% | |

| Gross Profit to Sales | 25.1% | 20.6% | 20.4% | 18.8% | |

| S,G & A Increase | 0.0% | -0.1% | 9.2% | 33.3% | |

| R & D Increase | 0.0% | -10.2% | 26.3% | 22.9% | |

| Operating Margin | -1.2% | 0.4% | 5.3% | 7.1% | |

The revenue position of the organization is seeing high growth as much as reaching 71% in the 1994 which was around twice the times of 1993. Further, the recent performance in the early 90’s era, the organization had seen recent losses and the current organization position is somewhat stabled with the operating margin increasing to 7.1% of the total revenue.

Further, the organization’s raw material costs are seen in an increasing trend with reduction in the Gross margin being reduced to 18.8%. The other expenses relating to the S, G, &A Expenses and the R&D Expenses has continually been increasing in the last years which is a constraint on the profitability of the organization.

STRATEGY FORMULATION

In this part of the paper we will consider the Strategy Formulation and the recommendation for the ACER INC.

BASIC INTERNATIONAL STRATEGIES

There are 4 basic international strategies being available to the organizations which are considering global expansion. (A.W.Harzing, 2000) The basic strategies available are:

- MULTI-DOMESTIC

This method consists of tailoring the products according to the needs of the local market in every country. This type of method is being used by NESTLE Company as it tailor its products according to its regions of operations. This is also somewhat in the research phases for ACER as ASPIRE is being developed according to the market needs in the US.

- GLOBAL COMPANIES

The global companies are the exact opposite of the Multi-domestic as explained above. The global model incorporates a single class of products which are available to all markets worldwide. This method is being used by big Pharmaceutical companies as there products are patented; an example of such firm is PFIZER PHARMACEUTICALS.

- TRANSNATIONAL

The other type of strategy available to the organization is the transnational strategy, which is a combination of both the multi-domestic and the global perspectives which wants to increase the business according to the flexible nature accumulated with the local economies. These organizations focus on the value chain and create economies of scale from wide operations, an example of such firm is the UNILEVER Organization.

- INTERNATIONAL COMPANY

This strategy incorporates the head quarter being the sole mind behind the corporation. This will implement the source head quarter creating all the products and distribute the products which are then supplied to all the areas of its working. This type of model is currently being implied by ACER as TAIWAN is the main source behind all the creation and development for the organization.

RECOMMENDATIONS

According to the above mentioned strategies, the main recommendation which will be suggested to the organization is to follow on as The Global Company approach which implies creating a standard product which is distributed throughout the world as per different distribution channels. This measure is similar to the current international strategy of the business but this changes the current view of the organization from the mind which is located in TAIWAN. This model implies a central Research and Development which will focus on all the markets where the organization is situated and will create different products according to the market needs.

This will provide ACER with the right focus and product which will be available to newer and advanced markets such as US and WESTERN MARKETS, and also to other developing markets which will have different second tier products providing solution to the need of every business unit of the organization.

The Multi-Domestic would have been more fruitful to the organization in this scenario, but as the organization has just recently suffered heavy losses and is redeeming its culture and structure, giving free hand to all markets will induce chaos which will be highly negative for the organization............

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.