SNEAKERS 2013 Case Study Analysis

Introduction

This case is about a company named New Balance located in Brighton, Massachusetts. The company has implemented a new policy for the employee's work-life balance. New Balance has an opportunity in a segment ignored by the firm’s large competitors, such as:the 18 years old male age group. New Balance can target them with an effective and efficient marketing strategy. There is a steady growth in the Athletic footwear industry, even the economy is facing crises.

So Michelle Rodriguez has to provide a position report on one of the New Balance’s most promising new athletic shoes. Data should be taken from all the departments, such as: marketing, finance, sales, technology and manufacturing. She has to perform an analysis and recommend whether to proceed or not.

Persistence Project

The costs related to the factory will not be included in the capital budgeting, because the factory costs are fixed and it would not change if the company takes the project or not. Purchase of the equipment will be included in the capital budgeting, because the company is incurring these costs solely for the Persistence project. Cannibalization of other sneaker sales will not be adjusted in the cash flows, because the Persistence project does not impact the sales of the existing product line. Interest costs are specifically related to the project’s financing, so these will be included.

Changes in current assets and current liabilities are mainly occurring due to the adoption of the Persistence project, so a change in working capital costs will also be included. Taxes will be included in the capital budgeting decision process, as the business must pay taxes on the generated earnings. To determine the project’s profitability and cash flows; the cost of goods sold, depreciation charges advertising and promotion expenses must be added.

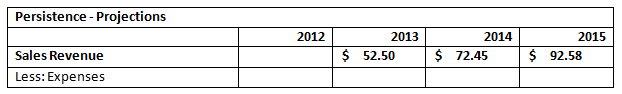

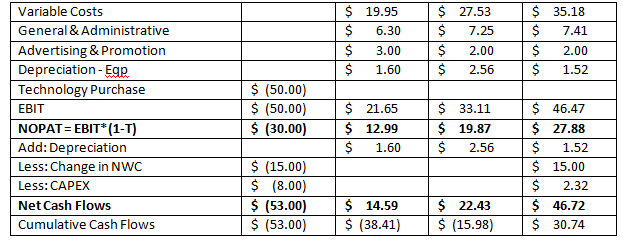

The Persistence project has an initial cash outlay of $53 million at year 0, i.e. 2012,and the project’s annual cash flows are $14.59 million in 2013, $22.43 million in 2014 and $46.72 million in 2015. (See Appendix 2)

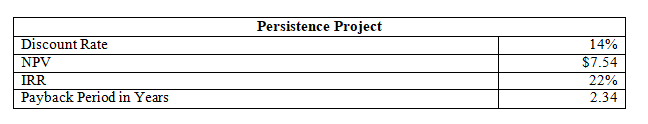

As per the quantitative analysis of the Persistence Project; the project appears to be viable, as the project generates a positive net present value of $7.54 million. The project generates an IRR of 22%, which is greater than the cost of capital of 14%, and its initial cost can be recovered by the company in 2.34 years, as the payback period is 2.34.

Sneaker 2013 Project

In the capital budgeting cost of equipment; purchase & installation and the cost of building the factory would be included, as this cost would solely be incurred for the Sneakers’ 2013 project. Research and development costs are carried out, to determine the project's feasibility, so these costs will also be included. Cannibalization of other sneaker’s sales will be adjusted in cash flows because this refers to the opportunity cost for the company’s existing product sales. Interest costs are specifically related to the project’s financing, so these will be included. Changes in current assets and current liabilities are mainly occurring due to the adoption of the Sneakers’ 2013 project, so the change in working capital costs will also be included.

Taxes will be included in the capital budgeting decision process, as the business must pay taxes on the generated earnings. For determining the profitability as well as FCF (Free cash flows) of the sneakers’ 2013 project; the cost of goods sold, advertising expense and promotion expense will be included. Depreciation charges are also included, to determine the project’s profitability and free cash flows.

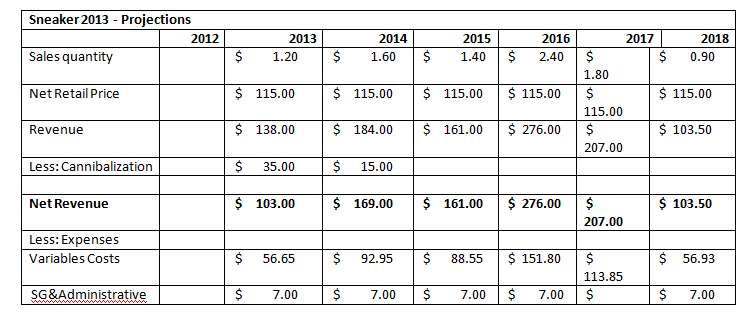

The Sneakers 2013 project has an initial cash outlay of $182 million at year 0 i.e. 2012. The project’s annual cash flows in 2013 are $9.50 million, $29.70 million in 2014, $37.27 million in 2015, $41.82 million in 2016, in 2017 its $46.37 million and its $143.68 million in 2018. (See Appendix 1).

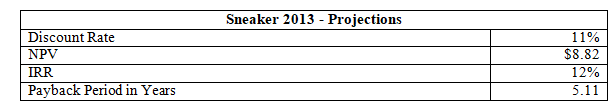

As per quantitative analysis; Sneaker’s 2013 project appears to be viable, because it generates positive NPV, i.e.$8.82 million net present value, as well as a greater internal rate of return than the cost of capital. The IRR is 12%.On the other hand, the cost of capital is 11%. The payback period of the project is 5.1 years, so the initial investment cost will be recovered in 5.1 years.

Additional Information

Question 1

The Sneaker’s 2013 project seems to be riskier as compared to the Persistence project, as its IRR is very low as compared to other projects, and the difference between the Sneakers’ IRR and cost of capital is very less. Further, the Sneakers’ 2013 project requires a high capital investment, regardless of which, it is generating a lower IRR and the payback period is also higher.

Question 2

In terms of NPV; the Sneakers’ 2013 project generates a higher NPV as compared to the Persistence project. In terms of IRR, the Persistence project is a better option as it generates a quite higher IRR of 22% as compared to an IRR of 12% in the Sneakers’ 2013 project. In terms of the payback period; it takes a longer period for the company to cover the initial cost over layin Sneakers’ 2013 project. So, the Persistence Project seems to be a better option taking under consideration the payback period’s perspective.

Question 3

From the capital budgeting perspective; NPV should be given a priority, and Sneakers’ 2013 project generates a higher NPV as compared to the Persistence project. So, to the New Balance Company is recommended to adopt the Sneakers 2013 Project.

Appendices

Appendix 1: Sneakers 2013 Project

Appendix 2: Persistence Project

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.