A Student's Dilemma: Rent or Buy The case solution

Sensitivity Analysis

We performed the sensitivity analysis based on the four parameters as given below in the table (see appendix:3), to see the impact of change in any of these parameters on NPV if they deviate from initial assumptions.

In the worst-case scenario, if the house price appreciates by 0% instead of 2%, in that case, NPV will be $5,467.27, not $14,172.63, so NPV will decrease by 59%. house price appreciation parameter has a huge impact on NPV, only a 2% decrease in appreciation rate, decreases NPV by 59%.

If the monthly rent is charged $435 instead of $475 the NPV will be $8,495.77 instead of $14,172.63. the 8.42% decrease in rent decreases NPV by 40.06%. if maintenance is $10,000 in the worst-case scenario the NPV will be $10,230.37 instead of $14,172.63. and if the mortgage rate increases to then 5% the NPV will be $10,135.56. The same happens when we change one by each parameter that affects the NPV in base get we get change in NPV. the NPV is more sensitive to the house pricing appreciation rate and least sensitive to the maintenance cost (see appendix:4).

we also built an amortization table to see the impact of mortgage rate on monthly mortgage payments, and interest expenses. if the worst situation occurs Scott has to 5% mortgage rate instead of 3.95% in that case the amount of the monthly installment will increase from $1003.95 to $1117.74, in base case scenario in which we assumed a mortgage rate of 3% instead of 3.95% the mortgage monthly payments decrease from $14,172.63 to $906.69 (see appendix 5&6).

Risk factors and other considerations

There are so many risk factors that must be considered before buying a house. the risk factors can be house pricing depreciation, increase in the mortgage rate more than we assumed in the worst-case scenario, for suppose the price of house depreciates by 5% due to the economic crises, in that case, Scott can face negative ($15,536.07) NPV, this loss is greater than in gain in initially assumed situation. even in 2% house price depreciation, the NPV will be decreased to (-$3,064.37), in buy-inclusive option. so, she could face problems while selling house after 3 years due to the economic downsize, in that case, she must wait some time until and unless the economy recovers and then sell, or she must include certain terms and conditions in the agreement that can save her from losses in such situations.

Christine Scott would be able to handle all these works if she works properly by making an applicable plan. as she is providing some discount to her friends in rental charges in return for the contract, she can also assign some responsibility to her friends related to the maintenance of the house, etc.

Conclusion:

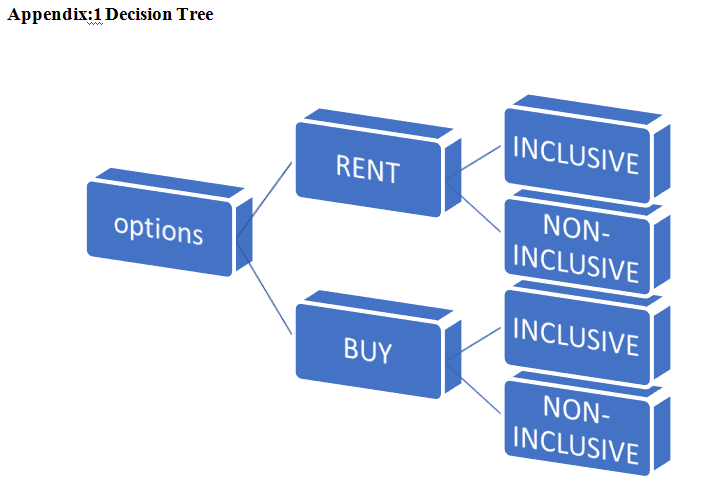

Each option offers some risk and returns, as we would recommend Christine Scott to buy the house and rent it to four other friends with an inclusive option. If Scott will earn profit equals the NPV of $14,172.63. while performing sensitivity analysis e come to conclude that in even the worst scenario the NPV is positive and above $5000, Moreover, the base case scenario could give the highest NPV $27,556.41. but with this can gain the number of risks associated such as the risk of loss if house price depreciates, mortgage rate increases, or maintenance expense increases. it shows that in any case buy an inclusive option will provide a positive NPV.

| Maintenance |

$14,172 Appendix:2 NPV of all available options.

