Small Stuff, Inc. Case Solution

Small Stuff, Inc.

To earn a little bit of money during your BA studies, you have decided to work as a part-time employee for Small Stuff Inc. The business model of this company is pretty simple: it produces and sells small stuff. Your work consists of assembling parts into finished stuff and selling it to fellow MBA students.

The financial reporting period is a work week (Monday-Friday). In other words, books are closed every Friday night. Because of industry practices, your salary is 50% of the profit generated by Thursday night of any given week, given that this profit is at least $15 (i.e., you receive no salary if your profit is below $15).

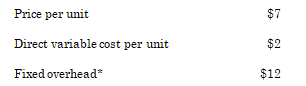

Your revenue and cost structure is as follows:

*Fixed overhead refers to the weekly rent of a small machine that has the capacity

to produce a maximum of 8 units of the stuff per week.

For the current week, your production & sales budget had been set at 4 units. On Thursday evening, you have already sold 6 units. That same evening, you meet with Small Stuff’s marketing manager and accountant to collect your salary.

Required:

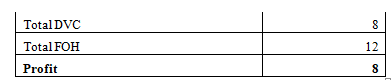

You compute the profit generated including the whole amount of fixed overhead (i.e., $12). You think: “Great – I’ll get a salary this week!”

- Calculate how much profit you think you have earned for Small Stuff until Thursday. (10 points)

To calculate the profit for units sold simply multiply the price per unit by the total unit sold to get the total selling price. Then multiply the variable cost per unit by the total units sold to get the total direct variable cost and total fixed overhead are includedin the calculations according to the given instruction. Profit is calculated by subtracting the total direct variable cost and total FOH from the total selling price.

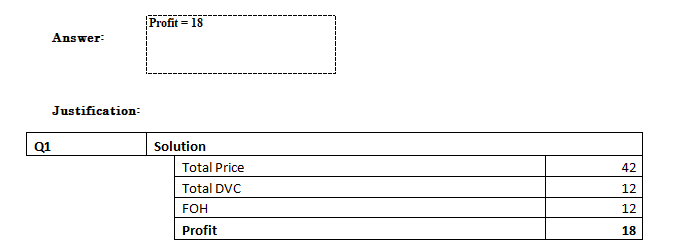

2. Calculate the break-even point (in terms of units during a given week). Apply the method that you have used in 1 (i.e., including the whole amount of fixed overhead in the profit computation). (5 points)

The Break-even point is calculated by using the formula of break-even point for units in which variable cost per unit subtracts from the sales price per unit then divide the results by the totalfixed overhead cost.

Break-even point in units = Fixed Cost / (Price per unit – Variable cost per unit)

