“Terracycle Inc.” Case Solution

PESTEL Analysis

Pestel analysis is helpful for understand the macro factors which affect the Terra Cycle Company.

Political Factors

The taxation rate, policies of government and competition regulations are the political factors which affect the Terra cycle. The increase in taxes decreases the level of revenue for the company. Changing in government policies directly affect the production costs because this whole system is interlinked.

Economic Factors

Inflation rate of United States, unemployment rate and interest rates these all factors affect negatively to the operations of Terra Cycle Company. Increase in inflation, unemployment and interest rates reduce the purchasing power of customer.

Social Factors

Demographically the company gain benefit because most of the youngsters like to purchase the recycle products of Terra cycle for their use. Education sectors has also positive impact on Terra cycle because most of the educators purchase these recycle products for the academic purpose.

Technological Factors

The company should invest inresearch and development to increase the productivity of the company. Increase in the internet, social media increase the chances of growth for the Terra Cycle Company.

Environmental Factors

The waste management, recycling and green consumption are the major environmental factors which affect the company.

Legal Factors

The Terra Cycle Company must consider the legal laws tokeep the company reputable and profitable. The laws of discrimination, employment laws, health and safety Laws Company must follow. If the discrimination happens ina workingplace, the effectiveness decreases by unsatisfied employees. The company must focus on the health and safety of employees because if an employee feelssecure,performing employees increase.

Quantitative Analysis

For the quantitative analysis, we have calculated the net cash flow with the investment in African and Orchid fertilizers. We have calculated its return on investment, and payback periods. We also have projected the firm’s income statement for the year 2006 with the investment and without the investment to analyse whether it is workable to invest in the fertilizers or not.

Note: Refer to Exhibit 1 to 3 for calculations

Alternatives

- First alternative is that this organization is launched “Two New Fertilizer Products” and invested all budget in these two products.

- Second alternative is that this organization is not launched and invests these “Two New Fertilizer Products”.

Decision Criteria

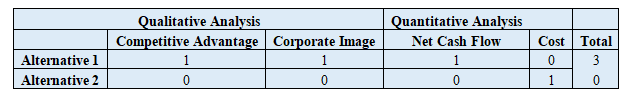

We have decided the decision criteria to be based on both qualitative and quantitative analysis. From qualitative analysis over criteria would be based on the competitive advantage and corporate image. Whereas we would base the decision on the net cash flow and cost out of the quantitative analysis. We have chosen these criteria because that way the pros and cons related to the investment would be clearer and based on both the financial and non-financial analysis. The decision would not be only limited to financial analysis. For the assessment of alternatives based on qualitative and qualitative analysis, we have used the ranking system from 0 to 1. The alternative coming up to the expected criteria would be ranked one and otherwise zero.

Alternative Assessment Matrix

Preferred Alternative or Recommendations

In the preferred alternative, the beneficial option for the corporate is that corporate is launched “Two Fertilizer Products” and invest your all budgets in these “Two Fertilizer Products” because in this option corporate’s “Net Loss” is smaller than the second alternative because of high total revenue as compare with second option income statement because in first option income statement, new product costs are available and in second option income statement, new product costs are not available, so this is the reason behind the corporate is selected first alternative. If a corporate is selected first alternative, so the recovery of “Net Loss” of the corporate will be easy and quick as compared with the second alternative income statement.

Action and Implementation Plan

As per the analysis, the company should definitely invest in both the products. In order to do so, the company could use various financing strategies, like in case of more capital requirements for the investment. The company is supposed to take long-term debt that must be eventually paid from the potential returns out of the investment. In case of stable saving, the company could partially finance the investments to launch new products and if the company has sufficient funds, the company is suggested to finance the investment completely equity based. For long-term growth and corporate sustainability, the company must look for potential investments with low risks and maximum returns.

“Terracycle Inc.” Case Solution

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.