Appendix:3 Sensitivity Analysis-Parameters

Appendix:4 Sensitivity Analysis-Results

.63 |

$10,230.37 | $16,143.76 | ||||||||||||||||||||||||||||||||||||||||||

| Mortgage Interest Rate | $14,172.63 | $10,135.56 | $17,623.48 |

Appendix:5Amortization table-worst case scenario.

| Month | Mortgage PMT | Interest | Principal Repayment | Ending Balance |

| 1 | 1117.74 | $796.67 | $321.07 | $190,878.93 |

| 2 | 1117.74 | $795.33 | $322.41 | $190,556.52 |

| 3 | 1117.74 | $793.99 | $323.75 | $190,232.77 |

| 4 | 1117.74 | $792.64 | $325.10 | $189,907.67 |

| 5 | 1117.74 | $791.28 | $326.45 | $189,581.22 |

| 6 | 1117.74 | $789.92 | $327.81 | $189,253.40 |

| 7 | 1117.74 | $788.56 | $329.18 | $188,924.22 |

| 8 | 1117.74 | $787.18 | $330.55 | $188,593.67 |

| 9 | 1117.74 | $785.81 | $331.93 | $188,261.74 |

| 10 | 1117.74 | $784.42 | $333.31 | $187,928.43 |

| 11 | 1117.74 | $783.04 | $334.70 | $187,593.73 |

| 12 | 1117.74 | $781.64 | $336.10 | $187,257.63 |

| 13 | 1117.74 | $780.24 | $337.50 | $186,920.14 |

| 14 | 1117.74 | $778.83 | $338.90 | $186,581.24 |

| 15 | 1117.74 | $777.42 | $340.31 | $186,240.92 |

| 16 | 1117.74 | $776.00 | $341.73 | $185,899.19 |

| 17 | 1117.74 | $774.58 | $343.16 | $185,556.03 |

| 18 | 1117.74 | $773.15 | $344.59 | $185,211.45 |

| 19 | 1117.74 | $771.71 | $346.02 | $184,865.43 |

| 20 | 1117.74 | $770.27 | $347.46 | $184,517.96 |

| 21 | 1117.74 | $768.82 | $348.91 | $184,169.05 |

| 22 | 1117.74 | $767.37 | $350.37 | $183,818.69 |

| 23 | 1117.74 | $765.91 | $351.82 | $183,466.86 |

| 24 | 1117.74 | $764.45 | $353.29 | $183,113.57 |

| 25 | 1117.74 | $762.97 | $354.76 | $182,758.81 |

| 26 | 1117.74 | $761.50 | $356.24 | $182,402.57 |

| 27 | 1117.74 | $760.01 | $357.73 | $182,044.84 |

| 28 | 1117.74 | $758.52 | $359.22 | $181,685.62 |

| 29 | 1117.74 | $757.02 | $360.71 | $181,324.91 |

| 30 | 1117.74 | $755.52 | $362.22 | $180,962.70 |

| 31 | 1117.74 | $754.01 | $363.72 | $180,598.97 |

| 32 | 1117.74 | $752.50 | $365.24 | $180,233.73 |

| 33 | 1117.74 | $750.97 | $366.76 | $179,866.97 |

| 34 | 1117.74 | $749.45 | $368.29 | $179,498.68 |

| 35 | 1117.74 | $747.91 | $369.83 | $179,128.85 |

| 36 | 1117.74 | $746.37 | $371.37 | $178,757.49 |

| 37 | 1117.74 | $744.82 | $372.91 | $178,384.57 |

| 38 | 1117.74 | $743.27 | $374.47 | $178,010.11 |

| 39 | 1117.74 | $741.71 | $376.03 | $177,634.08 |

| 40 | 1117.74 | $740.14 | $377.59 | $177,256.48 |

| 41 | 1117.74 | $738.57 | $379.17 | $176,877.32 |

| 42 | 1117.74 | $736.99 | $380.75 | $176,496.57 |

| 43 | 1117.74 | $735.40 | $382.33 | $176,114.24 |

| 44 | 1117.74 | $733.81 | $383.93 | $175,730.31 |

| 45 | 1117.74 | $732.21 | $385.53 | $175,344.78 |

| 46 | 1117.74 | $730.60 | $387.13 | $174,957.65 |

| 47 | 1117.74 | $728.99 | $388.75 | $174,568.90 |

| 48 | 1117.74 | $727.37 | $390.37 | $174,178.54 |

| 49 | 1117.74 | $725.74 | $391.99 | $173,786.55 |

| 50 | 1117.74 | $724.11 | $393.63 | $173,392.92 |

| 51 | 1117.74 | $722.47 | $395.27 | $172,997.65 |

| 52 | 1117.74 | $720.82 | $396.91 | $172,600.74 |

