Alternative Solution

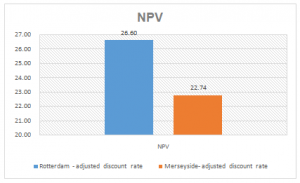

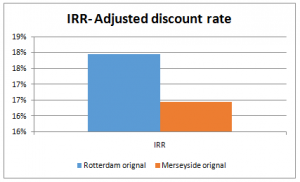

By adjusting the Firm’s cost of capital from 10 % to 7 % which results in more accurate, the expected Net Present Value of Rotterdam before erosion using the revised discount rate is GBP 26.60 million. NPV gives the explicit scrutiny to the time value of money and its methodology is reliable as assess all the relevant cost involves in the project. Also, NPV is only the method which considers all the relevant cash flows and considers the risk of cash flows through the cost of capital. However, the drawback of Net present Value is that it ignores the cash flows beyond the discount payback period; however, it provides the cured measure of liquidity. The project is feasible when the NPV of the project is greater than zero, then the project can be accepted by the firm. If the firm wants to full erosion of the Mersey side volume then still the project can be acceptable because the NPV of the Mersey side is still above the hurdle rate of return. The company should select the project with highest NPV and IRR. NPV is the most prestigious financial tools which should be used for the evaluation of the project. The company has two proposed projects for instance, Rotterdam and Mersey side.

Recommended Solution

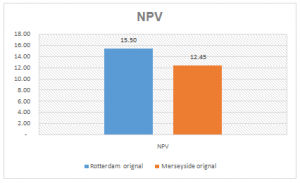

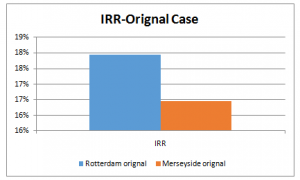

The Rotterdam project shows NPV of + 15.49 compared to NPV of + 12.44, full erosion in Mersey side volume. The IRR was 18% and 16% before and after full erosion in Mersey side volume. Rotterdam would take 9.04 years for payback of initial investment whereas, after the full erosion in Mersey side volume it would take 10.33 years to payback of initial investment.

The Rotterdam project before erosion has higher NPV of +3.05 million pound and higher ARR and lower payback period as compared to the Rotterdam project after full erosion of in Mersey side volume.

Since there is strife between the two mutually exclusive proposed projects, therefore, only one projects shall be undertaken among both based on NPV because NPV is assumed to reinvest at the cost of the capital and it is the most viable assumption from the rest of the criterion. Therefore, the Rotterdam project should be undertake without erosion of the Mersey side volume as erosion would results in the lower of NPV of the project after erosion. The profitability of Rotterdam project is much higher before it is eroded. The project revenue will be lower when the new product is introduced which leads to lesser NPV of project. From working progress inventory it can be seen that by the effect of Rotterdam project the loss of work in progress is reduced from incremental work in progress

Conclusion

The enhancement made to the Mersey side project by using the capital of the Rotterdam project can have significant impact over the firm in the terms of liquidity and profitability as against by reducing incremental profit. The decision to erode the Rotterdam project may result in lower profit but it doesn’t lead to negative Net Present Value. Since the Rotterdam Project before the erosion shows the higher NPV as compared to the project after the erosion of Mersey side volume, then it should not be difficult for the James Fawn for deciding to undertake which project, hence, Elizabeth Eustace’s proposal should be accepted.

Appendix 1

Appendix 2

Appendix 3

Appendix 4