Voyages Soleil: The Hedging Decision case: Case Study

Introduction

The case is about Voyages Soleil (VS) which is a tour operator company. The company operates in various currencies. Generally, it receives in Canadian dollars and pays in U.S. dollars. Hence the company is extremely exposed to exchange rate risk and it could face losses out of any Canadian currency depreciation against U.S. currency. (Michel, 2009)

Problem Statement

The company was extremely exposed to the exchange rate risk after the incident of 9/11 because of the fact that because of this incident there was a continuous decline of Canadian dollars against U.S. dollars. In order to avoid that risk of losses, the company was analyzing various hedging options.

Situational Analysis

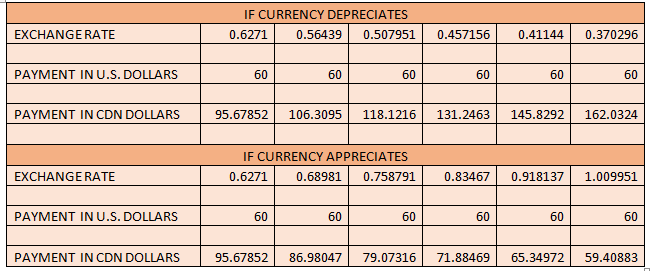

Alternative 1: Do Nothing

If the company chooses to do nothing against the risk the company would have to pay more than $95.27 in case of depreciation of Canadian dollars against U.S. dollars and vice versa.

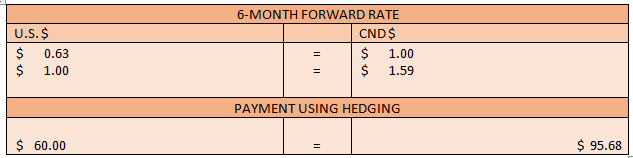

Alternative 2: Using Forward Contract

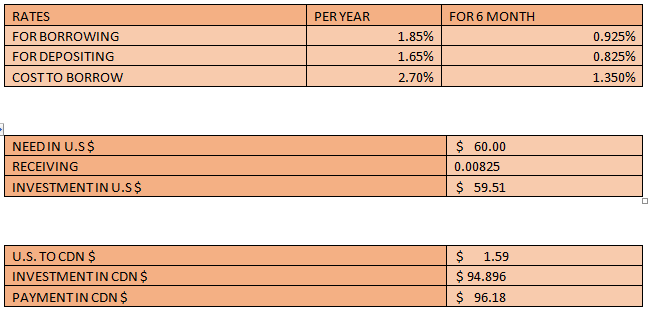

Alternative 3: Borrow CDN dollars and invest in U.S. dollars

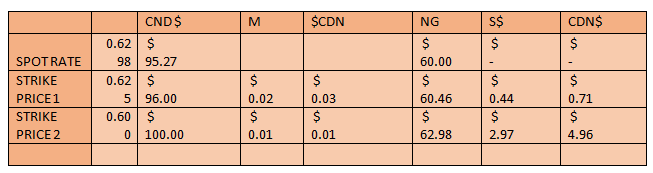

Alternative 4: Using Put Options

Recommendation and Conclusion

Based on the Analysis could be said that the best option for the company is to hedge its risk through a Forward contract because if it exercises this alternative it could easily mitigate the exchange risk which remains high with the company doing nothing, although using this approach the company would have to pay $95.68 Canadian dollars.

The alternative of borrowing CDN dollars and investing in U.S. dollars does not seemto be feasible because it contains high-interest rates and Forex risk while the company’s total estimated payment is about Canadian $ 96.18million which is higher than that of using the alternative of Forward Contract.

However the Put Option alternative does provide gain, only if the Canadian dollar depreciates in the six monthsbut based on the economic analysis there is a very low possibility of that happening, instead of high chances are that the Canadian dollars are likely to appreciate, hence this alternative contains high risk so the company must not go for this....

Voyages Soleil The Hedging Decision case Case Study

order on the website to order your own originally done case solution."}" data-sheets-userformat="{"2":14913,"3":{"1":0},"9":0,"12":0,"14":{"1":2,"2":3355443},"15":"\"open sans\", Arial, sans-serif","16":10}">This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.