Arundel Partners: The Sequel Project Case Study Solution

Black-Scholes Valuation

According to the estimates, the average hypothetical net inflow is amounting $21.7 million, which would be considered the value of our asset. Moreover, Average Hypothetical Negative Cost of Sequel has been hypothetical, estimated at $21.15 million, which will be our strike price. Furthermore, when the film gets hit; it takes a gap of two years from the initial year to start the production. Then from the third year the production will start and in the fourth year the sequel will be released so it will take a total of four years to get to know the result of sequel. The discount rate of 12% has been used to discount the average hypothetical net inflow. The risk free rate has been taken of year 1992 which was 7.02% (macrotrends).

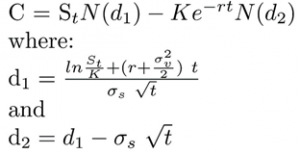

Exhibit 2 shows all the assumptions for the Black-Scholes Model. After putting in all of the values, the Black-Scholes Model has given us the valuation of $48.38 million. Exhibit 3 shows the formula and calculation for Black-Scholes Model.

Why doesn’t the DCF valuation work? What are the limitations of using the Black Scholes model?

DCF Valuation limitations

With the changes in the revenues for the upcoming years, the chances of further volatility will increase. With the growing uncertainty with the future cash flows, it will be difficult to apply the DCF valuation with the increased volatility. Another point to be considered would be the change in the discount rate, which would automatically tinker the DCF valuation; hence making it inaccurate. (Stephen)

Black-Scholes Limitations

The model assumes risk-free rate and volatility to be constant over the period of time. Due to this deficiency, the call price would change with slight fluctuation in volatility. With greater fluctuation in expected revenues generated over the period of time, there would be more variations swings in options valuations. To combat the threat imposed by the limitations, the expected revenues should be forecasted with larger accuracy. Otherwise, Black-Sholes model wouldn’t be reliable. (SETH)

If the deal is signed, what are some of the contractual terms that Arundel Partners should agree upon with the Studio to ensure fairness of outcomes?

Film actors and movie directors are the major part of a movie. They are the ones that drive a movie onto the path of success. As the venture has its own risks, initially, the company should make sure that the sequel is of high quality, so for that it has to make provision to include the best actors, directors and even cameramen. In order to satisfy the other party or studio, Arundel should share a slight percentage of amount from the revenues so that the studio’s interest stays intact for further sequels.

Exhibits

Exhibit 1

| cash outflow | in millions of dollars |

| Distribution fees | -12.86 |

| Distribution expense | -14.49 |

| Negative cost | -21.15 |

| -48.51 | |

| Revenue | |

| US Theatres | 10.42 |

| Other | 37.97 |

| total revenues | 48.39 |

| discount rate | 12% |

| NPV | $ -9.92 |

Exhibit 2

| Assumptions | US(million) |

| Avg. Hypothetical Net Inflow of Sequel | 21.568 |

| Avg Hypothetical Negative Cost of Sequel | 21.154 |

| period | 4.000 |

| WACC (based on 6% semiannual discount rate) | 0.120 |

| Avg. Hypothetical Net Inflow of Sequel (discounted to Year 0) | 13.707 |

| ∆T | 0.083 |

| σ | 1.210 |

| exp(σ√∆T) | 1.418 |

| U (continuously compounded returns in up step in binomial tree) | 1.418 |

| D (down step in binomial tree) | 0.705 |

| risk-free rate (based on 10 yr US Treasury rate in 1992) | 0.070 |

| exp(r∆T) | 1.006 |

| q (risk-neutral probability of up move, using Lognormal model) | 0.422 |

| Avg Hypothetical Negative Cost of Sequel (discounted to Year 2) | 18.473 |

Exhibit 3

| USD (million) | |

| d1 | $ 0.23 |

| d2 | $ (0.12) |

| Call Price | $ 48.38 |

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.