Nestle Case Study Solution

Along with it, high exit barriers due to intense capital investments in the industry encourage the rivals to fight for their survival and not to quit in the industry. In order to avoid heavy losses due to the exit from the industry, the rivals keep on changing their practices and focus on product development and packaging practices to ensure a long run survival in the industry.

One of the major factors of intense competitive rivalry in the industry is the easily available information about the products of various competitors.Food and Beverage industry deals in consumer goods, which are available at almost every retail store in the region. Customers have a deep knowledge about the products of almost every local brand. High availability of information about the brands increase the risk of consumer switching, resulting in intense competitive rivalry.(Staff, 2019)

Bargaining Power of Supplier

Determinants of bargaining power of supplier are similar to that of bargaining power or buyers. The only difference is that in this case it’s the firm in the industry is the buyer and the producers of raw material and input are the supplier. The important factor is the ease with which the firm can switch between the different suppliers of input and their relative bargaining power. Considering how vast the food and beverage industry is, there are many suppliers available to purchase from. Therefore the bargaining power of suppliers is low, especially in the countries which are economically backwards. Since suppliers are aware that big companies like nestle will bring them a lot of business, they therefore produce the raw materials as per the outlines given by the company.

Considering the revenues, Nestle is one of the largest food and Beverage Company of the world. It has the power the purchase goods from the supplier at lowest possible costs in order to increase their profits. Bargaining power of supplier is one of the main factors to be considered in any industry since the strength of the company depends on it. Over the time Nestle has developed strong relations with the buyer throughout the world due to the immense buying power it holds. In addition to this, Nestle also provides guidance to suppliers on how to work efficiently in order to decrease extra expenses. This in turn pays them off when there products are of top quality.

Raw materials in the food processing industry makes a huge difference, and nestle is well aware of this fact since majority of its products are made from agricultural and dairy raw materials. The fruits used for nestle juices and other products are of high quality and are purchased at good rate. Fruits collected from different are first examined by the international standard authority officers. The company goes great measures in order to retain their suppliers and maintain high standard in seeking quality.

Differentiation of input is low since there is not much difference in the raw material production. Fruits and milk produced elsewhere won’t be different to high extent. Due to supplier concentration, switching cost is low and presence of substitute inputs is high.(Porter, 2017)

Bargaining Power of Buyer

Bargaining power of the buyer in the food and beverage industry is high due to the presence of intense competition in the industry.Factors leading to the high bargaining power of the buyer include; low switching cost, low information complexity, Minor product differentiation and availability of numerous substitutes. Low switching cost increase the risk of consumer shift towards other competitive brands, forcing Nestle and other players in the industry to keep the prices as low as possible and introduce innovative products through high R&D spending to attract consumers.

Along with it, information regarding various products and brands is easily available to consumers due to availability of the products at almost each and every retail store.Low information complexity increases the chances of customer shift towards the competitor’s products, forcing players in the industry to introduce various customers value added services.

Products offered in the Food and Beverage industry are simpler products with minor product differentiation. Although Nestle has been successful to differentiate its products through its health and wellness feature, but the company still faces a huge competition in terms of taste, packaging, distribution etc. In order to avoid threat of low product differentiation, companies offer lower prices to their customers.

High threat of substitution is also one of the major factors of high bargaining power in the industry. Availability of large number of substitutes for most of the product categories of Nestle and its rivals tends to high bargaining power in the industry. The consumer can easily switch to the substitutes available in the market, forcing the companies along with Nestle to provide better quality products at reasonable prices.

Although there are numerous factors tending to high bargaining power of buyer, but there are various factors as well resisting the buyer power to be intense. These factors include; strong brand identity with high customer loyalty and low risk of customer shift, high buyer volume in the market and low buyer concentration due to high number of targeted customers.

Strategic Conclusions

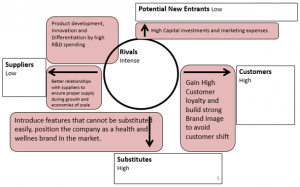

Strategic Conclusions regarding the five forces described above include various strategic initiatives that could be taken to accomplish strategic objectives in the presence of industrial forces. One of the major strategic objective of the company is to satisfy the needs of customers of all age groups, but the presence of high competitive rivalry and threat of substitution resist the company to accomplish the objective. Nestle can develop products which satisfy the needs of all the age groups and introduce new features in its products which cannot be substituted easily.

High threat of substitution and competitive rivalry can also be avoided by high product differentiation. Nestle should focus not only on health and wellness feature for its product differentiation, but it should also introduce various other product features to differentiate its products from competitors. Nestle can increase the taste of its products to attract more customers. It should change its packaging like the Unilever had done with its Sun silk Shampoo by introducing attractive packaging strategy, to attract more customers.

Another way to avoid the threat of substitution and competitive rivalry is to increase customer loyalty. Customer loyalty can be achieved by high customer value services. Nestle can introduce a membership card with special discounts, it should allow certain discounts at the point of sale, it should increase customer loyalty by targeting almost every customer group in the market. It should divide its customers into minor segments on various basis such as geographical location, age, income level, attitude etc. to evaluate the needs of its customers efficiently.

Nestle should spend more on its R&D sector to cope with the intense competitive rivalry and secure its rank in the long run. It should modify its current products and introduce new health and related tasty products to attract customers.

High bargaining power of the buyers can be pacified by increasing buyer’s loyalty and building a strong brand image. However in the presence of intense competition with giant players in the industry like Unilever, it would be quite challenging for Nestle to build its brand image. Nestle should take various strategic initiatives to increase its brand image among consumers. It should initiate various health related programs to show the extreme adherence of the company with the health and wellness of people. It should try to position its brand as a health and wellness brand in long rung to achieve the objective of high revenue growth.

Exhibits

Exhibit A: Nestle Porter’s Five Forces

| Potential New Entrants: LOW

· Economies of scale: HIGH · Product differences: LOW · Brand identity: HIGH · Switching costs: LOW · Capital requirements: HIGH |

· Access to distribution: HIGH · Absolute cost advantages: HIGH · Government policy: MODERATE · Expected retaliation: HIGH |

||

| Bargaining power Suppliers: LOW

· Differentiation of inputs: MODERATE · Switching cost: MODERATE · Input substitute: HIGH · Supplier concentration: HIGH · Input differentiation: LOW |

Competition in the Industry: HIGH

· Industry growth: HIGH · Switching costs: LOW · Informational complexity: HIGH · Diversity of competitors: LOW · Product differences: LOW · Brand identity: HIGH |

Bargaining power Customers: HIGH

· Buyer concentration: LOW · Buyer volume: HIGH · Buyer switching costs: LOW · Buyer information: HIGH · Substitute products: HIGH · Product difference: LOW · Brand identity: HIGH |

|

| Substitute Products / Services: HIGH

· Relative price performance of substitutes: HIGH · Switching cost: LOW · Buyer propensity to substitute: MODERATE |

|||

Exhibit B: Strategic Conclusions