G.G. Toys Case Study

Cost Accounting System

Introduction

G.G. Toys was a top high-quality manufacturer and supplier of dolls in U.S. G.G. Toys operated under two manufacturing plants- The Chicago Plant and The Springfield plant. G.G. Toys manufactured highly durable dolls and quickly became a well-known doll supplier which helped the company to gain major presence in the toy market. Various types of dolls were produced in Chicago Plant, whereas The other plant was used to assemble these dolls cradles. Both boys’ and girls’ dolls were designed under same procedure entailing some minor differences in the hair length and the body shape. Because of its increased demand, G.G. Toys increased its production line which yielded in eroded gross margins from 25% to 9%. Intense competition and retailers’ demand promoted G.G. Toys to provide customize production. G.G. Toys started customized product according to retailer’s specification which enabled the retailers to serve their local market with the desired stuff.

Problem Statement

Geoffrey doll product was G.G. Toys’ most popular and standard doll product. G.G. Toys’ president- Robert Parker had discussed the last operating results with his team. The production cost of Geoffrey doll product was increased and a rapid decline in the Geoffrey doll product was seemed. To cope up with this increasing production cost and declining margins, Robert Parker analyzed that the company should shift its product mix towards “specialty dolls”.

Situational Analysis

A detailed analysis has been performed in order to examine the G.G. Toys’ current situation with respect to its current cost system.

Question: 1

In the Chicago plant, the G.G. Toys is recommended to change its cost accounting procedure because its standards product’s production cost has been increased due to this system. ABC cost accounting is an effective system which will allocate only the respective product’s cost to each product based upon the machine and labor hours being used. Geoffrey doll product was G.G. Toys’ most popular and standard doll product. If G.G. Toys’ adopts this new system, the company will be able to increase its standard product’s profit margins up to 27% along with decreasing its production cost. Thus, its profit margin yielding increased returns. Additionally, as the intense competition and retailers’ demand promoted G.G. Toys to provide customize production, the number of sales of Specialty-Branded doll has been drastically increased.

Under the traditional accounting system, the system approach only a specific cost driver which is direct labor cost. This imposes overhead cost on the basis of total labor cost on each product with respect to the labor used despite of considering machine hours or other related production cost drivers. It is recommended to G.G. Toys’ that the company should adopt ABC accounting cost system because it will consider all the related cost drivers while allocating overhead cost on each product. This will determine the true picture of production price for each product. Additionally, this system entails high profit margin for its standard product. Each product types will require different amount of production runs, shipment, machine hours and setups. Geoffrey dolls requires less production runs, setups and related machine hours.

In the Springfield plant, the analysis represents that the profit margins will remain same in both type of accounting system. Additionally, this plant is more labor incentive and require all production procedure with hands. This unit produces only one product- The Cradles and it’s all related components had been purchased from local manufactures. Thus, it is recommended that the Springfield plant can go with the traditional accounting system because it is more labor centric, and the traditional system allocate its cost on the bases of labor cost.

Question: 2

Unit Cost Computation

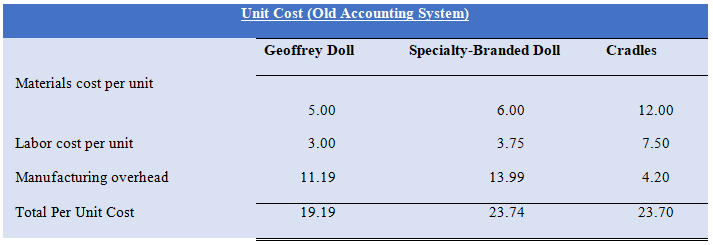

The cost of production comprises on three components- material, labor and overhead. In this case, G.G. Toys determine its overhead cost on the basis of production-run direct labor cost. The given table fully illustrate the per unit material, labor and overhead cost. Firstly, to determine the per unit overhead cost, total overhead cost has been divided with the total labor cost and then the resulted percentage has been used to allocate the overhead cost. Under the traditional accounting system, the per unit cost for Geoffrey doll was $19.19, for Specialty-Branded doll was $23.74 and the Cradles was $23.60.

Table 1

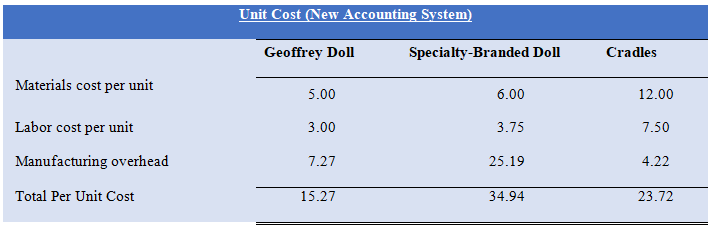

Under the new accounting system which was presented by the company after internal cost study, Geoffrey doll’s per unit cost is $15.27, for Specialty-Branded doll is $34.94 and for Cradles is $23.72. These new prices have been determined with the help of ABC costing accounting method in which all the cost drivers are used and evaluated while computing overhead cost. This could be seen that the price for cradles are same in both the accounting system because of labor incentive policy of Springfield plant. While the price for Geoffrey doll and Specialty-Branded doll has been changed with a significant margin(R Leupers, A Basu, P Marwedel, 1998). In addition to this, It could be seen that the price of Specialty-Branded doll has been understated in the traditional accounting system and the price of Geoffrey doll was overstated. Current valuation represents the better price allocation which is based on each product’s operation running capacity. Specialty-Branded doll requires more product’s customization and machine running cost along with number of changing setups. (See appendix 1)

Table 2

sample partial case solution. Please place the order on the website to order your own originally done case solution."}" data-sheets-userformat="{"2":14913,"3":{"1":0},"9":0,"12":0,"14":{"1":2,"2":3355443},"15":"Arial","16":10}">This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.