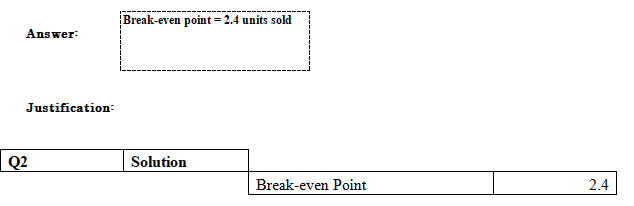

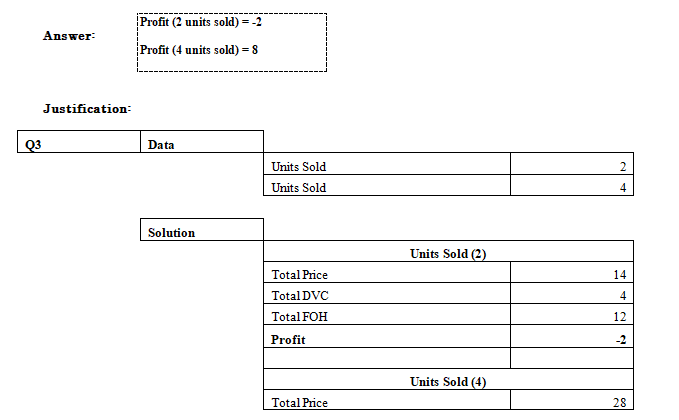

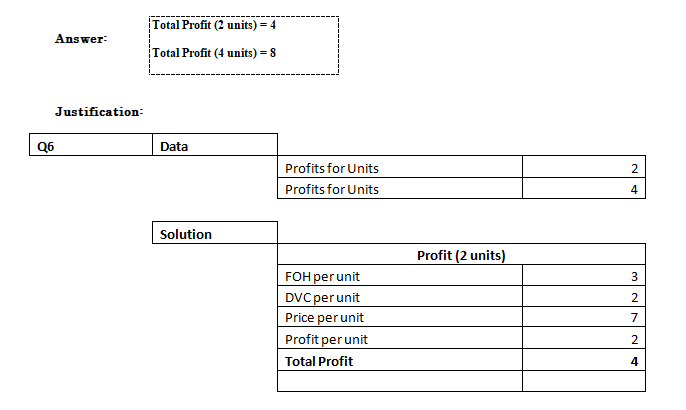

3. Also, calculate the profit that you would have earned if you had sold only 2 or only 4 units. Again, apply the method that you have used in 1.(10 points).

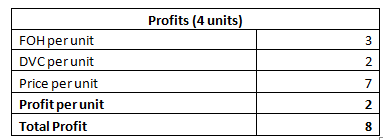

In this question, there are two scenarios for units sold (2 or 4) and to calculate the profit for both situations. It is simply calculated by using the same method from question 1. To calculate the profit for units sold simply multiply the price per unit by the total unit sold (2 or 4) to get the total selling price. Then multiply the variable cost per unit by the total units sold (2 or 4) to get the total direct variable cost and total fixed overhead are included in the calculations according to the given instruction. Profit is calculated by subtracting the total direct variable cost and total FOH from the total selling price.

The marketing manager reacts with disbelief that you have achieved exceeding your sales plan (the only person who has ever done so is him, and that was by only 1 unit!). Worse, the accountant does not agree with your profit calculation. According to his report, units are valued at their full cost and profits are just the sum of the profits per unit. Therefore, you have earned only $12 of profit.

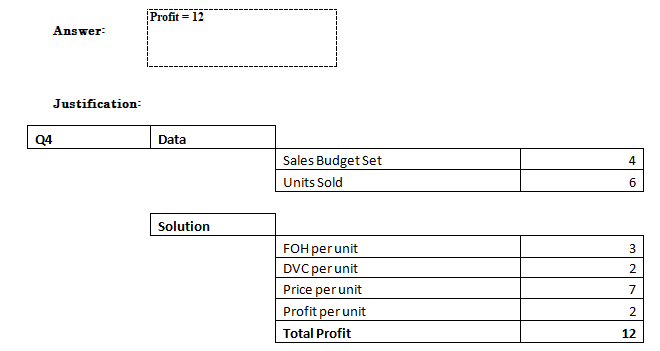

4. How can this be? Show how the accountant calculated this profit number of $12. (10 points)

The justification for this part is simple the accountant calculates the profit based onthe sales budget (4 units) and divides the Total FOH by the sales budget to get the FOH per unit then use the direct variable cost per unit and price per unit to get the profit per unit, which is about ($ 2). To get the total profit for (6) units sold multiply the profit per unit by the total units sold. This is the method used by the accountant to compute the profit based onthe set sales budget.

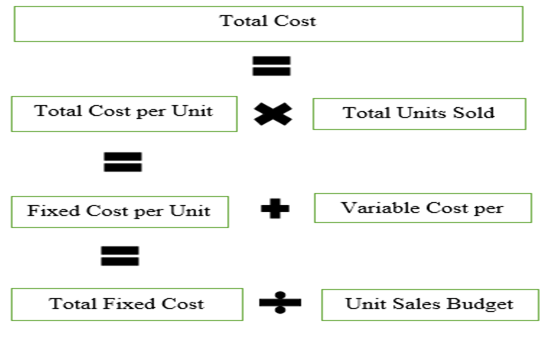

5. Draw a small diagram of the accountant’s cost system and compute the allocation rate. (5 points)

6. Use the process that you have identified in 5 to calculate the reported profits for 2 and 4 units, respectively. (10 points)

Again calculation for profit for the two scenarios of units sold (2 or 4) but this time used the module of accountant in which they divide the total FOH by the set sales budget. Then further calculation is the same as question 4. Calculate the profit based onthe sales budget (4 units) and divide the Total FOH by the sales budget to get the FOH per unit then use the direct variable cost per unit and price per unit to get the profit per unit for units sold (2 or 4).

