CSEM, CENTRE SUISSE D' ELECTRONIQUE ET DE MICROTECHNIQUE SA Case Solution

FINANCIAL ANALYSIS

CSEM wasn’t anymore just a non-profit organization, it had ventured into profit making businesses as well, which created substantial finances to further re-invest in their research activities. Twice a year board meeting was conducted where not only strategies but financial results were also discussed. The company wasn’t willing to pay dividends as it had already planned to reinvest their earnings in their research activities. The Board of Directors were from universities and representatives from industry shareholders.

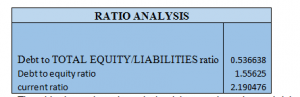

The corporation had different source of revenue generation. In 2000 their revenue amounted to $33.4 million. Most part of this revenue came from Government funds which was almost 30%. The next in line were the international clients who gave research and development projects to the company. This was 25% of the total revenue. The list of contributors continues in exhibit1. According to the estimates CSEM would be able to produce $72.41 million in revenue by the year 2005 if it continues to grow by 13% as expected because of success in spin off strategy. Exhibit 2 shows the calculation of estimated revenue for the year 2005. Other than this, when we analyze the balance sheet, in 2000 it was observed that total assets amounted as $46.4 million. This was well contributed by the minor investments in profit making subsidiaries. Exhibit 3 shows the balance sheet. After performing some of the ratio analysis it was seen that company’s total debt was more than 50% as compared to total debt and equity. This was because it was a non-profit organization and it had to get loans for its operations. The debt to equity ratio was again quite high at $1.5. This shows that for every dollar invested in equity they had $1.5 debt. For an investor’s point of view this is not a firm where someone would invest because its loans are higher than the equity, this creates dangers of bankruptcy for the firm. The current ratio shows that their short term assets were doubled as compared to their short term liabilities. In case if they had to pay off their short term debts they could do it quite easily. Though, they would need to further utilize their assets more efficiently. The ratios are given in exhibit4.

With the growing reputation, CSEM’s international clients were on a rise. Private sector customers were across the Europe and some of them from the US. The major chunk came from Swiss customers and the lease from the US. Exhibit 5 shows private customer contribution across the globe. The employees were increasing as 270 of them were in parent company and 350 were employed in for- profit companies.

ALTERNATIVES

Looking towards the future we can see a bright future for CSEM as it has established itself as a leader in micro technology production. There major focus has remained on European markets. The world trend is shifting and a potential market can be seen in Asian countries. China and Japan have shifted their gears and are now competing in technology with European countries and the US. Marketing their services and products to the eastern part of the World can do wonders for CSEM. With that, South Korean is also moving towards industrialization. If they can provide their product like optical sensory instruments and other Nano products, they will be among the first to capture that market. The Asian block is developing as an emerging market segment. CSEM has to keep an eye on their growth because a lot of small and medium sized enterprises are appearing on the surface. As CSEM basically gives its services to small and medium firms they will have the best opportunity to increase their world market share.

As, CSEM’s Chief Strategist; Thomas Hinder ling has a doctorate degree in biomedical engineering, he should just think to make products that are useful in the treatment of curing the cancer. They need to develop a product which can be a huge revolution in bio-engineering world. There aren’t many firms that are targeting this area of production. As CSEM specializes in nanotechnology they can make nanotechnology robots which can attack the cancer cells. This technology requires great expertise and no research corporation is better at the moment than CSEM is, to take this initiative. By this not only in Europe, But across the world their product will be of high demand. They still have to target the Asian market and Oceana region. By this new product they have great chance of having success.

Having experience in nuclear physics, CSEM is having another opportunity to provide their services to CERN, a nuclear research organization in Europe working on their hadron collider. Also as it’s located in Switzerland, it is easily accessible. CSEM will have to provide it advanced optical products which will make it easier for CERN to work on their Higgs Boson Particle. Their technological advancement in photo voltaic cells can help them become more energy efficient.

The other alternative is, to re-perform their research and development activities for the work they introduced CSEM which is the watchmaking industry. By using tremendous and innovative ideas with other successful ventures, CSEM has the ability to provide something new to the watchmaking industry. With the new innovation Swiss manufactures once again can have the same dominance that they used to have several years back.

RECOMMENDATIONS

CSEM was initially established to work on watchmaking art. The wanted to bring in new innovations and worked as a non-profit organization. Later they shifted their focus towards spinoffs and other small investments.

I would recommend CSEM to keep their focus on micro mechanical instruments and nanotechnology because the field has vast potential. The trend is shifting towards robotics and artificial intelligence and their corporation’s major products are Nano technological and Micro mechanical objects. Hence, they will have a lot more demand in coming future. Apart from this, they should be investing in small startups which are related to Nanotechnology and its related fields. By doing this they’ll be providing capital to an enterprise which is working on the same channel as that of CSEM plus, they’ll be getting financial rewards. Hiring most talented and committed new comers in bioengineering field has to be one of top priorities because the new generation can bring new ideas, they will take the corporation to the new heights.

If CSEM move out from the European market, they will witness a great potential in eastern part of the world. As the Asians countries are the new developing countries and might surpass the Europeans in technological race, so CSEM can work on marketing their products to Chinese or Japanese markets. Japanese are into robotic technology which can give a clear opportunity to CSEM for promoting the Nano products developed by CSEM engineers.

In the end, I would say that CSEM has been doing a very good job as they are one of the contributors to changing world of technology. They have become a source of innovation which is the need of time. They are making a mark for themselves and also CSEM is responsible of a value-added product being exported from Switzerland which is helping the Swiss economy a boost up.

EXIHIBIT

Exhibti1

| REVENUE CONTRIBUTORS 2000 | ||

| REVENUE | ||

| $39.30 | ||

| Contributors | ||

| Swiss federal government | 30% | $11.79 |

| International Clients | 25% | $9.83 |

| Other contributions | 11% | $4.32 |

| Contract production | 26% | $10.22 |

| Licensing services | 4% | $1.57 |

| Income from profit subsidiaries | 4% | $1.57 |

| TOTAL | 100% | $39.30 |

Exhbit1 shows the contributors to the revenue of CSEM.

Exhibit2

| Revenue | expected revenue(million) | ||||

| 2000 | 2001 | 2002 | 2003 | 2004 | 2005 |

| $39.30 | $44.41 | $50.18 | $56.71 | $64.08 | $72.41 |

The calculation is done on the basis of 13% expected annual revenue generation. After estimation it can be seen $72.41million revenue is generated in 2005.

Exhibti3

| CSEM BALANCE SHEET DEC2000 (CONSOLIDATED) | |||||||

| ASSETS | million | EQUITY/LIABILITIES | million | ||||

| CURRENT SSETS | SHORTTERM LIABILTIES | $ 10.5 | |||||

| Inventories | LONGTERM LIABILTIES | ||||||

| Receivables | Mortgage | ||||||

| Prepayments | Funds | ||||||

| CURRENT SSETS | $ 23.0 | LONGTERM LIABILTIES | $ 14.4 | ||||

| FIXED ASSETS | TOTAL LIABILTIES | $ 24.9 | |||||

| Building | SHAREHOLDERS EQUITY | $ 16.0 | |||||

| Equipment | MINORITY INV. | $ 5.5 | |||||

| Investments | |||||||

| FIXED ASSETS | $ 23.4 | ||||||

| TOTAL ASSETS | $ 46.4 | TOTAL EQUITY/LIABILITIES | $ 46.4 | ||||

The table above shows the total asset to be $46.4. Also total liabilities are greater than the shareholders’ equity.

Exhibti4