Web Tracker

Introduction

Julie Stern and Mark Foster sat at their common desk at the Java Shack Cambridge, Massachusetts. It was a popular place and the twain cofounders of web Tracker frequently met at 7:00 a.m. because they had no trouble claiming their normal spot. The pristine classmates had renovated at their fifteenth high college get-together. Foster was once an MBA graduate of a top-tier Midwestern enterprise school but Stern used to be a laptop knowledge grad, beyond an East Coast technology institute. Both had been working for massive software program companies(Roberts, 2015). They had located it sharing an entrepreneurial power or the desire regarding to set up a company. Prior to 2014, it ended up dehydrating itself because these concepts were a huge idea. They had over past the advance partly about the yr. fleshing it outdoors and flourishing a software prototype.

Case Analysis

Question No: 1 Web Tracker

Web Tracking is the procedure using operators on websites still third-party events collect, record and transmit about what visitors do on the World Wide Web. The analysis regarding a user's behaviour may additionally be aged by providing content which allows the users to imitate their preferences or can also keep an activity over a range of parties, certain advertisers. Web tracking executes a section on travel management.

Web Tracker Founders Own Their IP

No, the web tracker founders don’t own their IP because the World Wide Web, as soon as developed via the US government, is administered frequently through avenue regarding the Internet organization for Assigned Names, however, Numbers, as manipulate the activity on IP addresses through the Internet Assigned Numbers Authority.

Question No: 2Rising Venture Capital

The $2.5 that we are trying to grow remain with us. We have the option of trying to do that after we come up with another cycle within a year. If the whole thing is concerning the track, based totally on how they want to appear now, we must stay out attempting by raising a spherical of$12 million or so at a $45 million of pre-money valuation or that’s the hope. Of Course, there’s additionally the brawny exit. If we reach full figure, we might have a partnership. We do know, though, that this amount of strategic traffic is a far more likely result. Such traffic should nonetheless remain magnificent because of everyone.

Question No: 3Two Term Sheet Comparison

- The structures of the terms, sheets, proposed by Regent Capital or Bantam Ventures, as well as the dominance of the formulations in them are similar.

- It is also crucial that the processes associated along with the liquidation, or preferences, are also discuss in the documents in similar terms.

- The procedures by calculating dividends are different, affecting the founders’ shares of the situation on the liquidation.

- The balloting rights and safety provisions are additionally formulated differently.

Question No: 4 Term Sheet Preference

The analysis about these two-term sheets indicates, up to expectation, the record proposed by using Bantam Ventures is extra beneficial for Stern and Foster due to its less appropriate prerequisites but Anti-dilution provisions should stay analyzed by Stern and Foster within detail in discipline after figuring out whether or not the formulation proposed by Regent Capital is based regarding the equal factors as much the precept regarding the weighted common anti-dilution talked about via Bantam Ventures. From this point on, in choosing Regent Capital, the entrepreneurs assume the enchantment of the conditions provided for in the term destruction as the result ofthe negotiations.

Question No: 5 Term Negotiation

The pair's most important motives in imitation of choosing out the period duration proposed by Regent Capital and taking part in the negotiations are the excessive reputation of the enterprise and the aggregation concerning the funding. Therefore, the focal point should stay over negotiating Regent Capital’s term sheet. To accomplish it among changing the conditions, such is imperative for Stern and Foster to pick out the high-quality negotiation strategy. The argued commercial enterprise plan needs to reflect on the proposed conditions, related to the interesting factors because Regent Capital desire to stay working in the integral situation.

Question No: 6 Exit Plan of Web Tracker

The process related to the Initial Public Offering (IPO) for emerging companies is rather complicated because of the related expenses. Despite the fact that the amount Foster may recommend indicates the IPO as a good strategy, it is necessary for imitation to pay attention to the associated conditions or limitations including the process.

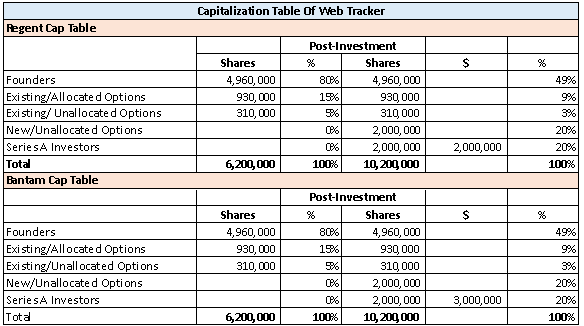

Question No: 7 Capitalization Table

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.