| 53 | 1117.74 | $719.17 | $398.57 | $172,202.18 |

| 54 | 1117.74 | $717.51 | $400.23 | $171,801.95 |

| 55 | 1117.74 | $715.84 | $401.89 | $171,400.05 |

| 56 | 1117.74 | $714.17 | $403.57 | $170,996.48 |

| 57 | 1117.74 | $712.49 | $405.25 | $170,591.23 |

| 58 | 1117.74 | $710.80 | $406.94 | $170,184.29 |

| 59 | 1117.74 | $709.10 | $408.63 | $169,775.66 |

| 60 | 1117.74 | $707.40 | $410.34 | $169,365.32 |

| 61 | 1117.74 | $705.69 | $412.05 | $168,953.27 |

| 62 | 1117.74 | $703.97 | $413.76 | $168,539.51 |

| 63 | 1117.74 | $702.25 | $415.49 | $168,124.02 |

| 64 | 1117.74 | $700.52 | $417.22 | $167,706.80 |

| 65 | 1117.74 | $698.78 | $418.96 | $167,287.84 |

| 66 | 1117.74 | $697.03 | $420.70 | $166,867.14 |

| 67 | 1117.74 | $695.28 | $422.46 | $166,444.68 |

| 68 | 1117.74 | $693.52 | $424.22 | $166,020.47 |

| 69 | 1117.74 | $691.75 | $425.98 | $165,594.48 |

| 70 | 1117.74 | $689.98 | $427.76 | $165,166.72 |

| 71 | 1117.74 | $688.19 | $429.54 | $164,737.18 |

| 72 | 1117.74 | $686.40 | $431.33 | $164,305.85 |

| 73 | 1117.74 | $684.61 | $433.13 | $163,872.72 |

| 74 | 1117.74 | $682.80 | $434.93 | $163,437.79 |

| 75 | 1117.74 | $680.99 | $436.75 | $163,001.05 |

| 76 | 1117.74 | $679.17 | $438.57 | $162,562.48 |

| 77 | 1117.74 | $677.34 | $440.39 | $162,122.09 |

| 78 | 1117.74 | $675.51 | $442.23 | $161,679.86 |

| 79 | 1117.74 | $673.67 | $444.07 | $161,235.79 |

| 80 | 1117.74 | $671.82 | $445.92 | $160,789.87 |

| 81 | 1117.74 | $669.96 | $447.78 | $160,342.09 |

| 82 | 1117.74 | $668.09 | $449.64 | $159,892.45 |

| 83 | 1117.74 | $666.22 | $451.52 | $159,440.93 |

| 84 | 1117.74 | $664.34 | $453.40 | $158,987.53 |

| 85 | 1117.74 | $662.45 | $455.29 | $158,532.24 |

| 86 | 1117.74 | $660.55 | $457.19 | $158,075.06 |

| 87 | 1117.74 | $658.65 | $459.09 | $157,615.97 |

| 88 | 1117.74 | $656.73 | $461.00 | $157,154.96 |

| 89 | 1117.74 | $654.81 | $462.92 | $156,692.04 |

| 90 | 1117.74 | $652.88 | $464.85 | $156,227.19 |

| 91 | 1117.74 | $650.95 | $466.79 | $155,760.40 |

| 92 | 1117.74 | $649.00 | $468.73 | $155,291.66 |

| 93 | 1117.74 | $647.05 | $470.69 | $154,820.98 |

| 94 | 1117.74 | $645.09 | $472.65 | $154,348.33 |

| 95 | 1117.74 | $643.12 | $474.62 | $153,873.71 |

| 96 | 1117.74 | $641.14 | $476.60 | $153,397.11 |

| 97 | 1117.74 | $639.15 | $478.58 | $152,918.53 |

| 98 | 1117.74 | $637.16 | $480.58 | $152,437.96 |

| 99 | 1117.74 | $635.16 | $482.58 | $151,955.38 |

| 100 | 1117.74 | $633.15 | $484.59 | $151,470.79 |

| 101 | 1117.74 | $631.13 | $486.61 | $150,984.18 |

| 102 | 1117.74 | $629.10 | $488.64 | $150,495.55 |

| 103 | 1117.74 | $627.06 | $490.67 | $150,004.87 |

| 104 | 1117.74 | $625.02 | $492.72 | $149,512.16 |

| 105 | 1117.74 | $622.97 | $494.77 | $149,017.39 |

| 106 | 1117.74 | $620.91 | $496.83 | $148,520.56 |

| 107 | 1117.74 | $618.84 | $498.90 | $148,021.66 |

| 108 | 1117.74 | $616.76 | $500.98 | $147,520.68 |

| 109 | 1117.74 | $614.67 | $503.07 | $147,017.61 |

| 110 | 1117.74 | $612.57 | $505.16 | $146,512.45 |

| 111 | 1117.74 | $610.47 | $507.27 | $146,005.18 |

