The audit procedures Case Study Solution

Audit Procedures:

Audit procedures are defined as the procedures which the auditor uses to obtain sufficient and appropriate audit evidence about the financial statements of the company. Hence these procedures can be used to identify the discrepancies in the financial statements.

Granite Bay Jet Ski, Incorporation has a good accounting system such as the company has the corresponding recording for each transaction. Along with this, many linked accounts automatically update when a transaction takes place. We can say that the company has strong control over the transactions therefore, minimum audit procedures will be required to evaluate the transaction. The audit procedures performed by the auditor are categorized in the following main headings:

Inspection: It is an audit procedure which is used to examine internal and external records which are held in various forms such as paper, electronic and others. The inspection provides the evidence for the assertion of existence and policies of the company however, it does not provide any evidence about the assertion of rights and obligation.

Observation: It is the audit procedure in which the auditor looks at a process. The evidence obtained from this procedure has limited use or for a particular time. Mostly audit or use this procedure at the time of counting the inventory.

External Confirmation: It is the audit procedure in which the auditor circulates the confirmation letter to the external parties. The evidence obtained from this procedure is considered as the most appropriate one because it is generated by the external source.

Recalculation: It is the audit procedure that is used to determine the mathematical accuracy of a transaction. In this procedure, auditor recalculates an amount to determine its mathematical accuracy, however, accuracy relating to the estimation cannot be determined through this procedure.

Re-performance: It is the audit procedure in which an auditor re-performs a process to verify the validity of certain assertions.

Analytical Procedures: It is the audit procedure which is used at every stage of the audit to verify the different assertion. In this procedure, auditor verifies the assertion by understanding the plausible relationships between non-financial and financial data and by comparing the current year results with the previous year.

Some of the audit procedures which can be used to find out the discrepancies in our calculated amounts and provided results are as follows:

- Make a dummy sale and observe that whether the merchandise inventory is updated with the corresponding amount or not.

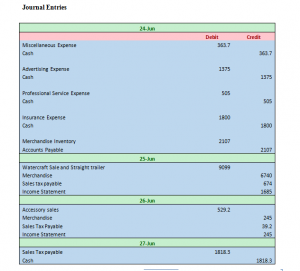

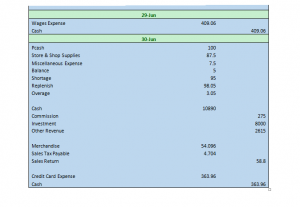

- Obtain the cash book and ensure that all the expenses are accounted correctly in the cash books.

- Obtain the expense vouchers or invoices and ensure that the quoted amounts are matched with the recorded expenses.

- Obtain the customer list and match the outstanding balances with the accounts receivables balances and enquire from management about the discrepancies.

- Circulate a confirmation letter to the customer and supplier to ensure that the corresponding amounts and discounts are appropriately recorded.

- Obtain the sales invoices to identify the amount of allowed discount and its term.

- Obtain the purchase invoice and ensure that quoted amount, the discount is in line with the calculation.

- Recalculate the allowed and received discounts to ensure that they are appropriately recorded.

- Recast the amount of accounts payable and receivables to ensure that they are appropriately recorded.

- Obtain a bank statement and perform a bank reconciliation to find out the discrepancies between cash book and bank statement after that ask the management to rectify them.

- Analyze the history of the company to understand that whether the company fulfills the term required to obtain the discount or not.

This is just a sample partial work. Please place the order on the website to get your own originally done case solution.