Real Estate Case Analysis

Step: 1

Real estate development, often known as property development, is a business process that includes everything from renovating and re-leasing existing structures to buying raw ground and selling developed land or lots to others. Real estate developers are the individuals and businesses responsible for coordinating all of these processes and transforming concepts into tangible assets.

Although many developers supervise the construction process or engage in house building, real estate development is distinct from construction or house building.

Developers buy land, fund real estate transactions, build or have builders build projects, form joint venture projects, and conceive, imagine, control, and orchestrate the development process from start to finish.

In the building or renovation of real estate, developers normally take the biggest risks and get the biggest returns. Developers often buy a piece of land, decide how to market it, create a building program and design, secure the appropriate public approval and financing, construct the structures, rent them out, manage them, and eventually sell them.

Sometimes, only a portion of the procedure is completed by the developer. Some developers, for example, find a property and have the drawings and permits authorized before selling the land to a builder at a premium price. Alternatively, a developer who is also a builder may buy a property that already has the designs and permits in place, eliminating the danger of failing to secure planning approval and allowing them to begin work right away.

Architects, city planners, engineers, surveyors, inspectors, contractors, lawyers, leasing agents, and other professionals collaborate with developers at every stage of the project. The Town and Country Planning Act 1990 s55 defines 'development' in the context of Town and Country Planning in the United Kingdom.

The process of constructing new structures and modifying existing ones to raise the value of a property is known as real estate development (or property development). In general, this entails converting the land into commercial or residential structures, such as apartment complexes and multi-family residences, as well as restaurants, offices, and retail outlets. Developers oversee the project from beginning to end, including planning, designing, and financing the initiative as well as assembling a team to carry it out. The developer usually sells the property to a real estate investor once the project is completed. A real estate developer could sell individual houses straight to the consumer if the project is for individual residences.

Step: 2

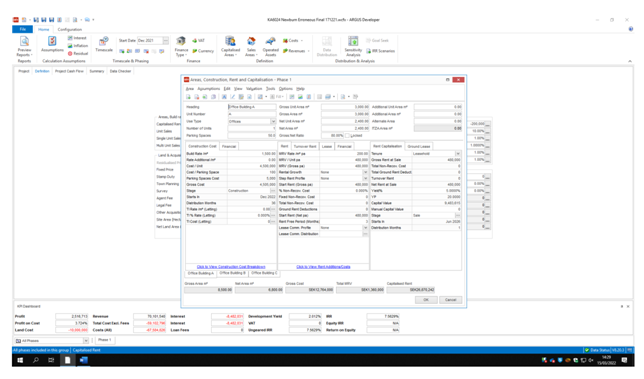

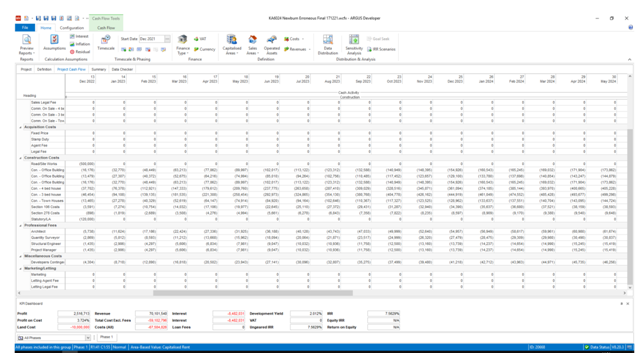

Testing and adjustment of quantum, density and mix of end uses to achieve the highest and best end-use and maximize viability/land price

Knowledge about the Real Estate Market

In the field of real estate development, assuming "If I build it, they will come" can be an expensive miscalculation. Developers should explore projects that address current market needs rather than attempting to invent one. Developers assess the trade area and a range of elements, including economic, educational, employment, and environmental aspects, to get a good feel on the market.

Project approvals and permits

Getting plan permission from the proper municipal office is one of the initial steps in the development process. Then there are permits for new construction, reconstruction, alteration, and repair, relocation to a new location, and the removal or demolition of any structure. Electrical, mechanical, HVAC, and plumbing systems require separate permits to install, extend, change, or repair.

While obtaining the necessary approvals and permits can be a simple procedure, there is always the possibility that it will take much longer than anticipated or that the approvals and permits will be denied. Developers should begin the permit and approval process early and interact efficiently with the local municipality's permit department to avoid hassles.

Step 3.