The marketing manager smiles: “well, I suggest we tamper with the weekly budget and restate it to 6 units. That would surely help you get your salary!” You are not sure if this is a good suggestion – you suspect that he just cannot stand that you have replaced him as the company’s star performer. After all, if your actual performance of 6 units is compared to a budget of the same number, then it will look as if you had not outperformed your budget and his “historical” benchmark!

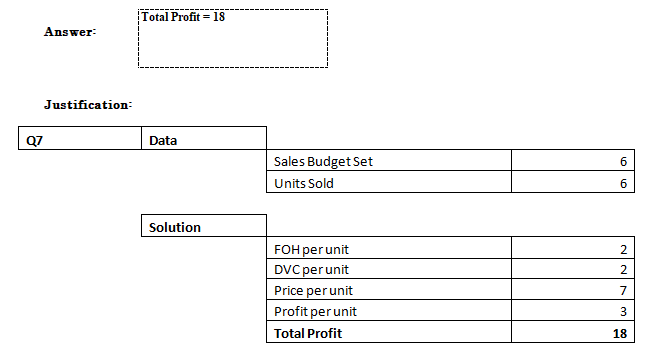

7. Calculate how much profit the accountant’s report would show if a budget of 6 units (instead of 4 units) was used to estimate fixed cost per unit. (10 points)

Now the sales budget is upgraded from units (4) to units (6). This new set sales budget for the units sold (6) concludes the total profit of ($18). Firstly calculate the FOH according to the sales budget and then use the direct variable cost per unit and price per unit.

8. Which general conclusion(s) do you draw from your answer to 7?(10 points)

The general conclusion drawn from the answer (7) and the calculation it presents is that increasing the sales budget is the right decision for small stuff Inc. because the machine used for production can produce (8 units) in a week. Increasing the sales budget ultimately increases the number of sales and it is helpful for the salesperson to generate profit.

9. What do you think about the compensation system? (10 points)

The compensation system in Small Stuff Inc. is considered to be unfair because it set that at least ($15) profit is necessary to get the salary and according to the accountant reports sales budget is (4) and based on this sales budget the total profit generated in a week is about ($12), which is again less than the need of profit from the salesperson. To make a fair compensation system Small Stuff Inc. has to decrease the profit need from ($15) to ($12) according to its sales budget. Otherwise, they need to increase the sales budget from (4 units) to (6 or 8) units because the machine can produce a maximum (of 8 units) in a week. This increased sales budget already shows the increasing profit in the previous part.

10. Based on what we saw in the last part of the second module, what is, in your opinion, a Balanced Scorecard? What would you use it for? (20 points)

A performance assessment method known as the balanced scorecard takes into account both nonfinancial and financial performance metrics. The balanced scorecard is an effective management tool for encouraging organizational performance when used in association with a compensation system. This tool evaluates the performance by mainly considering four aspects that incline financial perspective, customer perspective, business growth, and business operations perspective. In This case from a business growth and business operations perspective, the company had neither outperformed norunderperformed as the sales budget was set to 6 units and the sold units were also 6. But if the sales budget were kept at 4 units as in the first module it would have showcased a good performance of the company from business growth and business operations perspective. In the second module, because of the increase in the sales budget the performance of the company has been evaluated as low contrary to the previous sales budget of 4 units. But if the compensation process is considered and given that the company pays based on performance, the company should always use the second module in which it sets its sales budget as 6 units, so that all misconceptions are avoided and employees are compensated rightfully.........................

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.