Pine Street Capital Case Solution

By shorting stocks, it can limit the risk in the portfolio. It also gives the opportunity to express the views on particular stocks. Similarly to buying a stock, shorting it is a way to express the opinion about a specific stock. And, when the market goes down, they can profit from that as well. The price of a stock may go down or go up, so hedging it will save money for them in the long run.

When choosing a stock to short, they should consider the potential for profits. A shorting stock can help the hedge the risk. By buying shares in companies that are improving, it can manage the risk and signal. It can also earn profit if the share price drops. If they are a savvy investor, they will benefit from short-selling stocks. However, it's important to make sure they understand how it works.

Shorting stocks can help to minimize the risk. By buying shares in companies that are improving, it can control the risk in the portfolio. By selling the shares in a stock that is declining, they can earn a profit. It can also use shorting stocks as a hedge against losses and avoid investing in companies that are losing their value. While shorting is similar to buying a stock, it does not mean that it should be concerned with the market's performance.

Disadvantages of using Shorting Stock

There are a few disadvantages of shorting a stock. First of all, the upside-to-downside ratio is skewed. If a stock goes down, they will make money. However, if a stock goes up, they will lose money. In that case, it would need to cover the position. This is not a good strategy. In addition, they may experience margin calls and interest charges. Secondly, short sellers are vulnerable to market manipulation, and if the price of a company drops, they may have to pay hefty penalties to halt the losses.

Moreover, it can only be effective when the stock price is rising. In a bear market, the opposite happens. During a bull market, the short seller is forced to pay the full value of the stock. This means that they will lose more than what they initially paid for it. Nonetheless, there are advantages to short selling stocks. Depending on the reasons for getting involved, they may want to short sell a stock.

There are other disadvantages. For example, the opportunity cost of having the cash tied up in maintenance margin is a real issue. Lastly, they will have to replace the stock they borrow. When a short sale ends, the profits will be lower than the actual price. In such a scenario, they will have to replace all of the stocks that they sold. So, they will be paying a high fee if the stock doesn't go up in the short period, but a low one will result in no fees at all.

There are several disadvantages to shorting stocks. The biggest is that they will need to pay commissions. They will also have to spend expenses. The shorting stock can be risky if they don't know how to trade it. If theyare not careful, they might not be able to get any profit at all. Therefore, they have to be very patient and learn about the risks.

In addition to limited upside, shorting stocks can limit the upside. This means that they will be stuck with a limited upside while the downside is unlimited. When they are shorting a stock, they risk the risk of being stuck with a stock that has no way to recover. The risk of losing the money is also limited, so they will need to pay a high fee.

Another disadvantage is the lack of liquidity. They will have to replace every 100 shares they sell. This can be a big problem when stock prices go down. But shorting a stock has many advantages, but it's not a good idea for everyone. For starters, they will have to pay commissions. Secondly, they will have to pay expenses to cover the shorted stocks.

Alternate Three (Hedging using Future Contracts)

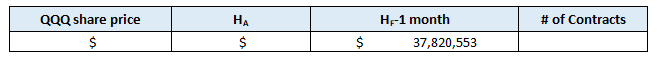

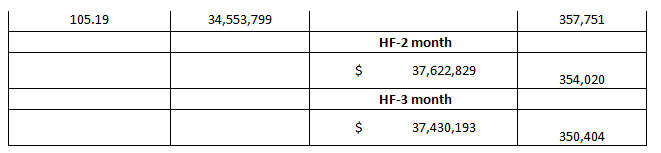

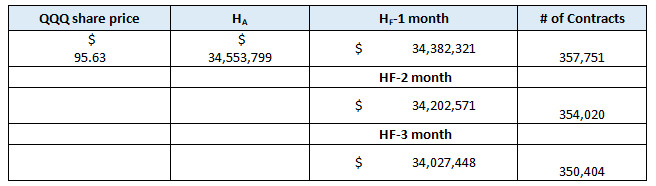

To achieve this, it assumes that the delta does not change when the QQQ stock price changes and that the futures contract applies to an index that does not pay dividends. Using futures contracts to create a neutral delta hedge is worse than selling stocks, but not as good as using a neutral delta and gamma hedge. Because futures contracts are quoted at market prices, their prices are adjusted daily. Holders of futures transactions realize gains or losses on futures positions at the end of each trading day. Thus, market-based pricing allows PSCs to apply the simplicity of short-term market jumps to hedge the simplicity of shorting against market risks, but without having to deal with huge potential losses, the market closes much higher on the trading day.

Advantages of using Future Contracts

The most obvious advantage of future contracts is the lower cost of trading. The margin required for each contract is usually 3% to 12%, which makes them less risky than other investments. Unlike stocks, the minimum size of a futures contract means that even a small investor can lose a lot of money. In addition, the minimum amount of money needed for a futures contract is generally much higher than that required for a stock.

The other advantage of futures contracts is their high liquidity. Because they are short-term, futures transactions are convenient for traders. While they may not be suited for investors, they can be beneficial for businesses that want to hedge their risks. The volatility of the futures market is high, but it is also low-risk, which means that they can lower the cost of doing business with them.

Aside from the low trading costs, futures contracts also lower the risk associated with investing in commodities. The downside to futures contracts is the high volatility, which can lead to massive losses for investors. This can make the futures market intimidating for small investors. However, the high volatility makes it easier to get into than the stock market, so even small investors can benefit from futures. This makes it more difficult to learn than the stock market, and therefore, is a good alternative for beginners.

The biggest advantage of futures contracts is that they have low trading charges compared to other types of investments. This is beneficial for traders and investors alike, because the risks associated with this form of trading are much lower than those of other types of investments. Because of the high volatility; there is a minimal margin requirement for futures transactions. This is the main reason why the underlying asset is more attractive to those who invest in it.................

Pine Street Capital Case Solution

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.