The Jacobs Division 2010 Case Solution

If you use a capital-intensive method, increasing capacity by 100,000 pounds would cost you 75,000 dollars. It may be computed that the capital-intensive plan would need a total investment of $150,000 if capacity is increased by 200,000 dollars as part of the strategy in order to compare the two ways. Capacity-intensive techniques are, without a doubt, more expensive than other ways in terms of available capacity. It is possible that this project will be outsourced in order to keep costs down if the firm adopts the capital-intensive method. As a result, the overall amount of money spent by the organization will be reduced.

Discount Rate

When discounting future cash flows, the discount rate is utilized to arrive at present values, which are then used to calculate future values. This number is represented as a percentage of the total number. The amount of money received in the form of stock and debt is used to calculate the amount of equity and debt expenditures incurred by a firm.

Alternate Prices

For example, according to the Soderberg research, pricing should be risk-adjusted and sufficiently flexible to allow for production flexibility, given that the competition is predicted to be at $1.90 per pound. If the firm is able to maintain itself with robust revenues over the long term, the risk will be well worth it. This is influenced by the method of cultivation that is employed to grow the plants. If we chose the labor-intensive option, it will be very difficult to decrease the price; yet, decreasing the price will have only a modest impact on sales if the product is exclusively created at the company's production facility. Because Soderberg believed his product's price was set too high at 1.0, he concerned that if competitors found a method to make things more cheaply using the capital-intensive approach, his product would be subjected to competition. In spite of the fact that forecasting prices is difficult owing to uncertainty in demand, competitors would take advantage of the circumstance if they saw an opportunity to do so at a lower cost.

Recommendations

It is necessary to evaluate two elements while considering whether or not Mr. Soderberg should suggest to Mr. Reynolds that he accept the Silicone-X project: money and labor. The labor-intensive alternative has a positive net present value (NPV) at 12 percent, 16 percent, and 20 percent, while the capital-intensive option has a slightly positive net present value (NPV) at these same percentages (NPV). In addition to corporate traditions, Mr. Reynolds' personal leadership of Jacobs Division provide credence to the labor-intensive approach. In addition to being a large advantage of advancing with the project outside of the NPV, if the labor-intensive option is chosen, Silicone-X might be available on the market within a year. Because it is a capital-intensive option, it will take two years to construct and will result in zero volume during the first year of operation. Therefore, the capital-intensive option plant's first two years of operation would be completely idle, and the remaining two-thirds of the plant's capacity would be idle during the final year of operation. It goes without saying that labor-intensive techniques are the best for making Silicone-X, and this is especially true given the fact that they meet the NPV criteria of Jacobs Division's head.

Action Plan

With an initial production capacity of 1.5 million pounds of chemicals, the labor-intensive factory is more comparable to Jacob's model type than the capital-intensive facility, which would have an annual capacity of 2 million pounds of chemicals. Labor-intensive factories are more expensive to expand than capital-intensive firms, which is an unfavorable characteristic. Jacob's history, on the other hand, seems to have been devoid of any significant advancement. Given the possibility that this factory will be operational within a year and will be able to fulfil almost all of the projected demand for its goods, hiring more employees is the preferred option.

Conclusion

It is the newest and smallest subsidiary of the Jacobs Corporation, but it is also one of the most rapidly expanding. As a result, cumulative net asset returns have averaged a healthy 13 percent over the last five years. Given Mr. Reynolds' successful professional background and tight standards for approving new initiatives, it is reasonable to assume that, in contrast to Mr. McFadden's more relaxed approach, he only authorizes ventures that are very unlikely to fail. Gains gained without taking any risks have a lower chance of outperforming the market average in the long run. After everything is said and done, Jacobs Division seems to be an extremely safe investment that gives an acceptable return; nevertheless, if I am looking for a high rate of return, Jacobs Division may not be the greatest pick.....................