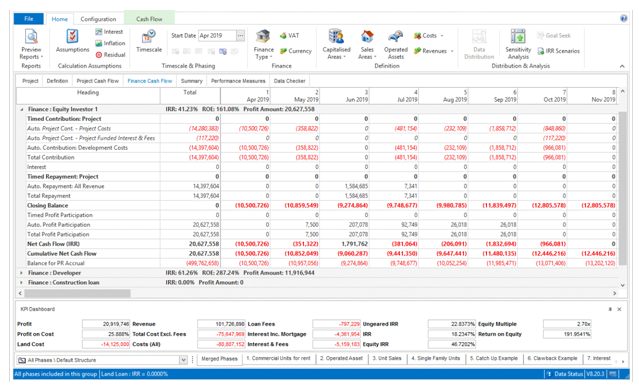

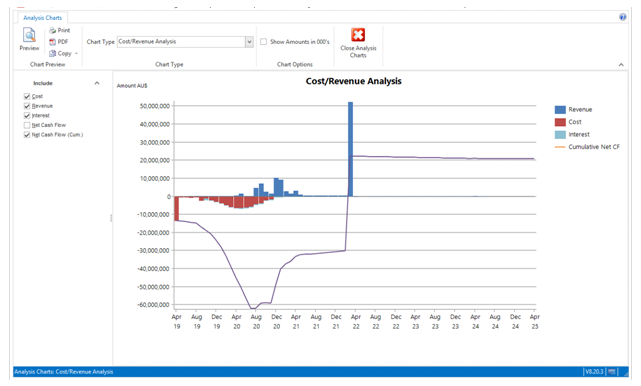

Explore sensitivity of major variables and present a summary of results to identify variables to which profit is most sensitive

Construction sites are inherently dangerous, and the risks must be identified and assessed. It is necessary to implement appropriate safety strategies and procedures. The fatal injury rate in the construction business is greater than the national average for all other industries, according to the Occupational Safety and Health Administration (OSHA). The following are the most prevalent injuries:

- Falling

- Slipping and tripping

- Excessive Noise

- Electrical Incident

- Burns

- Material handling

Contractors are accountable for worker safety, although the developer (who employs the contractor) is ultimately responsible.

Conditions on the job site can also cause project delays and increased construction costs. Weather, buried debris, unforeseen utilities, unanticipated rocks, higher-than-expected groundwater levels, and soil with insufficient bearing capability are all examples. These circumstances may trigger contract terms that transfer risk from the contractor to the developer.

The enormous diversity of regional geographic markets around the world might make it difficult to establish a clear and consistent picture of global property development patterns. The survey's findings, however, reveal a surprising amount of agreement among property developers about the market dynamics driving change, as well as a majority agreement on the key issues they face as a result. Despite a wide range of economic, financial, political, demographic, and technology-related variables, the survey results show that a major section of the industry is anticipating and responding to a variety of fast-changing industry challenges that offer possible business threats. However, how developers anticipate or respond to these difficulties varies greatly and is rather divisive.

Cost Overcome:

Contractors are accountable for worker safety, although the developer (who employs the contractor) is ultimately responsible.

Conditions on the job site can also cause project delays and increased construction costs. Weather, buried debris, unforeseen utilities, unanticipated rocks, higher-than-expected groundwater levels, and soil with insufficient bearing capability are all examples. These circumstances may trigger contract terms that transfer risk from the contractor to the developer. Despite a wide range of economic, financial, political, demographic, and technology-related variables, the survey results show that a major section of the industry is anticipating and responding to a variety of fast-changing industry challenges that offer possible business threats. However, how developers prepare or actively respond to these difficulties varies significantly and is polarizing, and it is not always based solely on pan-regional dynamics. There are also significant gaps in performance management and efficiency, as well as significant anxiety among industry executives regarding a number of emerging and possibly disruptive technologies. Furthermore, the majority of property developers are currently or preparing to finance development projects, which is undergoing a significant transition.

Emerging technology's impact on development

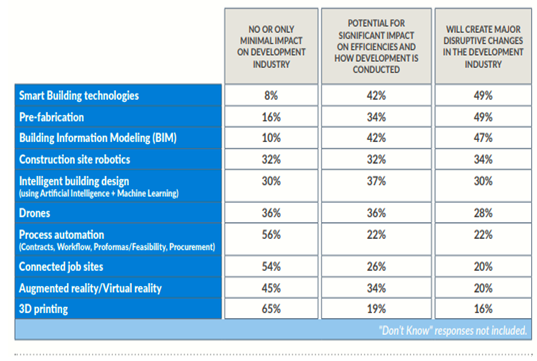

Property development will not be immune to the disruptive effects of new technologies, especially with the recent proliferation of PropTech (property industry technology) across the real estate industry. While 67 percent of respondents plan to or are already using advanced construction technologies, the survey results show that property development executives are concerned about the industry's potential impact from a number of emerging technologies that have already proven successful in other industries. The top three most disruptive technologies, according to poll respondents, have all been proved to assist innovative building design and construction processes, to varied degrees. This may place too much focus on what real estate development industries can "see now" as opposed to what they might be seeking for or expecting as disruptive, based on looking at regional outcomes.

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.