The Trouble with Lenders: Subtleties in the Debt Financing of Commercial Real Estate: Case Solution

Recommendations:

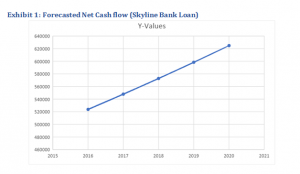

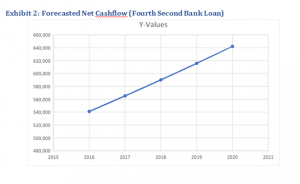

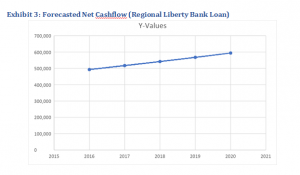

After the detailed qualitative and quantitative analysis, we concluded that Stanley Cirano should refinance the property (Brook line Road Shopping Center) by taking the loan from the Fourth Second Bank because it is giving the lowest interest rate 3.625% with the highest forecasted average ratio of DSCR, which is 3.66. The forecasted capital gain in Market value is 5.3%, which is greater than other alternatives.

Columbus Festival Plaza & its Alternatives:

Columbus Festival Plaza is based on 113,572 Square foot size, located in Class B Shopping Center Elm Park. It was acquired in 2010 by Stanley Cirano through the 55% debt and 45% equity. Now he is confused either to sell it or refinance it through 2 alternatives. First is to finance it by taking the loan from Oakwood Bank and second one is to take the loan from National Bank.For evaluation we took the average of three similar properties for Market Value of Columbus Festival Plaza (Excluding Fox Run Square because it posses the high Market Value which will lead to the unacceptable high average Market value of Columbus Festival Plaza).

| Property | Price |

| Fox Run Square | Excluded Due to High Value |

| 363 N Weberr Rd | 6,400,000 |

| The Landings | 9,500,000 |

| Prairie Point SC | 18,151,363 |

| Value of Brook line Road Shopping Center | 11,350,454 |

For further analysis, we have calculated the Average Growth in Net Operating Income, Average Growth in Net Operating Cash Flow and Average Capital Cost / Net Operating Income Ratio for this property with the assumptions of the 5-year refinancing.

Through above calculated values, we generated the Net Cash Flows of Property by dividing with the Capital Rate provided in the Exhibit 8, is 7.79%. Then we calculated the Present value to find the Capital gain after refinancing for 5-year.

After calculations, we started to compare all the two alternatives for Columbus Festival Plaza, the results will be shown in later.

Alternative 1 (Oakwood Bank Loan):

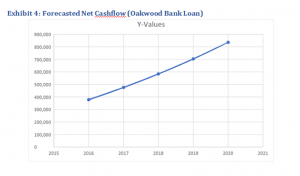

For Oakwood Bank Loan, we have 65% LTV with 4.9% interest rate and the 25-year Amortization period. The minimum DSCR ratio is 1.25 with the yearly payments of $518,238. Here our forecasted DSCR average ratio is 2.45 with the capital gain in Market value of Columbus Festival Plaza is -14.55%.

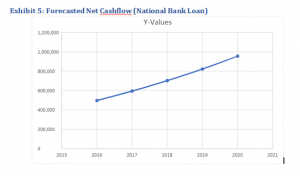

Alternative 2 (National Bank Loan):

For National Bank Loan, we have 60% LTV with 4.13% interest rate and the 30-year Amortization period. The minimum DSCR ratio is 1.4 with the yearly payments of $399,838. Here our forecasted DSCR average ratio is 3.17 with the capital gain in Market value of Columbus Festival Plaza is -1.16%.

Recommendations:

After the detailed qualitative and quantitative analysis, we concluded that, Stanley Cirano should sell this property because after analyzing the both alternatives, there is a high chance of declination of the Columbus Festival Plaza’s Market Value in the future because of the forecasted Capital gain from both alternatives is in negative, that means in future they might lose their capital value.

Exhibits: