Business Idea Case Study Solution

Finance:

The company needs to know all the finances that are being invested in the play area initiative. For this they have made three groups; estimation, budgeting and accounting.

Estimation:

This group will do the market research and figure out the estimated cost on how much expenses will the company need to bear to launch the initiative. They will give a round off of the cost that will be incurred initially and the repetitive cost.

Budgeting:

This group will be responsible to create a budget. This will be based on the market research done by research analysts on how much market demand is estimated on the sales they can make according to it. They will also use the information provided by the estimation department. The budgeting team will budget the annual profits and analyze the success of the project in monetary terms.

Accounting:

The accounting team will keep a record of all the expenses that will be incurred in real, starting from the R&D to the maintenance and repair cost of the project. This group will report the profits and losses to the head of finance and try to keep the finances as per the budget created.

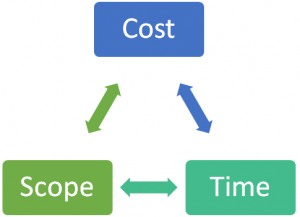

Scope-Time-Cost Objectives

Scope-time-cost is when the company needs to keep a balance in these three elements of the business. Scope are the tasks that need to be done in order to reach the goals of the company. These tasks are to be completed efficiently and effectively. Time is the specified time period in which the company should reach its desired goal and the project be completed and be working in full swing. The third is the cost, this needs to be in balance with the time and scope. Too much costs will result in the failure of the project. The company needs to balance the three elements as the increase or decrease in any of the element will affect the other two elements.

In this situation marketing, finance and product planning &designing depend on each other and the project depends on these elements. These elements will help the company to accomplish the scope-time-cost objective. All the market research, budgeting and financing inter depends and the project depends on them.

In order to gain the scope element the company needs to make the groups effective so all the tasks should be done efficiently. Another goal is to do everything on time, the company will define and specify the time limit on which they will demand the outcome. This will specify the time period of the project. Third is cost, this will mostly depend on the finance department but designers and research analysts will also keep a budget in mind while formulating their work because they need to make the project feasible and successful.

Obstacles and impediments:

The company is launching a unique idea which has never been implemented before. The chances of failure can be kept in perspective while launching the initiative. The costs are all estimated and budgeted, the real costs can differ from the budgeted costs. If the costs are higher, then Scope and Time will be effected as they are interlinked with the cost(Westland , 2018).

Secondly, the company cannot be sure about the revenue generation and the growth rate as they are the estimations done on the basis of the research done by the market research team, the results can be different than the budgeted amount.

Risk Mitigation

Risk mitigation are the steps taken to reduce the risk as much as possible. There are four types of steps in risk mitigation. These are; risk acceptance, risk avoidance, risk limitation and risk transferee (Herrera, 2013).

Risk acceptance is when the company assess the risk and the cost of risk is lower than the cost of elimination of the risk. The company decides to take the risk rather than eliminating it. Risk avoidance is when the company avoids risk at any cost as they believe that the company shouldn’t have any risk at any cost. Risk limitation is when the company faces risk in a very limited amount, they try to minimize it. The last is risk transferee this is when the company outsources some of its risky operations to a third party to work on their behalf.

In this case the company is trying to minimize the risk by evaluating the project and calculating the budgeted NPV to know the success of the business. They are following the risk limitation strategy as they want to lower the risk as much as possible to make higher profits by increasing revenue. Controlling the costs and researching about the need of the product will make the project successful. To keep the project going and generating profits out of it, it’s important for them to keep a quality assurance check and maintain the play area. This will make the project successful and keep the risks at minimum.

Exhibit 1:

| Budgeting (million) | ||||||

| Initial Investment | 1st Year | 2nd Year | 3rd Year | 4th Year | 5th Year | |

| Estimated Growth % | 15% | 12% | 12% | 10% | ||

| Sales | 1000 | 1150 | 1288 | 1443 | 1587 | |

| Operating cost: | ||||||

| Utilities | 50 | 50 | 50 | 50 | 50 | |

| Repair Cost | 20 | 20 | 20 | 20 | 20 | |

| Insurance | 20 | 20 | 20 | 20 | 20 | |

| Maintenance | 40 | 40 | 40 | 40 | 40 | |

| Depreciation (10% straight-line) | 50 | 50 | 50 | 50 | 50 | |

| Salaries | 300 | 300 | 300 | 300 | 300 | |

| EBIT | 520 | 670 | 808 | 963 | 1107 | |

| Tax (10%) | 52 | 67 | 81 | 96 | 111 | |

| EAT | 468 | 603 | 727 | 866 | 996 | |

| Marketing Cost | 50 | |||||

| Equipment Cost | 500 | |||||

| Planning and Production Costs | 100 | |||||

| Free Cash Flow | -650 | 518 | 653 | 777 | 916 | 1046 |

| WACC (Assumed) | 10% | |||||

| DCF | $2,870 | |||||

| NPV | $2,220 | |||||

Exhibit 2:

Exhibit 3:

Exhibit 4:

This is just a sample partical work. Please place the order on the website to get your own originally done case solution