Appendices

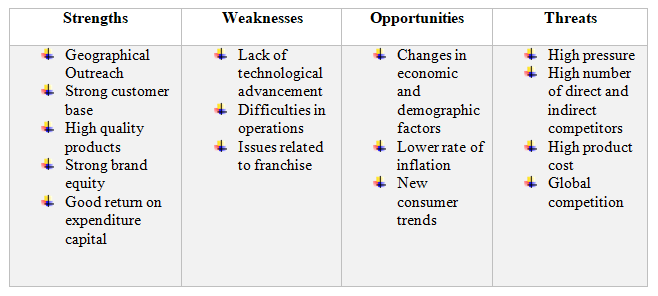

Appendix 1: SWOT Analysis

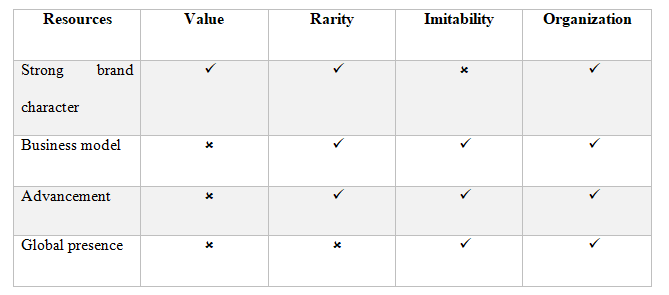

Appendix 2: VRIO Analysis

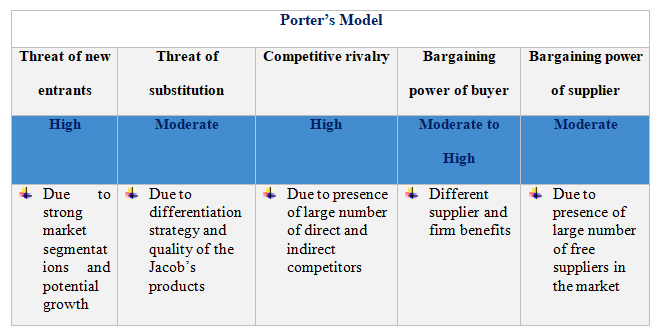

Appendix 3: Porters Five Forces Model

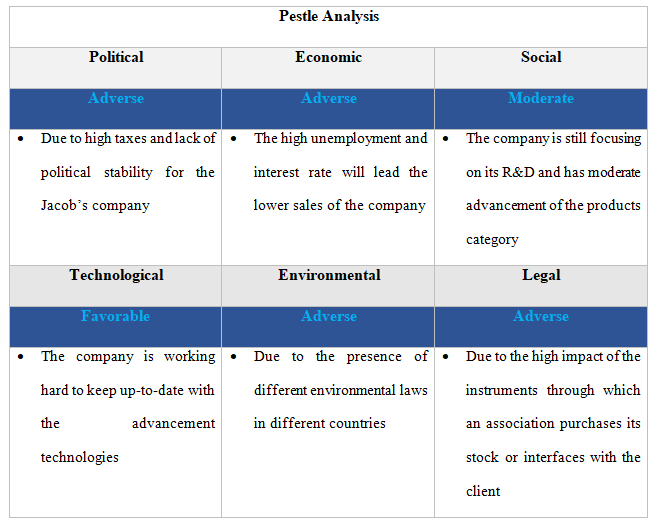

Appendix 4: PESTEL Analysis

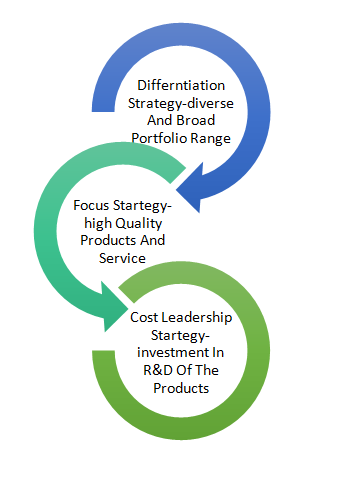

Appendix 5: Jacob’s Generic Strategies

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.