Sriram Wheels Case Study Solution

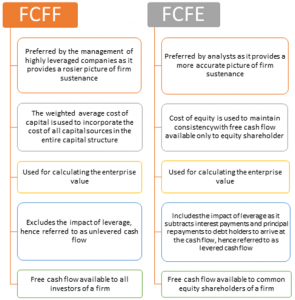

FCF to equity is the amount remaining for firm’s common equity holders. While FCF to firm is the amount remaining for the firm’s investors, both stockholders and bondholders.

FCFE includes leverage impact by deducting net financial obligations, known to be as levered cash flow. While FCFF is referred to as levered cash flow as it doesn’t include leverage impact, neither does it consider financial obligations for the calculation of residual cash flow.

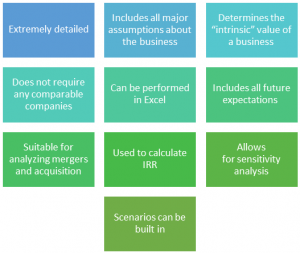

FCFF is used in valuation of DCF for the calculation of intrinsic value or the enterprise value of the firm. While FCFE is used in the valuation of DCF for computation, of firm’s intrinsic and equity value, accessible to common equity shareholders.

FCFF is paired with WACC in valuation of DCF, for maintaining the consistency in incorporation of capital suppliers for enterprise valuing. While to maintain the consistency for incorporation of common equity shareholders in FCFE, it is paired with cost of equity.

| Equity ratio | 50% | |

| Cost of Equity | 15% | |

| D = Debt ratio | 50% | |

| Kd = Cost of Debt | 10% | |

| After tax Cost of Debt | 7% | |

| Tax Rate = Corporate Tax Rate | 30% | |

| WACC= Equity Ratio* Cost of Equity+ Debt Ratio * After Tax Costof Debt | ||

Therefore:

WACC = 0.5*0.15+0.5*0.07

= 11.18%

Detailed calculations of the free cash flows are done in excel. Business value beyond the forecasted period is calculate to be 12.786 (Terminal value). The market value of the business is calculated to be 6.94 million. While its equity value after deduction of debt and addition of cash is 5 million.

Since Math y u is investing 2 million rupees in the business, and the equity value of the business is calculated to be 5 million, then a fair percentage of share of Math y u according to the valuation should be 40% rather than 50%.

Although, as Alex has already invested a lot of time in establishing his business, he should get more fair percentage calculated through valuation. A share between 35% - 40% would be appropriate.