| 112 | 1117.74 | $608.35 | $509.38 | $145,495.80 |

| 113 | 1117.74 | $606.23 | $511.50 | $144,984.30 |

| 114 | 1117.74 | $604.10 | $513.63 | $144,470.66 |

| 115 | 1117.74 | $601.96 | $515.78 | $143,954.89 |

| 116 | 1117.74 | $599.81 | $517.92 | $143,436.96 |

| 117 | 1117.74 | $597.65 | $520.08 | $142,916.88 |

| 118 | 1117.74 | $595.49 | $522.25 | $142,394.63 |

| 119 | 1117.74 | $593.31 | $524.43 | $141,870.21 |

| 120 | 1117.74 | $591.13 | $526.61 | $141,343.60 |

| 121 | 1117.74 | $588.93 | $528.80 | $140,814.79 |

| 122 | 1117.74 | $586.73 | $531.01 | $140,283.78 |

| 123 | 1117.74 | $584.52 | $533.22 | $139,750.56 |

| 124 | 1117.74 | $582.29 | $535.44 | $139,215.12 |

| 125 | 1117.74 | $580.06 | $537.67 | $138,677.45 |

| 126 | 1117.74 | $577.82 | $539.91 | $138,137.54 |

| 127 | 1117.74 | $575.57 | $542.16 | $137,595.37 |

| 128 | 1117.74 | $573.31 | $544.42 | $137,050.95 |

| 129 | 1117.74 | $571.05 | $546.69 | $136,504.26 |

| 130 | 1117.74 | $568.77 | $548.97 | $135,955.29 |

| 131 | 1117.74 | $566.48 | $551.26 | $135,404.04 |

| 132 | 1117.74 | $564.18 | $553.55 | $134,850.48 |

| 133 | 1117.74 | $561.88 | $555.86 | $134,294.62 |

| 134 | 1117.74 | $559.56 | $558.18 | $133,736.45 |

| 135 | 1117.74 | $557.24 | $560.50 | $133,175.95 |

| 136 | 1117.74 | $554.90 | $562.84 | $132,613.11 |

| 137 | 1117.74 | $552.55 | $565.18 | $132,047.93 |

| 138 | 1117.74 | $550.20 | $567.54 | $131,480.39 |

| 139 | 1117.74 | $547.83 | $569.90 | $130,910.49 |

| 140 | 1117.74 | $545.46 | $572.28 | $130,338.22 |

| 141 | 1117.74 | $543.08 | $574.66 | $129,763.56 |

| 142 | 1117.74 | $540.68 | $577.05 | $129,186.50 |

| 143 | 1117.74 | $538.28 | $579.46 | $128,607.04 |

| 144 | 1117.74 | $535.86 | $581.87 | $128,025.17 |

| 145 | 1117.74 | $533.44 | $584.30 | $127,440.87 |

| 146 | 1117.74 | $531.00 | $586.73 | $126,854.14 |

| 147 | 1117.74 | $528.56 | $589.18 | $126,264.96 |

| 148 | 1117.74 | $526.10 | $591.63 | $125,673.33 |

| 149 | 1117.74 | $523.64 | $594.10 | $125,079.23 |

| 150 | 1117.74 | $521.16 | $596.57 | $124,482.66 |

| 151 | 1117.74 | $518.68 | $599.06 | $123,883.60 |

| 152 | 1117.74 | $516.18 | $601.55 | $123,282.05 |

| 153 | 1117.74 | $513.68 | $604.06 | $122,677.99 |

| 154 | 1117.74 | $511.16 | $606.58 | $122,071.41 |

| 155 | 1117.74 | $508.63 | $609.11 | $121,462.30 |

| 156 | 1117.74 | $506.09 | $611.64 | $120,850.66 |

| 157 | 1117.74 | $503.54 | $614.19 | $120,236.47 |

| 158 | 1117.74 | $500.99 | $616.75 | $119,619.72 |

| 159 | 1117.74 | $498.42 | $619.32 | $119,000.40 |

| 160 | 1117.74 | $495.83 | $621.90 | $118,378.49 |

| 161 | 1117.74 | $493.24 | $624.49 | $117,754.00 |

| 162 | 1117.74 | $490.64 | $627.09 | $117,126.91 |

| 163 | 1117.74 | $488.03 | $629.71 | $116,497.20 |

| 164 | 1117.74 | $485.41 | $632.33 | $115,864.87 |

| 165 | 1117.74 | $482.77 | $634.97 | $115,229.90 |

| 166 | 1117.74 | $480.12 | $637.61 | $114,592.29 |

...............................

A Student’s Dilemma Rent or Buy The case solution

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.