Estimating The Wacc Of Mylan Inc. Case Study Solution

| Yield to Maturity Calculations | |

| Number of Payments Yearly | 2 |

| Maturity Years | 5 |

| Total Number of Payments | 10 |

| Semiannual Coupon Payment | 1.575 |

| Coupon Payment | 3.15 |

| Coupon Rate | 3.15% |

| Semiannual Yield to Maturity | 1.40% |

| Current Price of the Bond | 101.63 |

| Face Value of the Bond | 100 |

| Yield to Maturity | 2.80% |

As it is known that the bond maturity is only for 5 years, so it is not as lengthier as I needed. In order to address this issue; I would like to add 3 % as a premium in the yield to maturity, in order to estimate the yield of the bond if itis issued by the company for 20 years.

So, the estimate for the cost of debt for the company would be 2.80 % + 3 % = 5.80 %

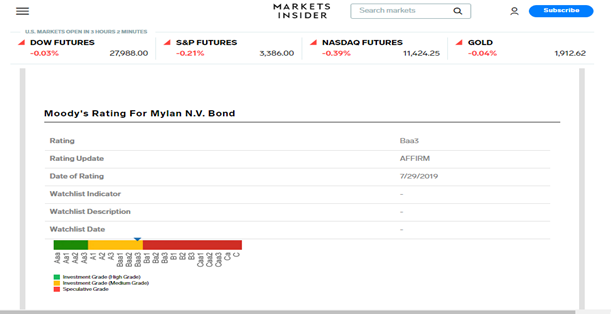

In addition to this, it has been found that the bond has rated Baa3 in the year 2019, and according to the corporate spread table; the Baa3 bonds lies under the spread of BB2 Industrial.

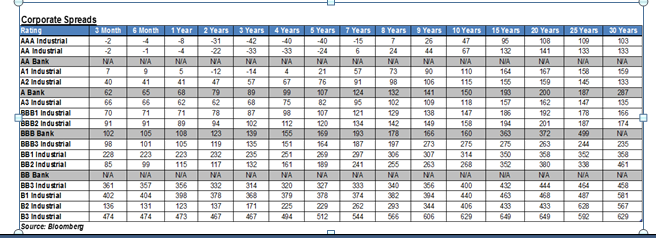

Industrial. In the following table, by looking at the 20 years’ column of BB2 Industrial; 380 is showing 380 basis points, which is equal to the 3.80 %.

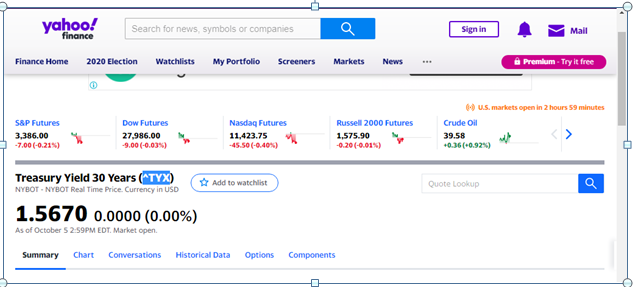

Now by using the second method to find out the cost of debt;I need to add 3.80 % premium in the 30 yearsrisk free rate of the US Treasury bond, which is 1.567 %. SO, the total cost of debt according to the second method will be: 3.8 % + 1.567 % = 5.367 %

The 30 years risk free rate of the US Treasury bond has been found by putting the symbol ^TYX in the search tab of the Yahoo finance site and then clicking for further proceed.

Now I have two estimates for cost of debt, which are: 5.80 % and 5.367 %. So, in this case I will take the average to choose the best estimate for the cost of debt, which is 5.584 %.

For the estimation of cost of equity; I have three options:

- First Option:Cost of debt + risk premium for equity.

- Second method: Dividend growth model.

- Third Option: CAPM.

In the first option, I will assign 6 % premium for the equity to the company, in order to find out the cost of equity. The reason to assign 6 % premium to the company is the higher percentage of debt against its equity.

So, the cost of equity in the first method would be: 5.584 % + 6 % = 11.584 %

By using the second option, firstly I have clicked the historical tab of the company in order to find out the company’s historical data.

After that, I have applied the filter “Dividends Only” to find out the historical data for the company’s dividends. Also, I have sorted the data from Oct, 05, 2015 to Oct, 05, 2020 (just for 5 years), but it has been found that the company has not paid any dividend from last 5 years, so the dividend growth model is not suitable for this company.

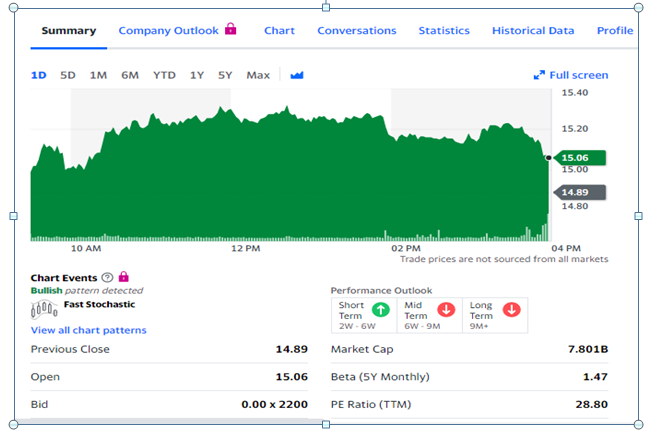

In the third option: capital asset pricing model; I need risk free rate, beta of the company and the market risk premium. From the above-mentioned image; the risk-free rate is 1.567 % and the following image shows the beta of the company as 1.47. And at last, the market risk premium is 5.7 % (as mentioned in the requirements section).

The company’s cost of equity, according to the capital asset pricing model, will be:

Ke = 1.567 % + 1.47 *5.7% = 9.946 %

Now I have two estimates for the cost of equity, which are: 11.584 % and 9.946 %. So, in this case I will take the average to choose the best estimate for the cost of equity, which is:10.77 %................

Estimating The Wacc Of Mylan Inc. Case Study Solution

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.